The dollar generally lost versus its peers following the speech of Chicago Fed President Evans, an outspoken dove who had pushed for the tying of monetary policy to the unemployment rate. In his speech yesterday Evans stated that the U.S. economy is performing “pretty well right now”, citing improvements in the labour market, consumer spending and housing, despite the economic data catching markets by surprise, as signaled by the Citigroup Surprise Index, which is at the lowest, negative levels since early February. He stressed that the “key issue” is to see the average 200k non-farm payroll increases witnessed the past 6 months “maintained over the next few months”. Despite his dovishness, however, with his comment about inflation being that he would like to see it higher towards the Fed’s 2% target, Evans stated that he thinks this is the year when they will “really turn things around” as the U.S. economy has improved “quite a lot”. His statement, though about job gains, likely pushes the tapering off of QE to at least autumn; further away than the summer some dollar bulls were anticipating. However, with the FOMC minutes released tomorrow, after Bernanke testifies on the economy, the autumn scenario may simply turn out to be the timespan a dove feels comfortable with, thus making QE tapering off in 2013 likely, and in the summer possible.

Early today, Germany’s PPI figures for April will likely place in the spotlight again the disinflationary pressures witnessed in the Eurozone, which are a consequence of the no growth environment. The YoY figure showed a 0.1% increase in prices, lower than the 0.2% estimate and March’s 0.4% increase, with the MoM data exhibiting a third consecutive month of deflation, an event last seen during the financial crisis bottom in the first half of 2009.

Later today, the UK announces the consumer and producer price indices for April. The CPI is forecast to be up +0.5% mom in April, an acceleration from +0.3% mom in March, but this would actually be a decline on a yoy basis to 2.7% from 2.8%. The output prices index is forecast to be up a bit at +0.4% mom, vs +0.3% mom in March. Does it matter? The Bank of England itself forecasts that inflation “is set to edge higher over coming months…. bolstered by external price pressures and administered and regulated prices.” Lower inflation this month would be nice, but I doubt they will embark on a more aggressive easing course right now when their own inflation expectations are so high. Wait until Mr. Carney arrives in July for any such change.

Elsewhere, Mr. Carney, Bank of Canada governor for 10 more days, is scheduled to give a speech today before the Board of Trade of Metropolitan Montreal with another one scheduled by St. Louis Fed President James Bullard on “Monetary Policy in a Low-Rate Environment” in Frankfurt.

Overnight attention will be shifted to Japan, where the likely large increase in exports for April on the weaker yen, following the BoJ change in monetary policy, is due to decrease the adjusted merchandise trade deficit by a third. These indicators are released a few hours before we have the completion of the two-day BoJ policy meeting and Kuroda’s speech, with stimulus expected to remain steady, despite the recent increase in Japanese bond volatility.

The Market

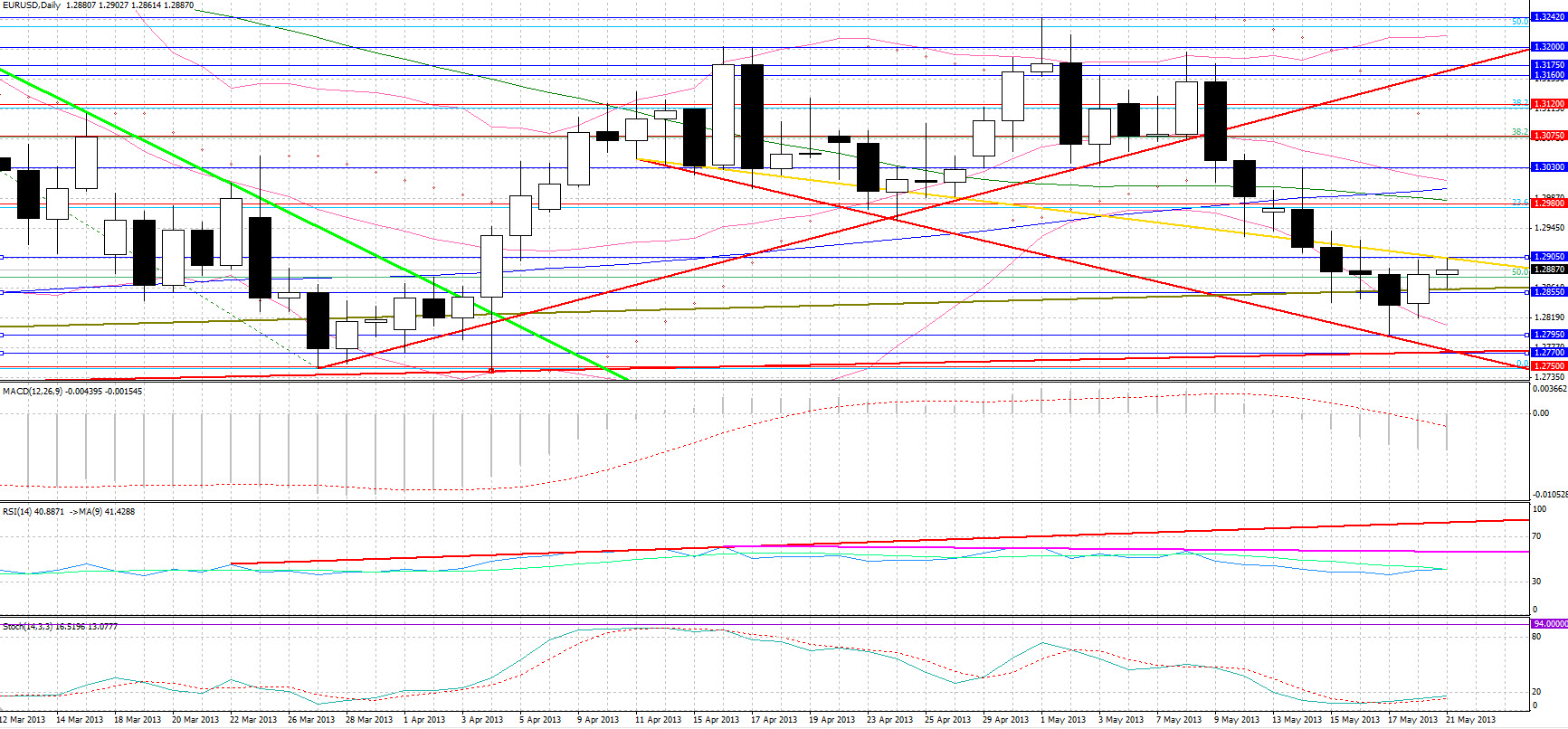

EUR/USD

EUR/USD" title="EUR/USD" width="1733" height="806" />

EUR/USD" title="EUR/USD" width="1733" height="806" />

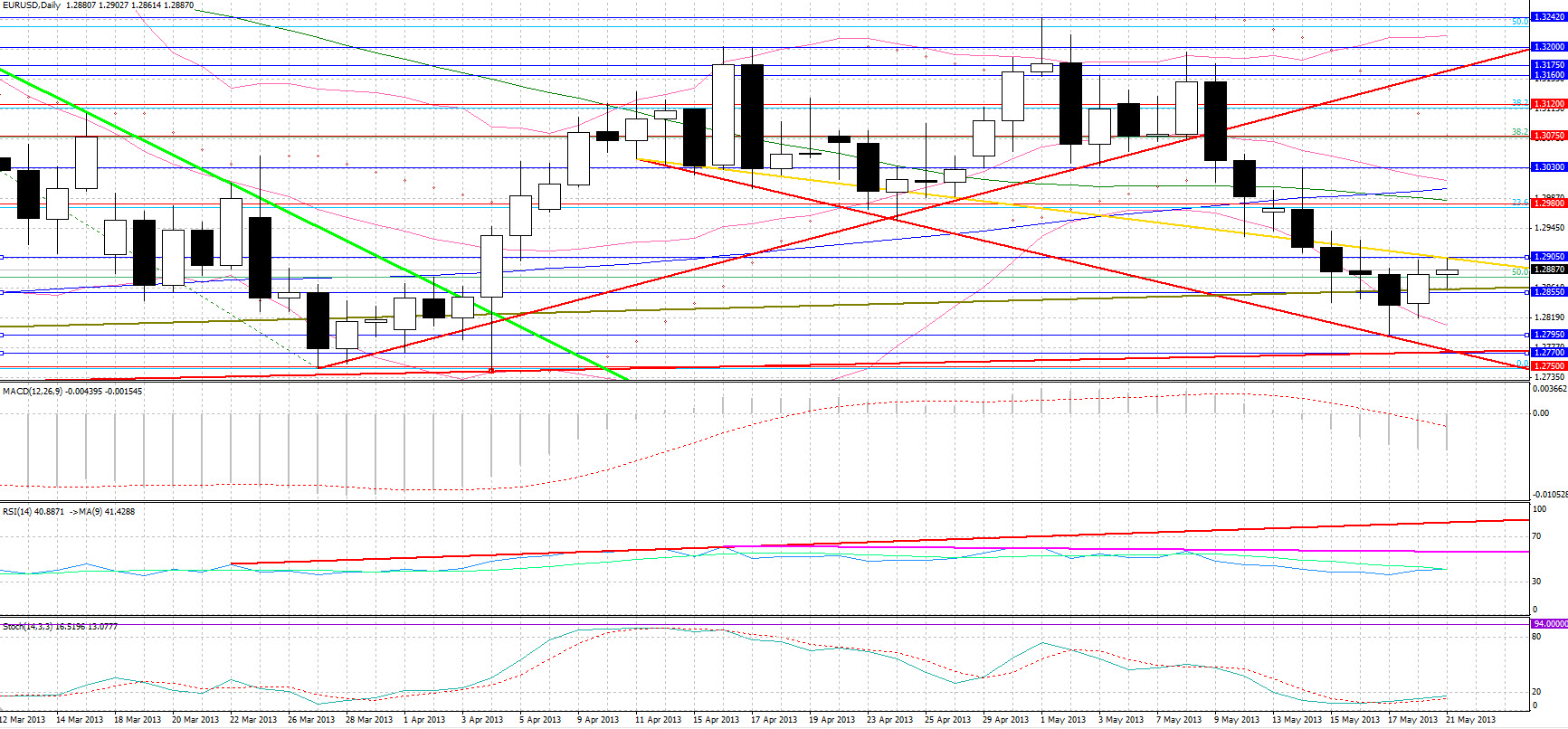

• EUR/USD began a rebound following the deteriorated, six-month low Chicago Fed National Activity Index for April, with the rebound continuing into Evans speech. Trendline resistance came at 1.2900, with 1.2905 seeing resistance today as well, whilst stronger Fibonacci resistance comes at 1.2980. Trendline support looks to come at 1.2855, with stronger support in the 1.2770 – 1.2795 area.

USD/JPY

USD/JPY" title="USD/JPY" width="1733" height="804" />

USD/JPY" title="USD/JPY" width="1733" height="804" />

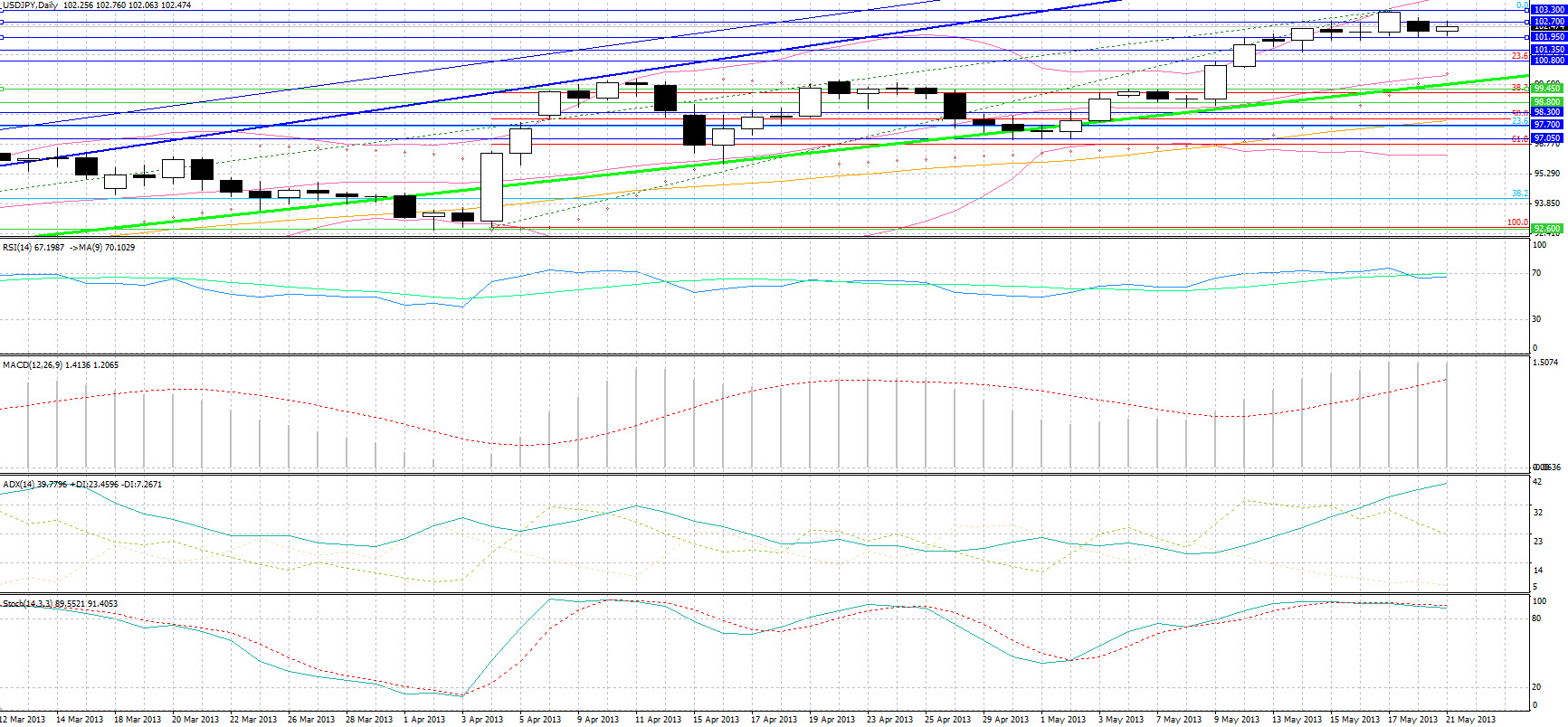

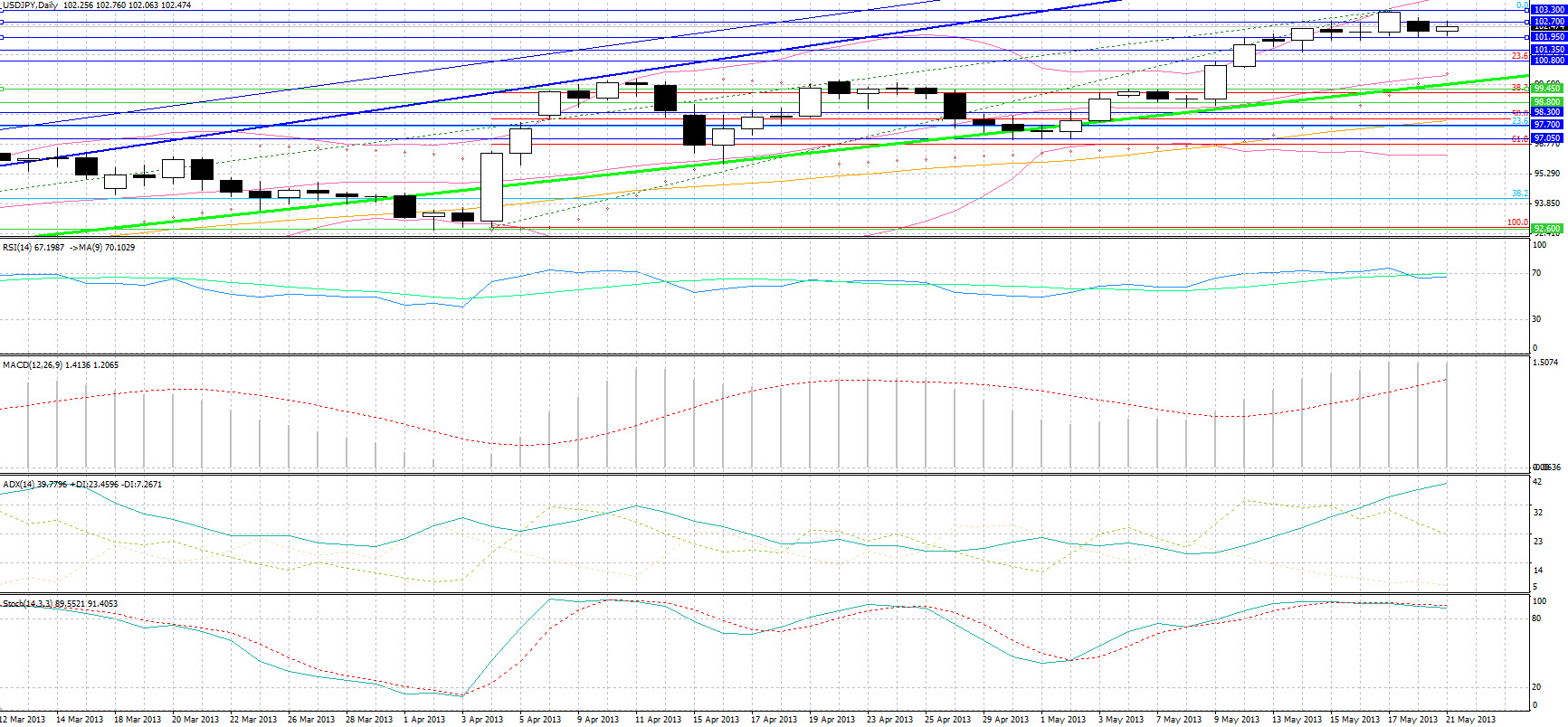

• USD/JPY lost yesterday on the back of comments by Japan’s Economy Minister Amari that further yen weakness may impact “people’s lives”, with the down move triggering, in overbought levels, bearish crossovers in the Stochastics and the RSI. However the pair gained overnight after Amari retraced on his Sunday comments, stating that he will not say whether or not the yen’s overly strength “has been corrected, or where it will finish”. Resistance came at 102.70, with likely further resistance coming at 103.30. Well-tested support is seen at 101.95, with further support at 101.35.

GBP/USD

GBP/USD" title="GBP/USD" width="1732" height="804" />

GBP/USD" title="GBP/USD" width="1732" height="804" />

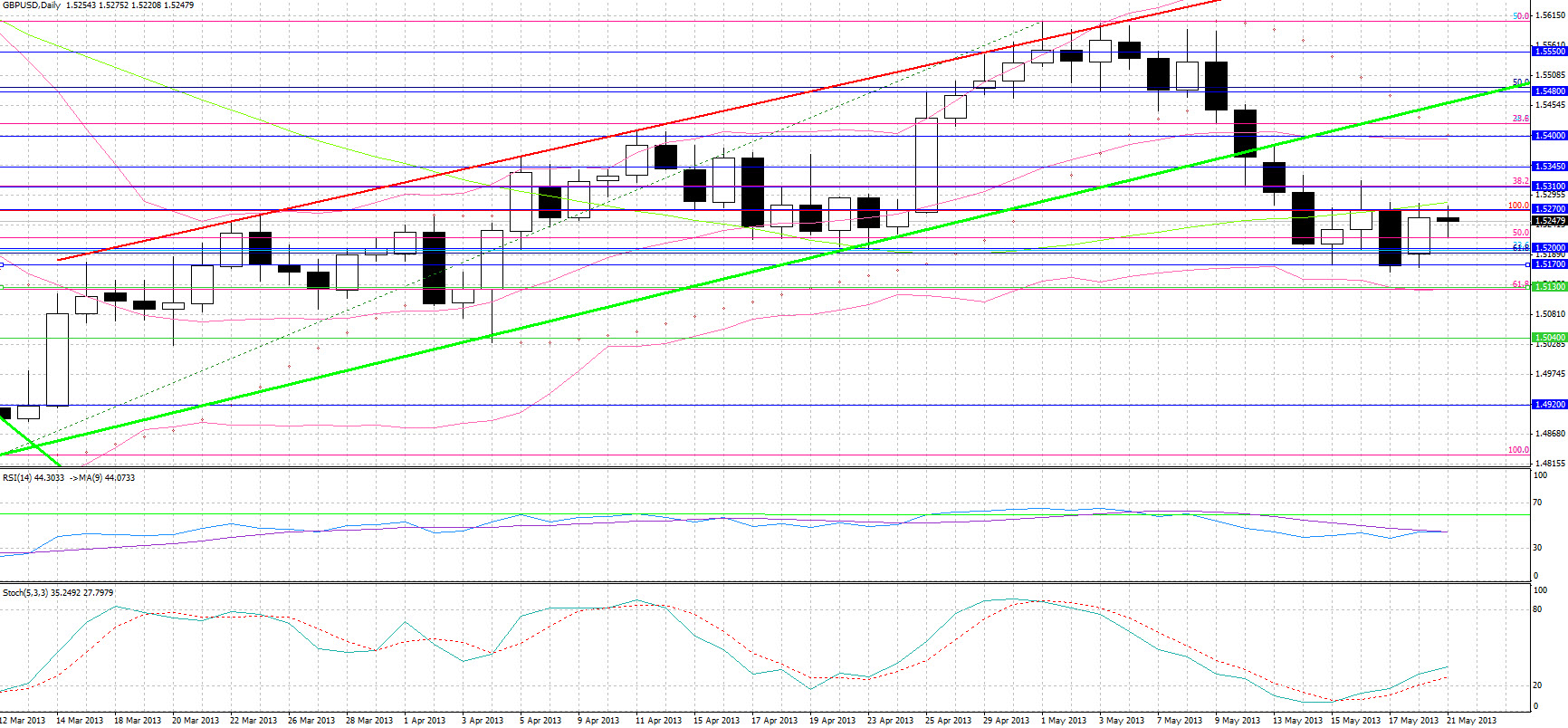

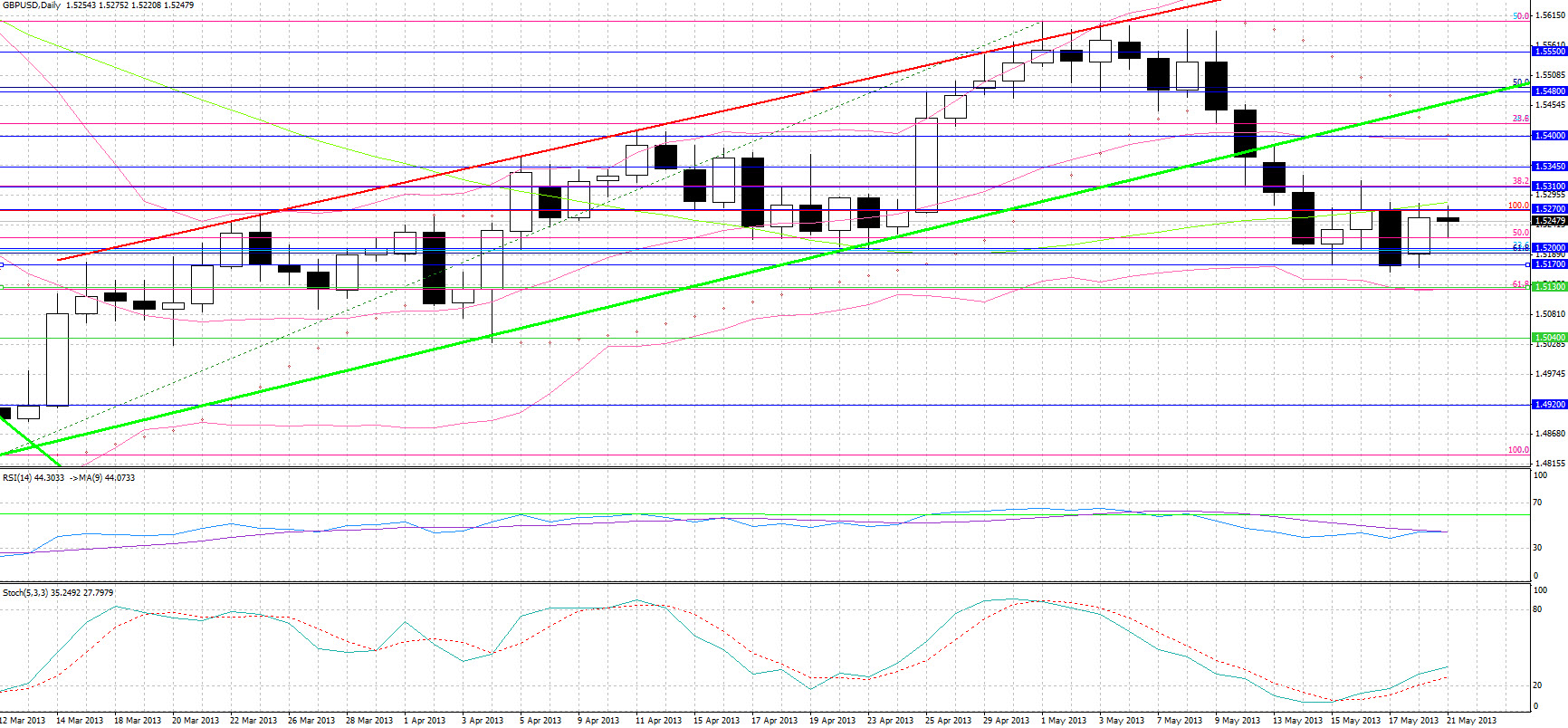

• Cable rebounded from 1.5170, its 1 ½ month lows, following the highest increase in the YoY Rightmove House Price Index in more than a year, with the sterling furthering its gains as BoE Governor King cited “modest recovery”. Strong resistance came around 1.5270, which sees a reversal level and the 50-day MA. The former 1.5220 resistance level, which is the 50% retracement level of the March – April rebound, is now acting as support with stronger support in the 1.5190 – 1.5200 area and Fibonacci support at 1.5130. Resistance above the 50-day MA is likely to come at 1.5310.

Gold

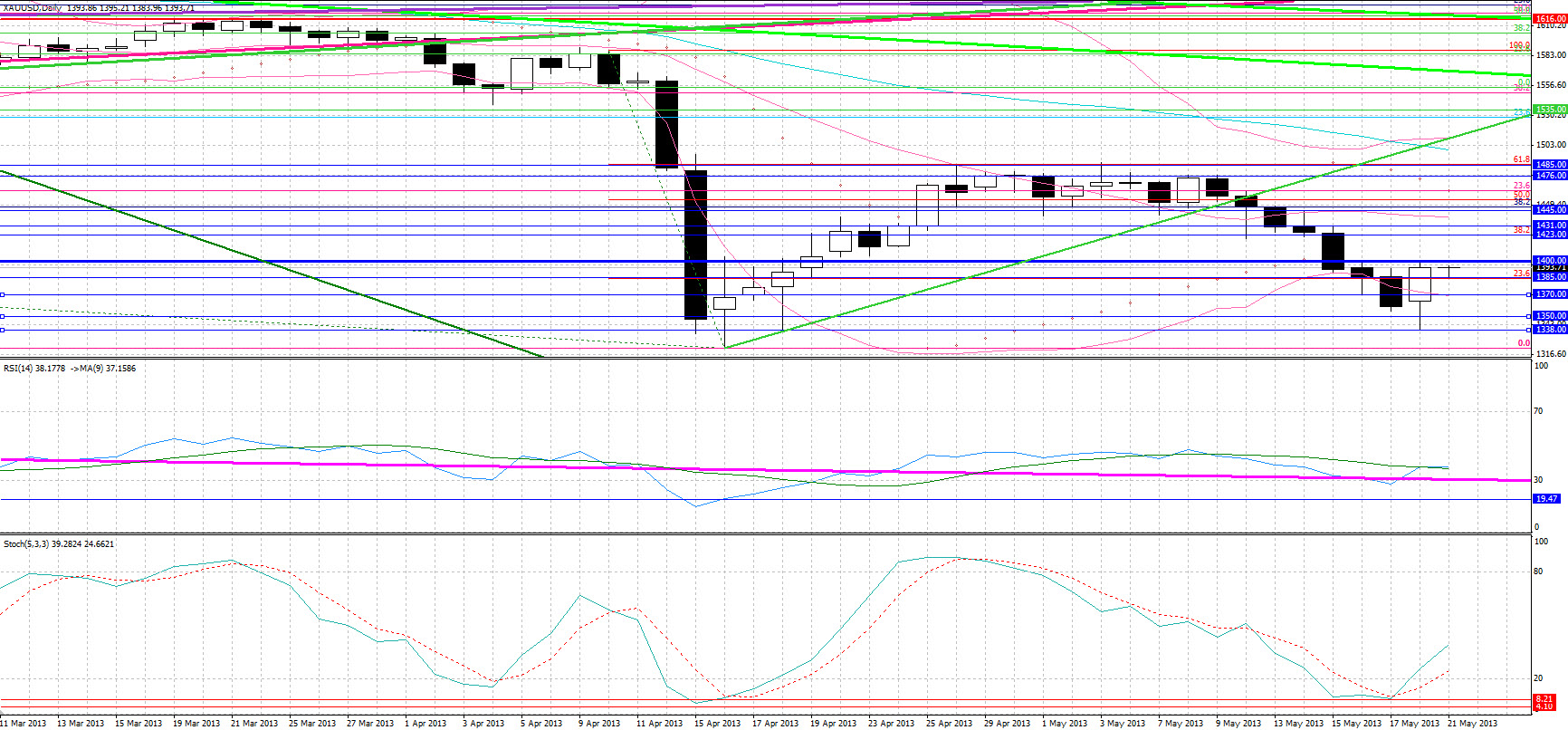

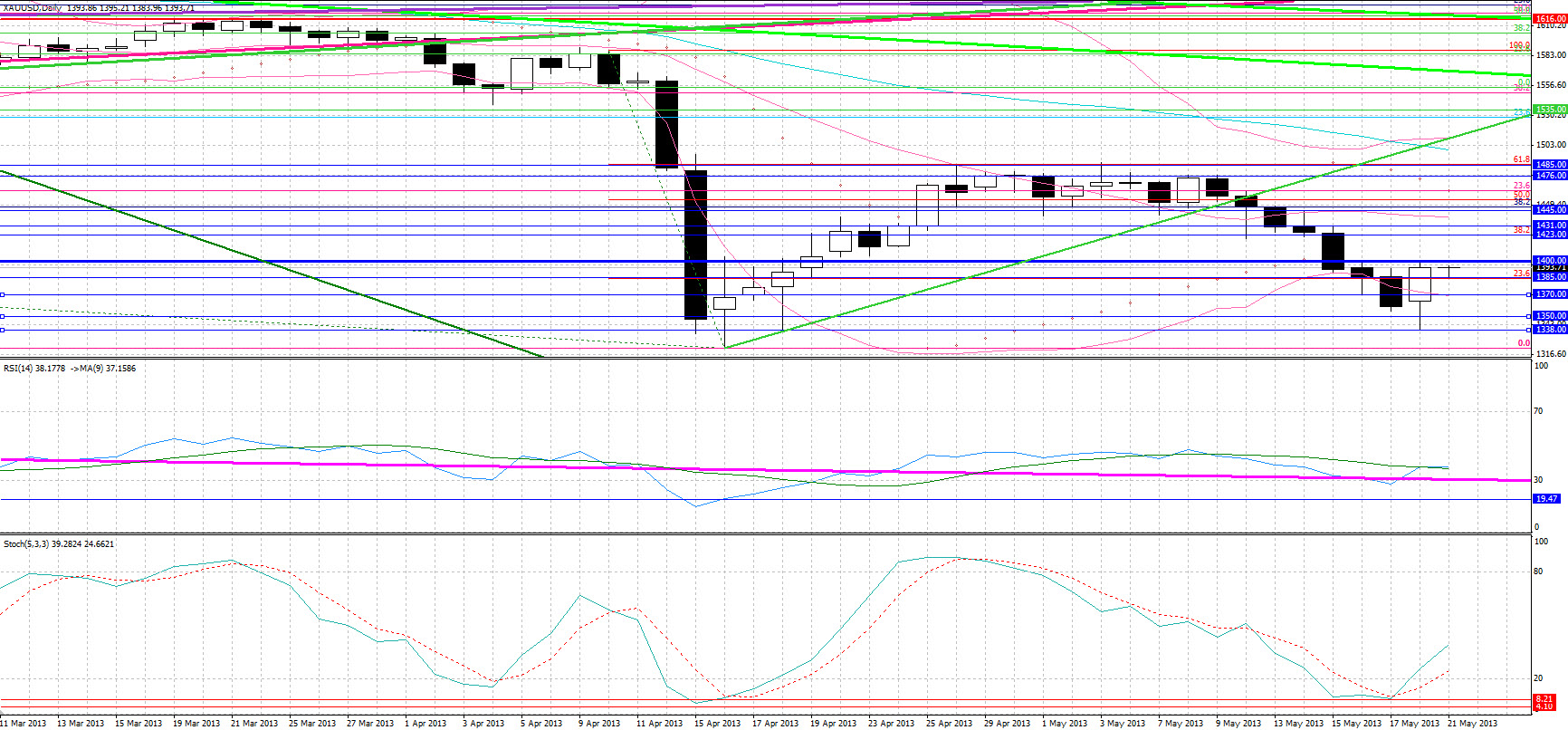

• Gold bulls managed to reverse yesterday’s morning picture as the precious metals, particularly silver and gold, had an exceptional 24-hours, with gold rebounding from its double-bottom at $1338, breaking out from $1370 and $1385 resistance, though finding twice resistance at $1400. The inability to break below the lows and the support found at $1385, with a bullish Stochastics crossover and the RSI on the verge of a bullish crossover, point to a technical rally, should we breakout from $1400, initially to the $1423 – 1431 area ant thereafter to $1445, where there will likely be strong selling pressure.

WTI

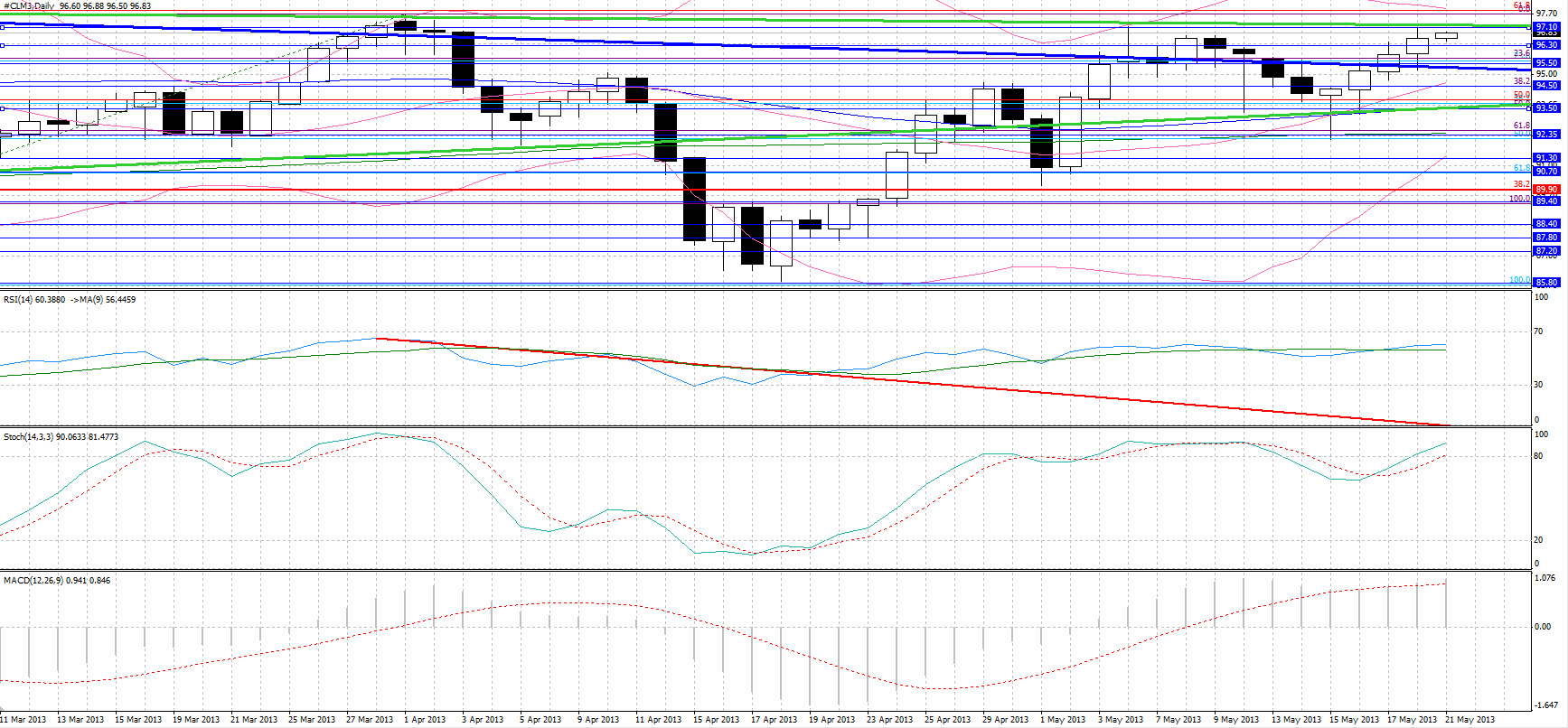

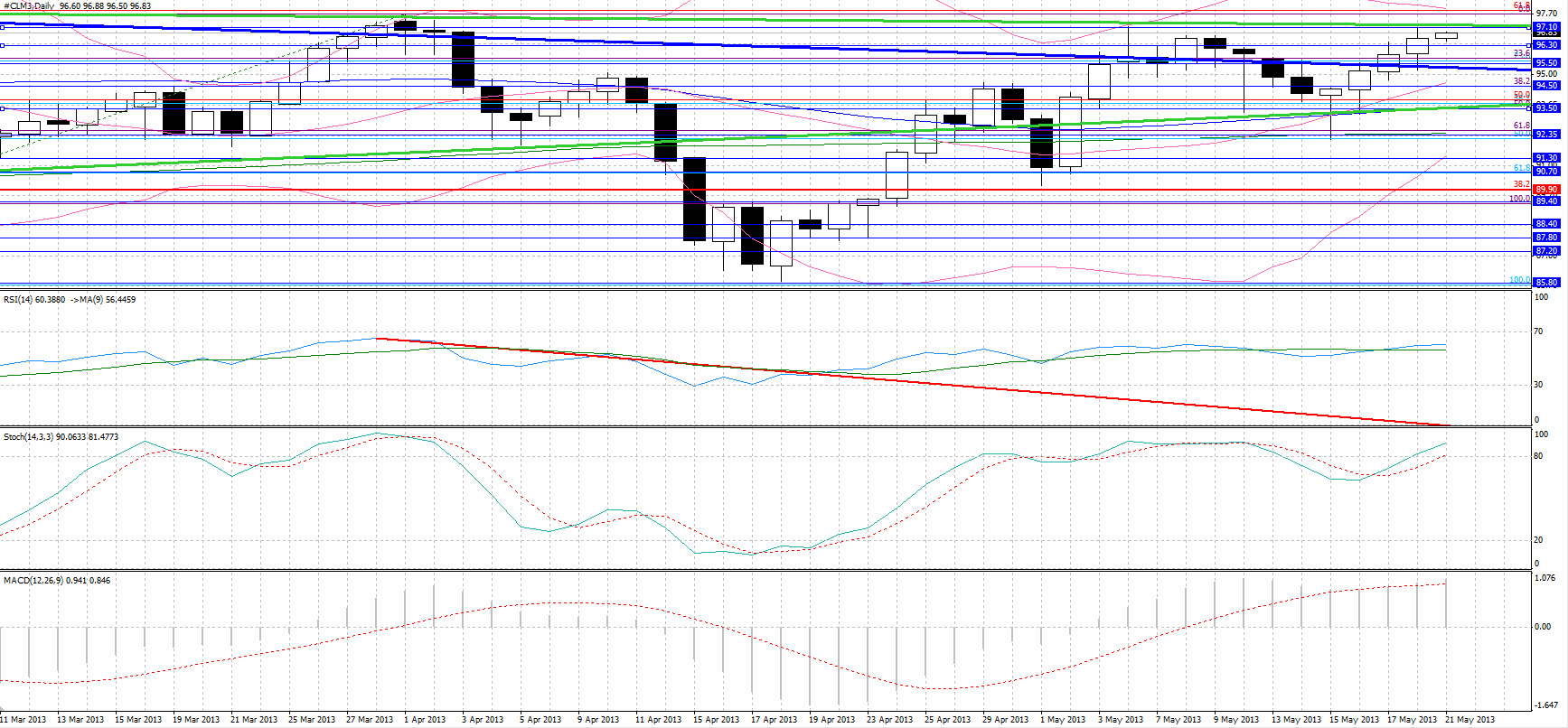

• WTI was also a major gainer yesterday, rebounding from trendline support at $95.40, hitting strong trendline resistance at $97.10 on anticipation that U.S. crude stockpiles declined further as we head into the driving season. A continuation of the rally may find resistance around 98.00. Initial support comes at $96.30 with further support found at $94.50.

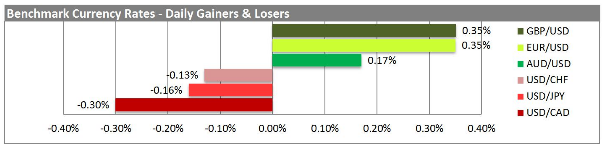

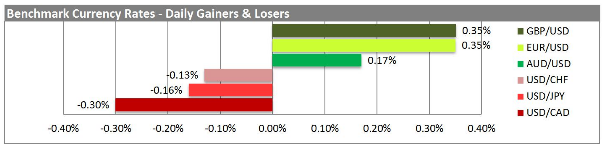

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

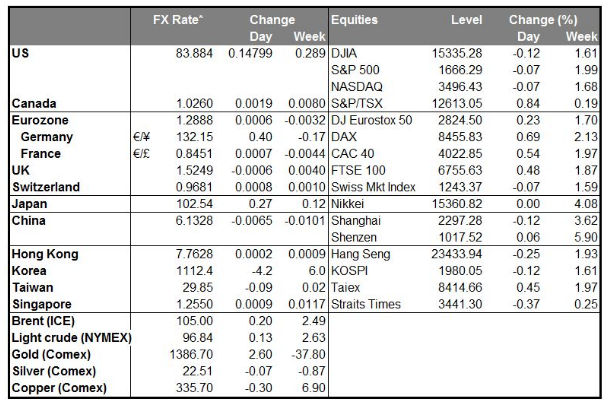

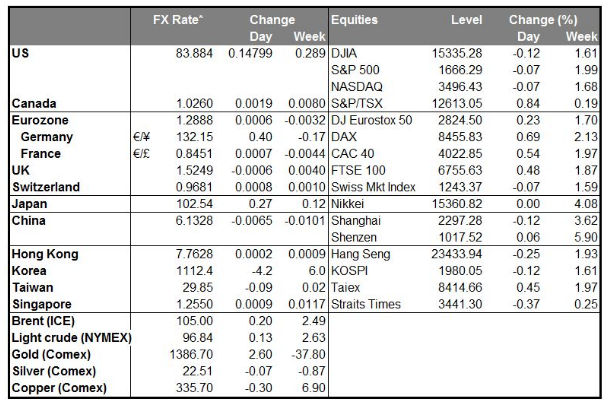

MARKETS SUMMARY

Early today, Germany’s PPI figures for April will likely place in the spotlight again the disinflationary pressures witnessed in the Eurozone, which are a consequence of the no growth environment. The YoY figure showed a 0.1% increase in prices, lower than the 0.2% estimate and March’s 0.4% increase, with the MoM data exhibiting a third consecutive month of deflation, an event last seen during the financial crisis bottom in the first half of 2009.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Later today, the UK announces the consumer and producer price indices for April. The CPI is forecast to be up +0.5% mom in April, an acceleration from +0.3% mom in March, but this would actually be a decline on a yoy basis to 2.7% from 2.8%. The output prices index is forecast to be up a bit at +0.4% mom, vs +0.3% mom in March. Does it matter? The Bank of England itself forecasts that inflation “is set to edge higher over coming months…. bolstered by external price pressures and administered and regulated prices.” Lower inflation this month would be nice, but I doubt they will embark on a more aggressive easing course right now when their own inflation expectations are so high. Wait until Mr. Carney arrives in July for any such change.

Elsewhere, Mr. Carney, Bank of Canada governor for 10 more days, is scheduled to give a speech today before the Board of Trade of Metropolitan Montreal with another one scheduled by St. Louis Fed President James Bullard on “Monetary Policy in a Low-Rate Environment” in Frankfurt.

Overnight attention will be shifted to Japan, where the likely large increase in exports for April on the weaker yen, following the BoJ change in monetary policy, is due to decrease the adjusted merchandise trade deficit by a third. These indicators are released a few hours before we have the completion of the two-day BoJ policy meeting and Kuroda’s speech, with stimulus expected to remain steady, despite the recent increase in Japanese bond volatility.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The Market

EUR/USD

EUR/USD" title="EUR/USD" width="1733" height="806" />

EUR/USD" title="EUR/USD" width="1733" height="806" />• EUR/USD began a rebound following the deteriorated, six-month low Chicago Fed National Activity Index for April, with the rebound continuing into Evans speech. Trendline resistance came at 1.2900, with 1.2905 seeing resistance today as well, whilst stronger Fibonacci resistance comes at 1.2980. Trendline support looks to come at 1.2855, with stronger support in the 1.2770 – 1.2795 area.

USD/JPY

USD/JPY" title="USD/JPY" width="1733" height="804" />

USD/JPY" title="USD/JPY" width="1733" height="804" />• USD/JPY lost yesterday on the back of comments by Japan’s Economy Minister Amari that further yen weakness may impact “people’s lives”, with the down move triggering, in overbought levels, bearish crossovers in the Stochastics and the RSI. However the pair gained overnight after Amari retraced on his Sunday comments, stating that he will not say whether or not the yen’s overly strength “has been corrected, or where it will finish”. Resistance came at 102.70, with likely further resistance coming at 103.30. Well-tested support is seen at 101.95, with further support at 101.35.

GBP/USD

GBP/USD" title="GBP/USD" width="1732" height="804" />

GBP/USD" title="GBP/USD" width="1732" height="804" />• Cable rebounded from 1.5170, its 1 ½ month lows, following the highest increase in the YoY Rightmove House Price Index in more than a year, with the sterling furthering its gains as BoE Governor King cited “modest recovery”. Strong resistance came around 1.5270, which sees a reversal level and the 50-day MA. The former 1.5220 resistance level, which is the 50% retracement level of the March – April rebound, is now acting as support with stronger support in the 1.5190 – 1.5200 area and Fibonacci support at 1.5130. Resistance above the 50-day MA is likely to come at 1.5310.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Gold

• Gold bulls managed to reverse yesterday’s morning picture as the precious metals, particularly silver and gold, had an exceptional 24-hours, with gold rebounding from its double-bottom at $1338, breaking out from $1370 and $1385 resistance, though finding twice resistance at $1400. The inability to break below the lows and the support found at $1385, with a bullish Stochastics crossover and the RSI on the verge of a bullish crossover, point to a technical rally, should we breakout from $1400, initially to the $1423 – 1431 area ant thereafter to $1445, where there will likely be strong selling pressure.

WTI

• WTI was also a major gainer yesterday, rebounding from trendline support at $95.40, hitting strong trendline resistance at $97.10 on anticipation that U.S. crude stockpiles declined further as we head into the driving season. A continuation of the rally may find resistance around 98.00. Initial support comes at $96.30 with further support found at $94.50.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI