T2108 Status: 57.9%

VIX Status: 16.6

General (Short-term) Trading Call: Hold

Commentary

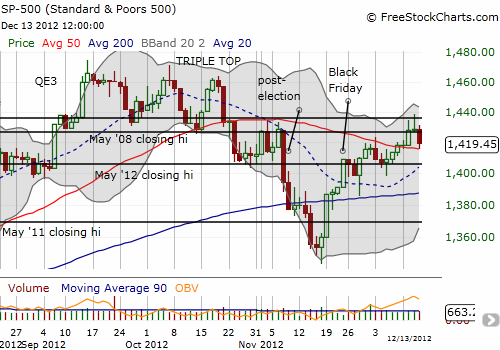

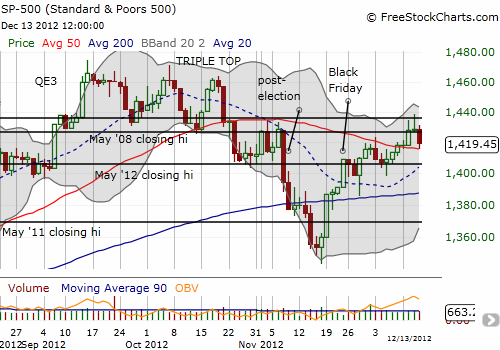

In yesterday’s T2108 Update, I pointed out how the S&P 500 faded two days in a row from resistance formed by its QE3 price. Today delivered the follow-through with the S&P 500 dropping 0.6%. This marks the classic “fade the Fed rally” move. With a picture-perfect bounce off the lows at the 50DMA, the “fade the fade” move is already getting set up.

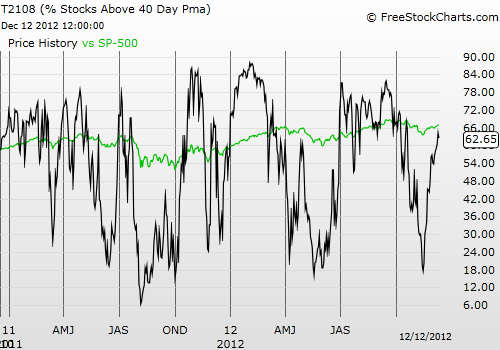

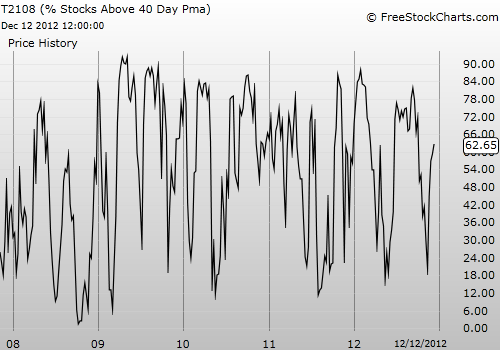

I fully expect the S&P 500 to bounce right back to return to its price before the Federal Reserve’s latest statement on monetary policy. T2108 has fallen back to 57.9%, relieving the overbought pressure that had built up going into this week. As I mentioned yesterday, without an overbought reading, shorting the S&P 500 makes the most sense after the index closes below its 50DMA. If/when the index manages to overcome QE3 resistance, I will assume the index will be off to the races on an overbought rally.

Speaking of off to the races, Facebook (FB) has been on a tidy run-up since its last lock-up expiration. In just one month, FB has gained 42%. The stock has benefited from a lot of positive news flow and a notable lack of negative news flow – a winning combination that makes everyone forget why FB had become one of the most hated stocks on the planet for a while. Another lock-up expiration on Friday is likely to pass as a non-event. From the chart, it looked like FB started December with a blow-off top: a rally hitting the upper-Bollinger Band followed by a sell-off to close lower than the previous day. However, since then, FB has not traded lower. In fact, it has steadily crept up higher in what NOW looks like a coiled spring ready to burst higher.

Despite this more bullish outlook on FB, I am betting that in the fullness of time much of this counter-trend run-up will get reversed. I am net short FB shares as well as long calls in case I am correct about a fresh run-up. Anywhere between $30-33 looks like a convenient point for a cap to the rally. Manage to get passed that and a larger and larger cadre of sellers await as FB approaches its $39 price.

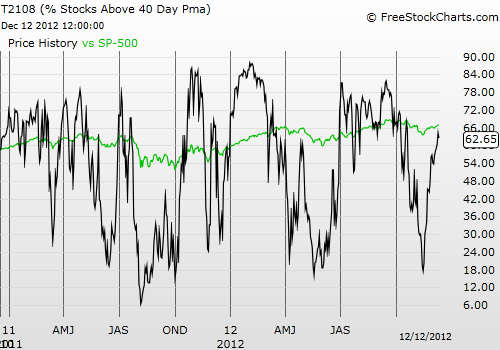

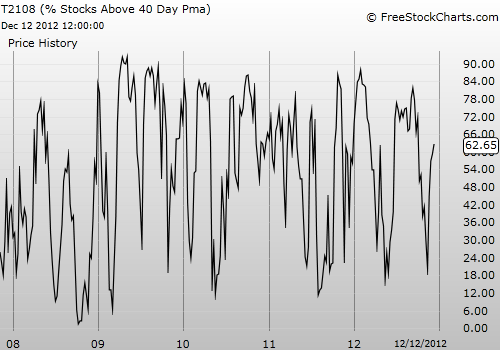

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Be careful out there!

Full disclosure: long FCX; long AAPL shares, call and put spreads; long JKS

VIX Status: 16.6

General (Short-term) Trading Call: Hold

Commentary

In yesterday’s T2108 Update, I pointed out how the S&P 500 faded two days in a row from resistance formed by its QE3 price. Today delivered the follow-through with the S&P 500 dropping 0.6%. This marks the classic “fade the Fed rally” move. With a picture-perfect bounce off the lows at the 50DMA, the “fade the fade” move is already getting set up.

I fully expect the S&P 500 to bounce right back to return to its price before the Federal Reserve’s latest statement on monetary policy. T2108 has fallen back to 57.9%, relieving the overbought pressure that had built up going into this week. As I mentioned yesterday, without an overbought reading, shorting the S&P 500 makes the most sense after the index closes below its 50DMA. If/when the index manages to overcome QE3 resistance, I will assume the index will be off to the races on an overbought rally.

Speaking of off to the races, Facebook (FB) has been on a tidy run-up since its last lock-up expiration. In just one month, FB has gained 42%. The stock has benefited from a lot of positive news flow and a notable lack of negative news flow – a winning combination that makes everyone forget why FB had become one of the most hated stocks on the planet for a while. Another lock-up expiration on Friday is likely to pass as a non-event. From the chart, it looked like FB started December with a blow-off top: a rally hitting the upper-Bollinger Band followed by a sell-off to close lower than the previous day. However, since then, FB has not traded lower. In fact, it has steadily crept up higher in what NOW looks like a coiled spring ready to burst higher.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Despite this more bullish outlook on FB, I am betting that in the fullness of time much of this counter-trend run-up will get reversed. I am net short FB shares as well as long calls in case I am correct about a fresh run-up. Anywhere between $30-33 looks like a convenient point for a cap to the rally. Manage to get passed that and a larger and larger cadre of sellers await as FB approaches its $39 price.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Be careful out there!

Full disclosure: long FCX; long AAPL shares, call and put spreads; long JKS

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.