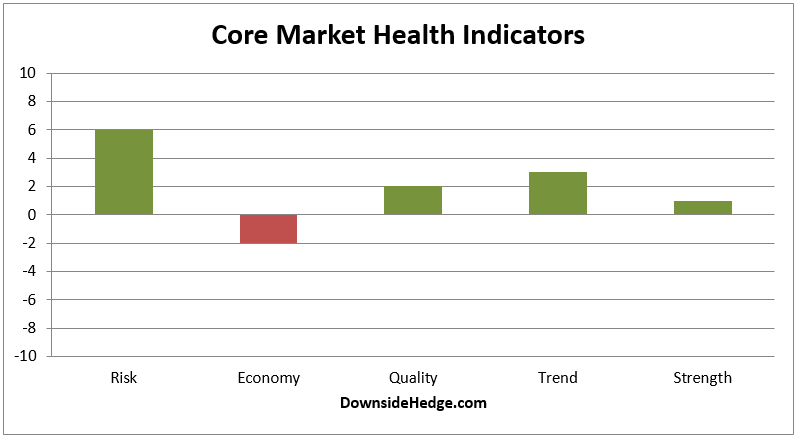

Over the past week, most of my core market health indicators rose dramatically. It appears that market internals are preparing for a move higher. As I mentioned last week, it looks like the current dip is merely rotation before a move to all time highs rather than the making of a long term top.

The measures of market quality and strength moved into positive territory this week. That changes the core portfolio allocations as follows:

Long / Short hedged portfolio: 90% long high beta stocks and 10% short the S&P 500 Index (or use the ETF with symbol ProShares Short S&P500 (NYSE:SH))

Long / Cash portfolio: 80% long and 20% short

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.