Stock market today: S&P 500 slumps as Trump tariff blitz triggers bloodbath

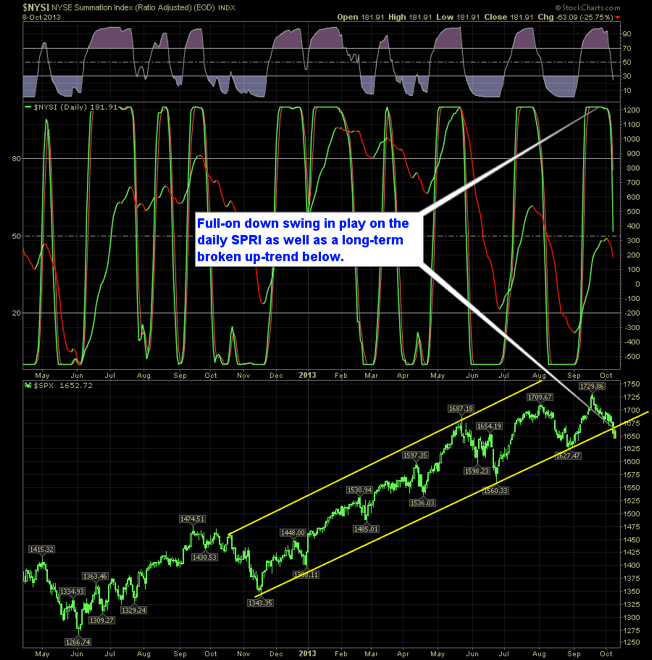

The daily continues to confirm its reading last week of a strong move lower in the markets and is signifying that it is only half-way through with what it intends to pull off.

Here's the Daily SharePlanner Reversal Indicator

What is even more troubling for this market is the fact that the weekly SPRI is only about to confirm and, therefore, signifying much more to the move than we've already seen to date.

Here's the weekly SPRI

Hard To Be Long

So it's becoming increasingly difficult to focus on the long side of the trade as the market is giving very little incentive for doing so. But sooner or later the twits that we call politicians will come to some agreement that drives are country in an even greater whole and we'll see this market rally as a result. So be careful with the shorts that you do have because that will happen.

Original Post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.