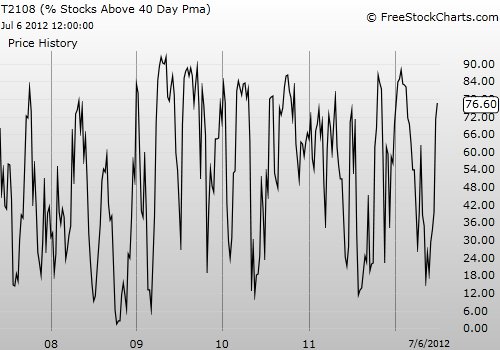

T2108 Status: 76.6% (5th overbought day)

VIX Status: 17.1

General (Short-term) Trading Call: Continue selling bullish trades, open fresh bearish trades (do not accumulate) – watch out for earnings-related volatility

Commentary

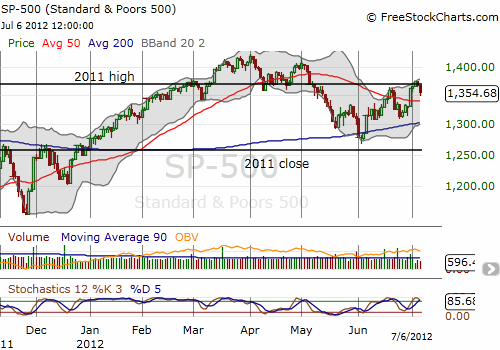

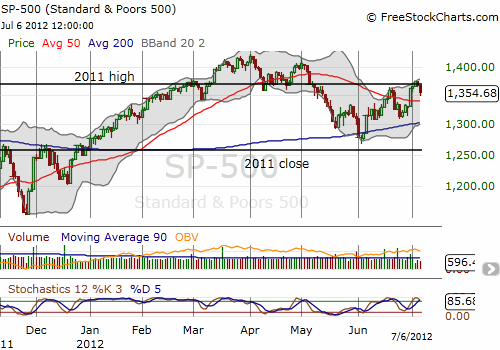

The S&P 500 fell back from resistance at the 2011 high as it sold off as much as 1.4% on the day Friday. Surprisingly, T2108 only fell to 76.6% and the VIX even dropped, driving VXX from a small gain to a small loss. Notice in the the chart below of the S&P 500 that stochastics are also overbought.

Note that the upward momentum still holds from the June low as defined by the 200DMA. A change in character for the S&P 500 will not occur until either resistance breaks or the momentum from the bounce breaks. For a closer look at the intraday action on Friday, July 6, see my post on Seeking Alpha: “How Divergences Between The Australian Dollar And The S&P 500 Can Signal Trades.” In particular, the U.S. dollar is already retesting the top of the presumed trading range bounded on top by the “QE2 Reference price.”

Volatility also fell, I believe mostly on the late rally into the close (based on looking at VXX). This divergence suggests that buyers remain quite willing to continue pushing the index higher through these overbought conditions. Extremely light trading volume during the past two days of selling is also good news for the bulls. However, time is now working against the bulls with the overbought period on its fifth day.

With another earnings season upon us, company expectations for the second half of the year present the largest wildcard to the short-term outlook. Based on some very bad warnings and guidance last week from various high-tech companies, we should expect a lot of sour talk about demand in Europe. The first companies to report such news should get beaten up badly (like last week!), but in time, this news will get priced in and toward the end of earnings season, we could even see counter-intuitive rallies as the market concludes things are “not as bad as feared.” In other words, do not over-extrapolate the reactions from the first half of earnings season to the second half. Most importantly, companies with minimal exposure to Europe (and the global economy for that matter) should outperform although expectations may already be very high for these companies. Stay tuned!

