We are seeing some follow through today on the indices, but to be honest, it looks weak to me. That may change by the end of the day, but all the previous bounces following hard sell-offs has resulted in sizable 'snap-backs'. In two days we have only moved 12 points.

Unless we rally hard in the afternoon, I will probably put out 1-2 new short positions and from there, if the market keeps rising, I'll cut my losses and move on. But at this point, considering the lack of enthusiasm in this dead cat bounce, the charts are still showing there to be more downside to come.

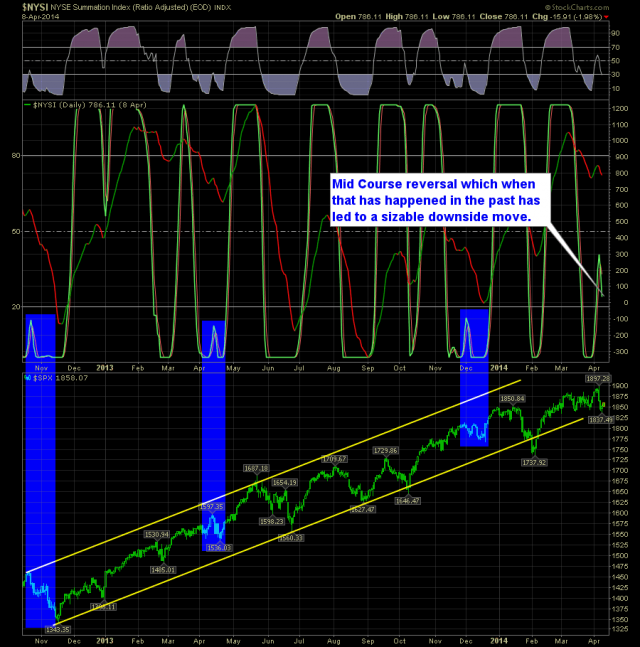

On the Daily SharePlanner Reversal Indicator (SPRI), you are seeing where an attempted bounce has quickly reversed in mid-course which doesn't happen much but when it does happen, it usually signals a couple more weeks of downside to come. Just look at the blue shaded areas on the chart below.

Here's the Daily SPRI:

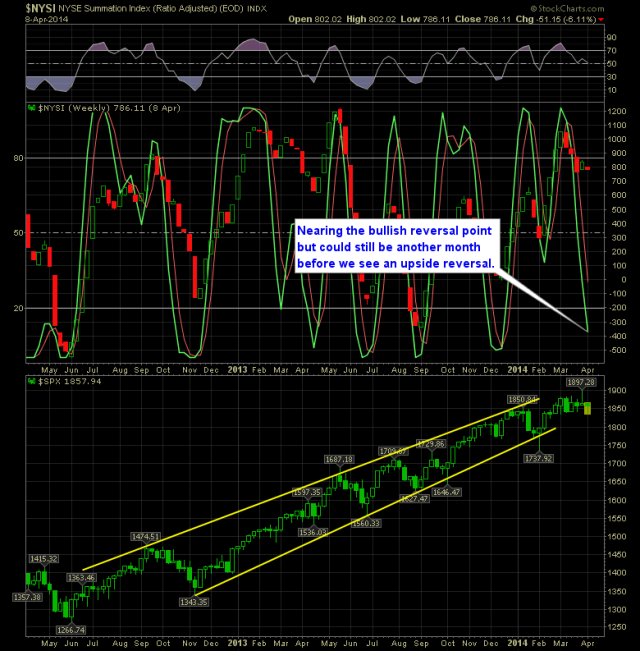

On the weekly chart you have more downside possible. A lot of times this is the point where most of the downside should have been achieved already, but as we have seen of late, the bears are arriving late to the bearish reversal party.

Here's the Weekly SPRI:

Coupled with the Daily SPRI, the bears have the edge in this market. But as always tippie-toe back into the bearish waters and don't get all short at once. Being caught in a short squeeze is not fun by any means. So be skeptical and slowly align yourself with the direction the market is taking.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.