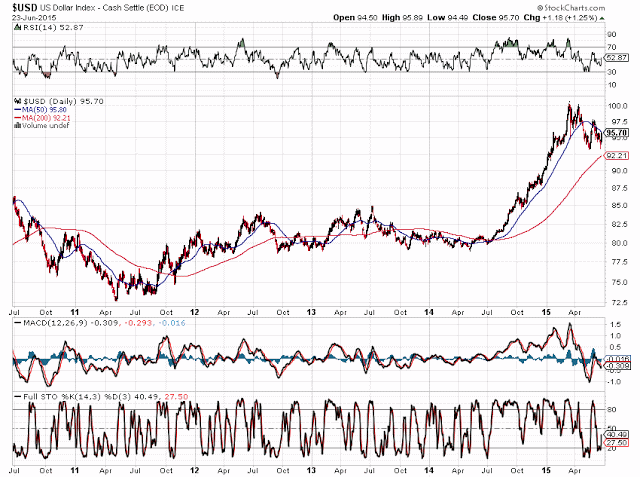

The U.S. Dollar is back above the major support level of 95 after a brief break below, as shown on the Daily chart (cash index) below. As I mentioned here and here recently, I believe a large move is coming, one way or the other, in currencies. The RSI indicator is back above the 50 level, hinting that bulls are back in charge of the USD.

A re-test of 98 is not out of the realm of possibilities next and will be the first major resistance level that will need to be overcome to convince traders to pile in on this trade...assuming price breaks back (and holds) above the declining 50 MA around 96 immediately above yesterday's (Tuesday's) close. Coincidentally, there is a confluence of major resistance at the 96 level -- formed by a Fibonacci fanline and mid-Bollinger® Band intersect -- as shown on the next Weekly chart of the U.S. Dollar Futures Index. Watch for the RSI to stay above the 50 level (on the cash index) to confirm such a rally. As well, we'll need to see a higher high on the RSI at the 98 price level as a sign of bull conviction for any sustainable move higher.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.