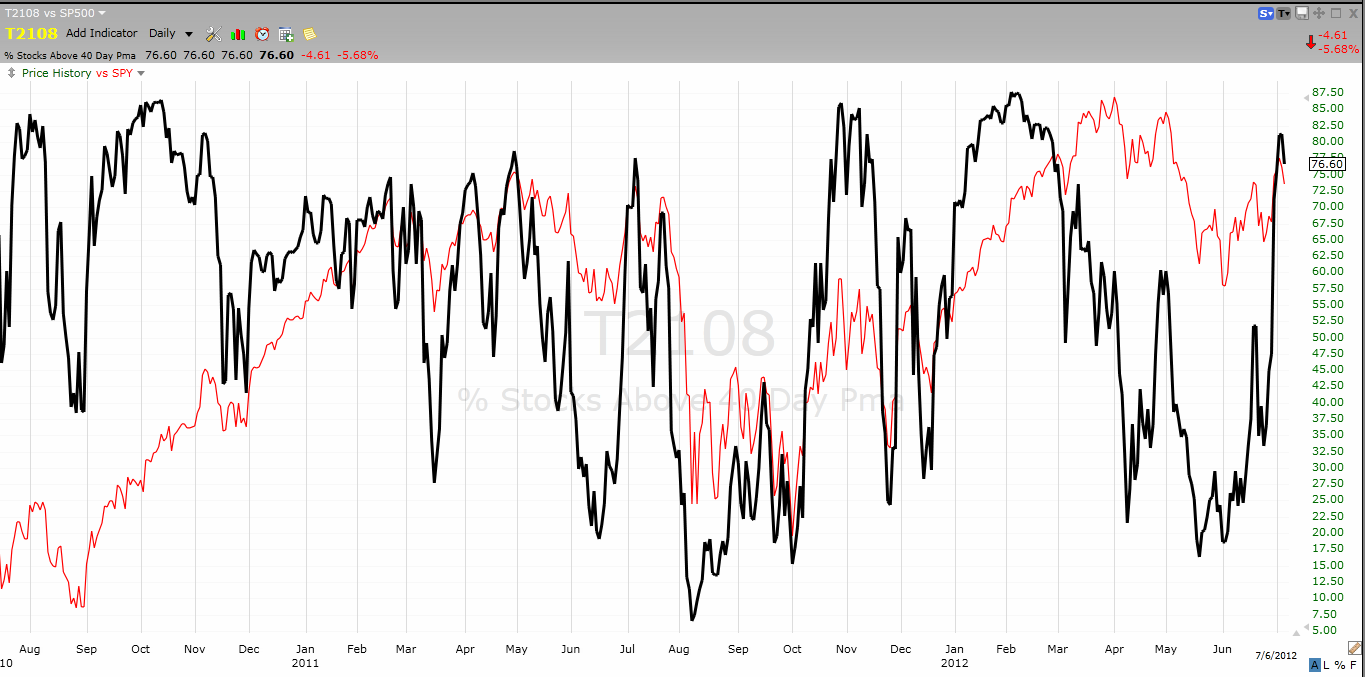

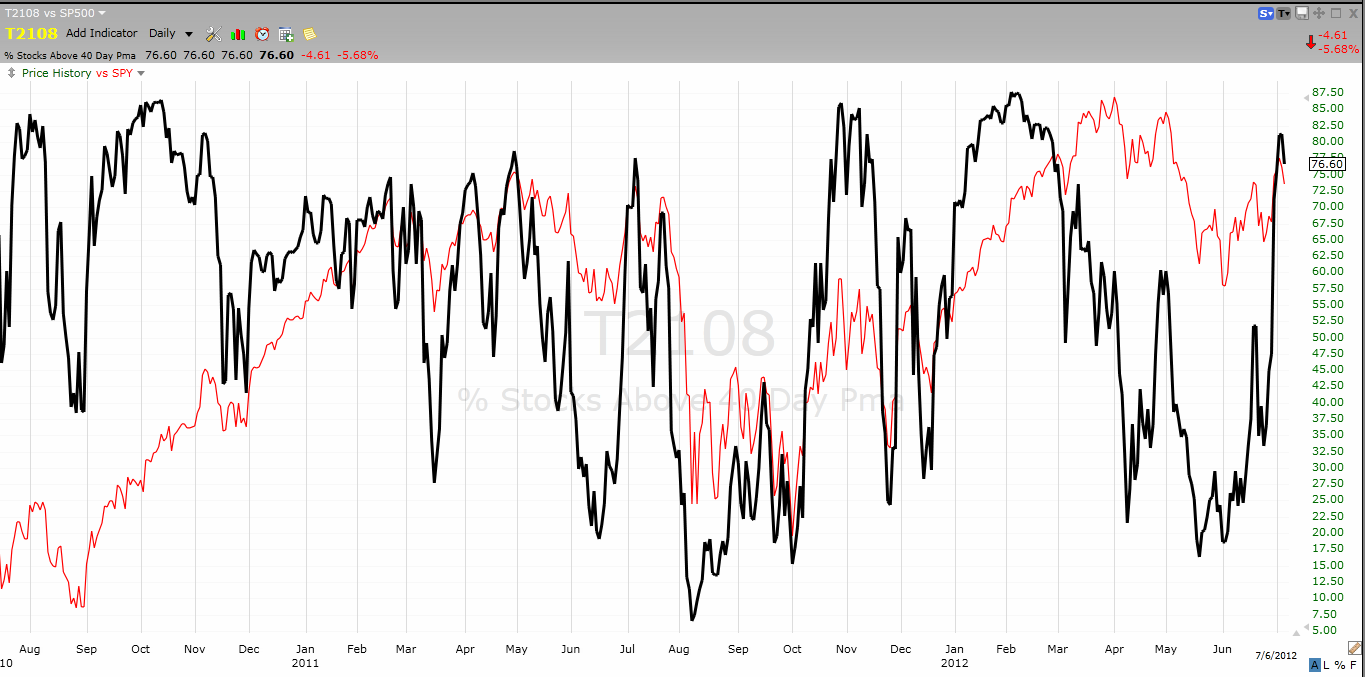

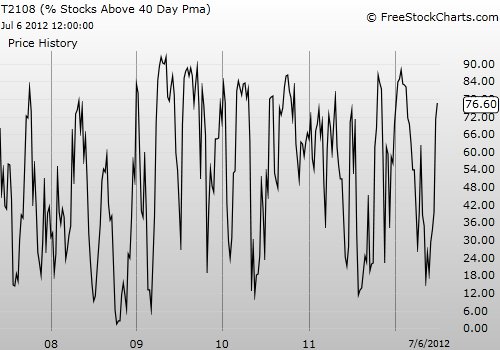

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Be careful out there!

Full disclosure: long SDS; long VXX shares; short VXX call spreads

VIX Status: 17.1

General (Short-term) Trading Call: Continue selling bullish trades, open fresh bearish trades (do not accumulate) – watch out for earnings-related volatility

Commentary

The S&P 500 fell back from resistance at the 2011 high as it sold off as much as 1.4% on the day Friday. Surprisingly, T2108 only fell to 76.6% and the VIX even dropped, driving VXX from a small gain to a small loss. Notice in the the chart below of the S&P 500 that stochastics are also overbought.

Note that the upward momentum still holds from the June low as defined by the 200DMA. A change in character for the S&P 500 will not occur until either resistance breaks or the momentum from the bounce breaks. For a closer look at the intraday action on Friday, July 6, see my post on Seeking Alpha: “How Divergences Between The Australian Dollar And The S&P 500 Can Signal Trades.” In particular, the U.S. dollar is already retesting the top of the presumed trading range bounded on top by the “QE2 Reference price.”

Volatility also fell, I believe mostly on the late rally into the close (based on looking at VXX). This divergence suggests that buyers remain quite willing to continue pushing the index higher through these overbought conditions. Extremely light trading volume during the past two days of selling is also good news for the bulls. However, time is now working against the bulls with the overbought period on its fifth day.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The median overbought period is 4 days and the average is 9.2 days. With another earnings season upon us, company expectations for the second half of the year present the largest wildcard to the short-term outlook. Based on some very bad warnings and guidance last week from various high-tech companies, we should expect a lot of sour talk about demand in Europe. The first companies to report such news should get beaten up badly (like last week!), but in time, this news will get priced in and toward the end of earnings season, we could even see counter-intuitive rallies as the market concludes things are “not as bad as feared.” In other words, do not over-extrapolate the reactions from the first half of earnings season to the second half. Most importantly, companies with minimal exposure to Europe (and the global economy for that matter) should outperform although expectations may already be very high for these companies. Stay tuned!

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Be careful out there!

Full disclosure: long SDS; long VXX shares; short VXX call spreads

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.