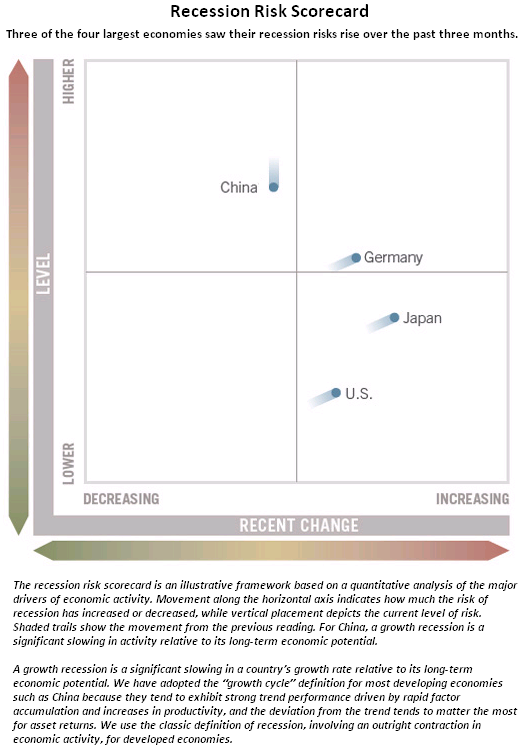

From a business cycle perspective, Fidelity recently released a report that indicated the risk of a recession in the U.S. was rising. Although the rising recession risk is low, the report cited weak "external" factors as the cause. Also, these weak external factors may be impacting company earnings expectations as noted previously.

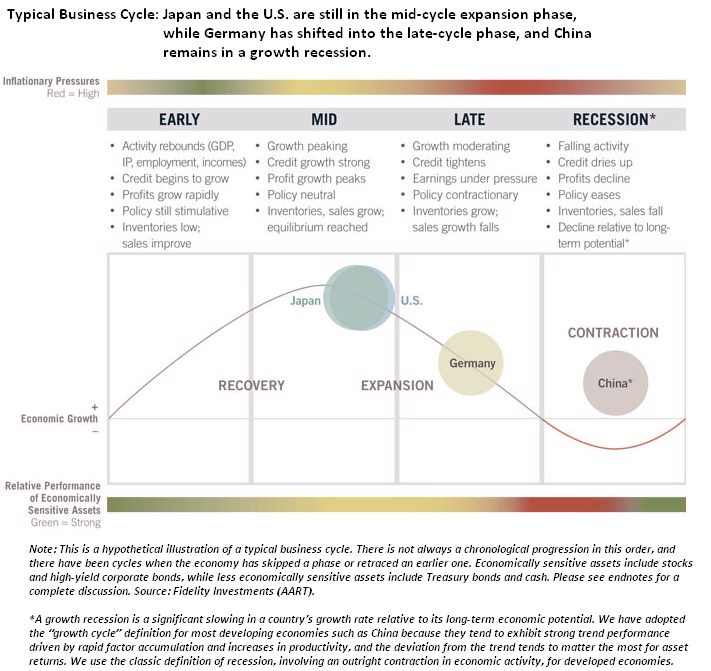

In spite of this higher risk, the U.S. and Japan remain in the mid-cycle expansion phase, while China is contracting.

Importantly for investors, one question being ask is where should investment dollars be allocated if the economy is nearing a slowdown. Clearly, the U.S. economy is slowing. The Bureau of Economic Analysis released the second revision of GDP last Wednesday and it estimates GDP growth in the second quarter came in at 1.7%. This compares to 2.0% real GDP growth in the first quarter.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.