After the blowout number from Friday's Non-Farm Payroll (NFP) release, there was some buzz that it would lessen the probability that the Federal Reserve would undertake QE3. I don't think so.

According to its statement after its January 2012 FOMC meeting, the Fed has a 2% inflation target but no target for employment [emphasis added]:

The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the Committee’s ability to promote maximum employment in the face of significant economic disturbances.

The maximum level of employment is largely determined by nonmonetary factors that affect the structure and dynamics of the labor market. These factors may change over time and may not be directly measurable. Consequently, it would not be appropriate to specify a fixed goal for employment; rather, the Committee's policy decisions must be informed by assessments of the maximum level of employment, recognizing that such assessments are necessarily uncertain and subject to revision. The Committee considers a wide range of indicators in making these assessments. Information about Committee participants' estimates of the longer-run normal rates of output growth and unemployment is published four times per year in the FOMC's Summary of Economic Projections. Charles Schwab recently published a research note indicating that the Fed is watching inflation as measured by core PCE because it has a lower housing weight than CPI [emphasis added]:

The Fed also announced an explicit 2% inflation target for the first time in its history. This explicit inflation target also helps reduce uncertainty about policy long-term. The Fed will use the 2% annual target, based on changes in personal consumption expenditures (PCE) as their measure. The current year-over-year increase in PCE is 1.8% in the latest numbers. So they're still a touch below those targets. Bernanke was asked in the press conference following the meetings, "why PCE and not the consumer price index?" One reason is that in CPI, housing has a far greater weight. It appears to have understated inflation during the housing bubble and may overstate it now that renting is more popular than buying. The PCE is also adjusted more flexibly to changing consumption patterns. Fed critics might also argue that annual increases in PCE also tend to be lower than changes in the CPI.

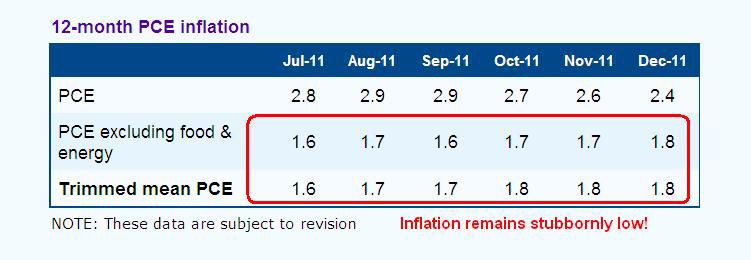

Remember, under the Fed's new transparency initiative, we don't have to guess what the Fed is going to do anymore and revealing their methodology. Consider these figures from the Dallas Fed for PCE, core PCE and trimmed mean PCE, which is another technique for excluding the more volatile components of the inflation rate.

Any way you look at it, core PCE and trimmed mean PCE remains stubbornly low and below the 2% target. This suggests to me that the Fed believes it has more room to stimulate without igniting an inflationary spiral. Watch this series for hints that QE3 might be moving off the table and don't fret about signs of a cyclical rebound from economic releases like NFP.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI