EU said to plan 30% tariffs on $117 billion of US goods if Trump imposes levies

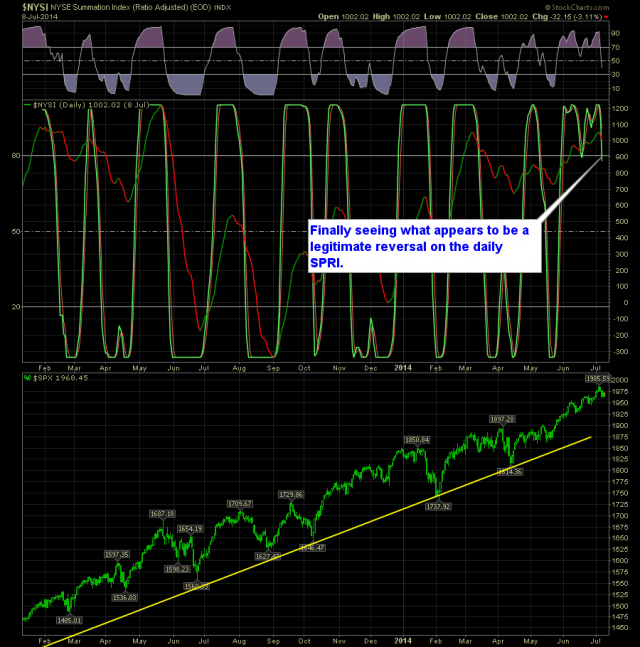

It has been since late February that we saw a legitimate bearish signal on the SharePlanner Reversal Indicator - while it didn't usher in a huge wave of selling, it did nonetheless lead to nearly 3 months of consolidation, which in a market that has trended higher for the last five years, it isn't all that shocking that a bearish reversal can simply lead to mind-numbing consolidation.

The Daily SPRI has been a bit choppy at the highs with numerous false reversal calls. However, the SPRI as it currently stands is breaking below the range and leads me to believe this is a more legitimate move for the indicator.

Here's the Daily SPRI:

The Weekly SPRI is showing the same bearish signal:

Here's the Weekly SPRI:

I think you definitely have to be concerned with the upward movement that still remains in this market short-term. However, I don't believe we are at a stage where you look to get net short on this market. SPX price broke below the 10-day moving average yesterday, and while that is a start for the bears, there really hasn't been any technical shift in the bear's favor on the charts.

Until that happens, I'm not going to short this market at all, as the bearish reversal signals could simply be a sign that we are going to see an extended consolidation period like the SPRI signal suggested back in February.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI