Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

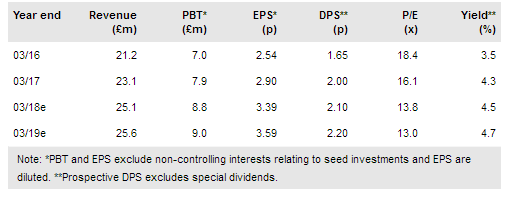

Record’s (LON:RECL) FY17 results were close to our expectations so the main new news was the level of ordinary dividend increase (+21%), the announcement of a revised capital policy and the accompanying return of capital by way of a c £10m tender offer. These underline the balance sheet strength and cash-generative nature of the business. Despite re-rating in the last year the shares still trade below average multiples for UK asset managers and the yield, including the special dividend, is over 7%.

FY17 results

As reported previously, AUME was $58.2bn, up 10% (or 26% in sterling terms). Underlying revenue, excluding income from seed funds, increased by 9%, helped by sterling weakness against the base currencies of Record’s main client exposures in Switzerland and the US. Pre-tax profit on the same basis was 13% ahead of FY16. Reflecting the dividend policy adopted last year, there was both a 21% increase in the ordinary dividend and a special dividend payment, giving a total dividend of 2.91p, in line with basic earnings per share.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI