Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

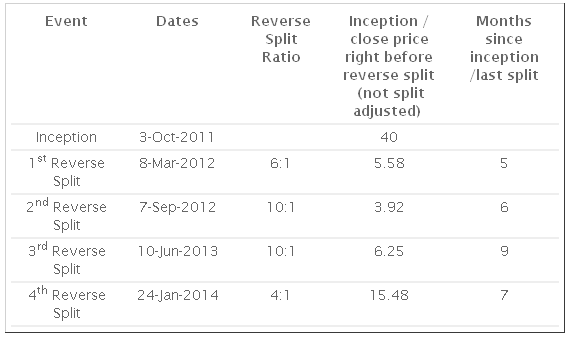

ProShares Ultra VIX Short-Term Fut, (UVXY) announced that they will reverse split UVXY 4:1 effective 24-January-2014.

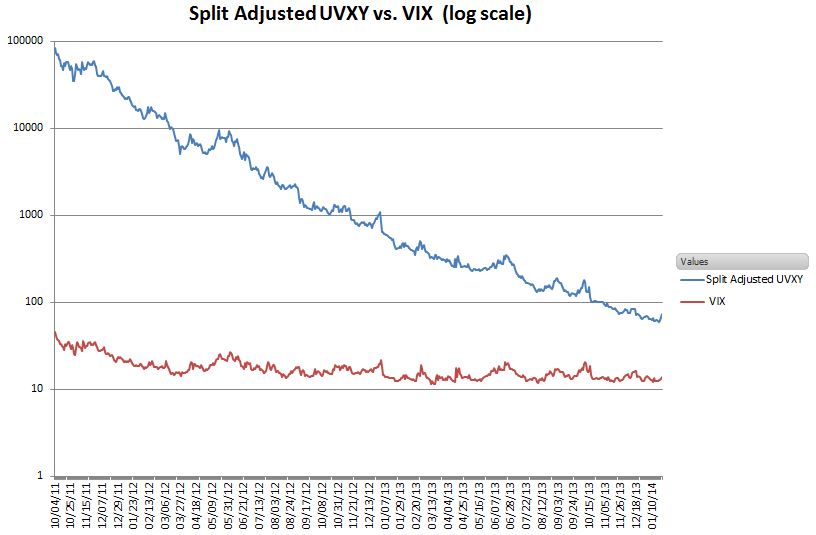

Lacking major volatility spikes the 2X leveraged short term volatility ETPs like ProShares’ UVXY and VelocityShares’ TVIX need to be reverse split about every 9 months to keep their products in a reasonable trading range. Lacking market panics they tend to be ravaged by contango at the rate of around 90% per year.

If you hold shares of UVXY there isn’t anything to worry about. The value of your investment stays the same through the reverse split process. You just have 4X fewer shares that are worth 4X more each. If your share holdings are not a multiple of four, say 215 shares, you will get 53 reverse adjusted shares and a cash payout for the 3 remaining pre-split shares.

If you are short UVXY, same story, no material impact.

If you were holding UVXY options (long or short) when the reverse split occurred there’s still no material impact, however the option chains are going to hurt your head for a while. For reasons unknown to me the Options Clearing Corporation chose to adjust for the reverse split by changing the number of shares per contract from usual 100 to 25. The option chains don’t adjust the strikes and the underlying symbol changes to UVXY2—which is one quarter of UVXY’s price. New options will be generated with UVXY as the underlying, but the old adjusted options will hang around until they expire.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI