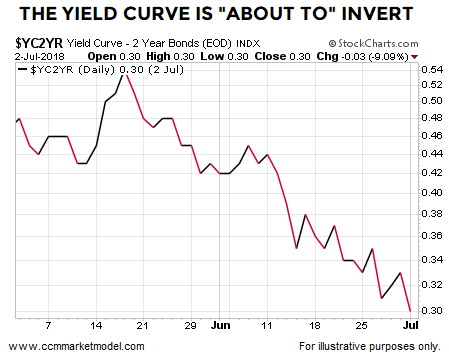

According to numerous articles written in the last six months, a flattening yield curve nearing the zero boundary is a major red flag for stocks and the economy.

10-year Yield Vs. 2-Year Treasury Yields

Data This Week Looks Strong

Monday's ISM Manufacturing data landed in a "strong and growing economy" range and nowhere near an "imminent recession" range. From MarketWatch:

The Institute for Supply Management said its manufacturing index rose to 60.2% last month from 58.7% in May. That matches the second highest level of the current economic expansion that began in mid-2009. In February the index hit a 14-year high. Readings over 50% indicate more companies are expanding instead of shrinking.

During the holiday-abbreviated session Tuesday, the latest read on factory orders was released. From MarketWatch:

U.S. factory orders rose 0.4% in May, led by an increase in demand for machinery and military wares. Economists polled by MarketWatch has forecast no change. The originally reported 0.8% decline in factory orders in April, meanwhile, was revised down to show a 0.4% drop, the government said Tuesday.

The Misunderstood Yield Curve

This week's video takes a detailed and factual look at the yield curve, helping us address the following questions:

- Is it possible for really good things to happen after a period that features a flattening yield curve?

- If the yield curve continues to fall, should we sprint for the nearest exit?

- Is there any historical difference between "the yield curve is about to invert" and "the yield curve has already inverted"?

- In the 2000 and 2007 cases, how long did it take for the major stock market peak to arrive after the first sign of yield curve inversion?

- In the 2000 and 2007 cases, how much did the S&P 500 gain between the first sign of yield curve inversion and the major market peak?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI