Bitcoin price today: rangebound near $119k ahead of Fed meet, tariff deadline

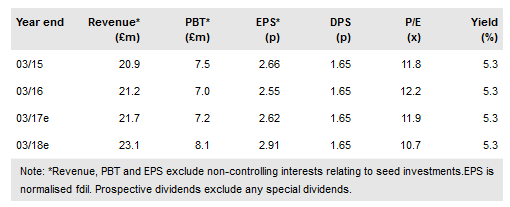

Record's (LON:RECL) first-half results announced on 18 November held no surprises after a detailed Q217 trading update issued in October. While underlying profits were down modestly year-on-year, this reflected lumpy allocations to a tactical mandate in H116. More importantly, assets under management equivalents (AUME) and client numbers increased and the company reports that the recent prominence of currency volatility has helped to increase interest in a range of Record’s products. The current rating of c 12x FY17e earnings appears conservative and the ordinary yield (before any special payment) stands at over 5%.

H117 results

Compared with end March 2016, AUME rose 4% to $55.0bn from $52.9bn under a new classification approach set out on page 2. Inflows contributed 2.6% to growth and market moves 4.3% partly offset by a 3% negative exchange rate move. Passive hedging mandates now comprise 83% of the total AUME and generate 53% of fee income, covering operating costs before the group profit share scheme. Underlying pretax profit nearly matched H116; a period that benefited from an unusually high allocation to a tactical bespoke mandate. The majority of currency for return strategies performed well, a potentially positive indicator for future flows. We leave our forecasts unchanged having raised them following the Q2 trading update.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI