Comments

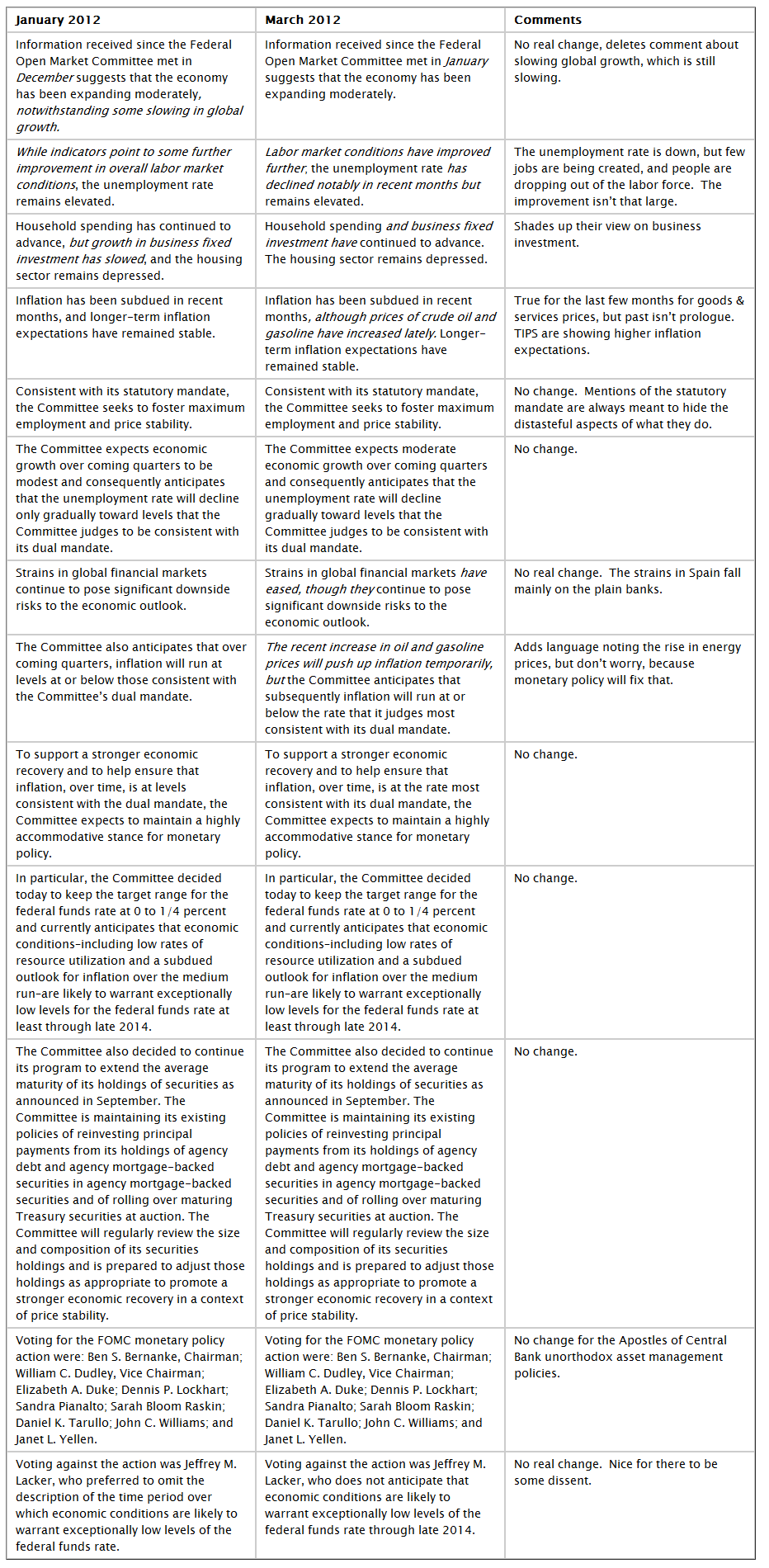

- No significant changes from last time. They do note that energy prices are rising, but they don’t see that affecting inflation.

- In my opinion, I don’t think holding down longer-term rates on the highest-quality debt will have any impact on lower quality debts, which is where most of the economy finances itself.

- Also, the reinvestment in Agency MBS should have limited impact because so many owners are inverted, or ineligible for financing backed by the GSEs, and implicitly the government, even with the recently announced refinancing changes.

- The key variables on Fed Policy are capacity utilization, unemployment, inflation trends, and inflation expectations. As a result, the FOMC ain’t moving rates up, absent increases in employment, or a US Dollar crisis. Labor employment is the key metric.

- The Fed is out of good policy tools, so it will use bad policy tools instead, and for longer than before.

- Do they want the yield on 30 year TIPS to go negative? Looks that way.

- GDP growth is not improving much if at all, and the unemployment rate improvement comes more from discouraged workers. Inflation has moderated, but whether it will stay that way is another question.

- Is it possible that you don’t really know what would have worked to solve the Great Depression, and you are just committing an entirely new error that will result in a larger problem for us later?

- Why do think extending the period of accommodation by a little more than a year will have any significant effect on the economy, aside from stock and bond prices?

- Discouraged workers are a large factor in the falling unemployment rate. Why do you think the economy is doing well?

- Couldn’t increased unemployment be structural, after all, there is a lot more competition from labor in emerging markets?

- Why do you think that holding down longer-term rates on the highest-quality debt will have any impact on lower quality debts, which is where most of the economy finances itself?

- Why will reinvestment in Agency MBS help the economy significantly? Doesn’t that only help solvent borrowers on the low end of housing, who don’t really need the help?

- Isn’t stagflation a possibility here? I mean, no one expected it in the ‘70s either.

- Could we end up with another debt bubble from keeping short rates so low?

- If the Fed ever does shrink its balance sheet, what effect will it have on the banks?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.