EU and US near trade deal with 15% tariffs - FT

The daily and the weekly SharePlanner Reversal Indicator is at odds with each other.

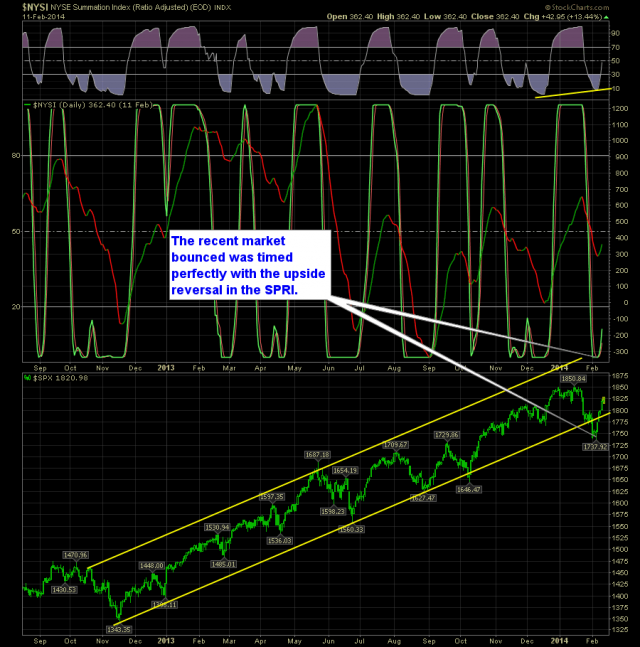

On the daily chart you have a clear upside reversal and that has been backed up by the action we've seen out of SPX over the past 5 trading sessions.

Here's the Daily SPRI:

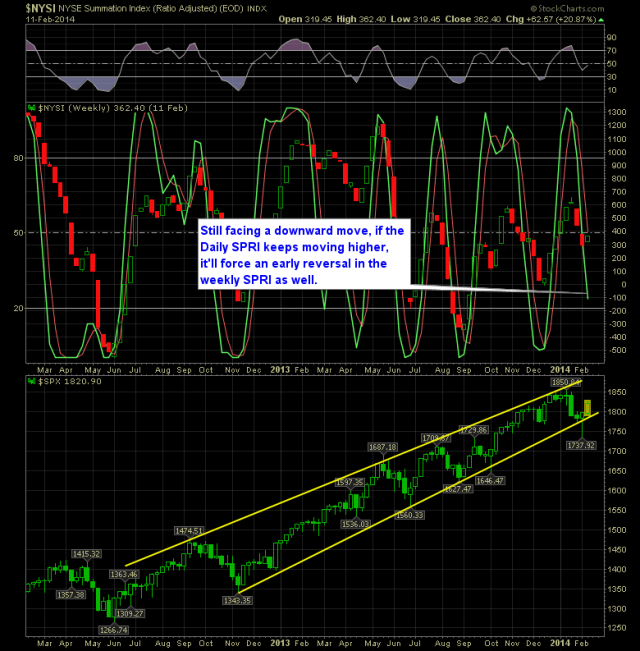

On the weekly, the bottoming has not come close to happening, though based on my experience, I can tell you this that If the market even rallies half of what it has done since last Tuesday, the weekly will be forced by the Daily SPRI to reverse early and give us another bullish reversal signal as well. This doesn't happen much but the market conditions are ripe for something like this to occur.

Here's the Weekly SPRI:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.