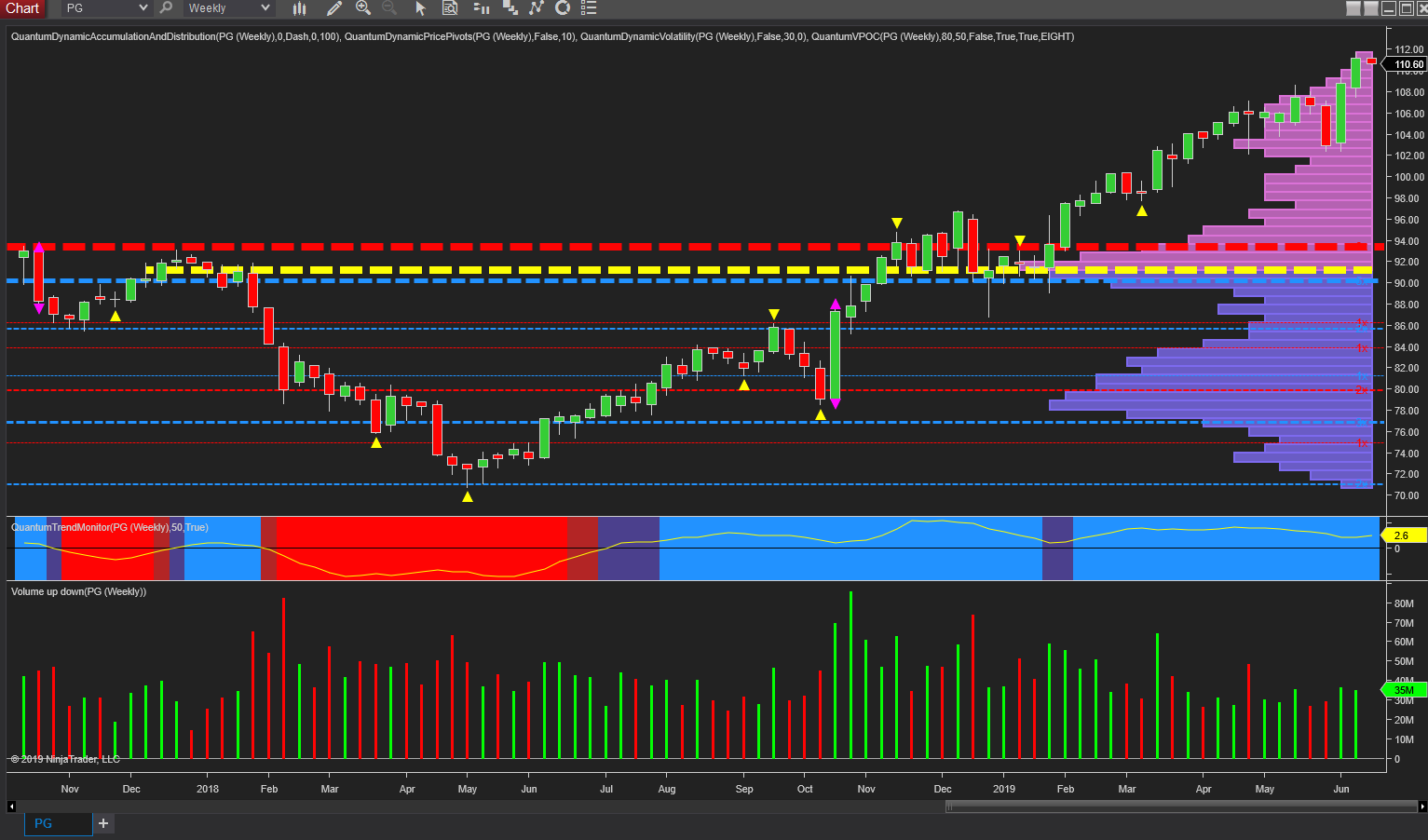

The longer term trend higher in Procter & Gamble Company (NYSE:PG) could best be described as steady, and a great an example of a blue-chip stock providing steady gains on the share price, as well as above average returns on the dividends which are above average at 2.8% and which have increased for a remarkable 62 consecutive years. A stellar performance by any yardstick and one that looks set to continue, and for income investors one to consider particularly given the technical picture which remains very bullish.

Last week’s price action saw the stock close with a wide spread up candle on good volume taking the price from $108.32 to $111.20 on the weekly chart, as bullish sentiment continued from the prior week which had seen a strong two-bar reversal develop. What is also interesting in this move higher, is those weeks where sustained selling developed, only for this to be reversed by strong buying as the candles closed with a deep wick to the lower body on high volume. These occurred in March and April thereby sending a strong signal of intent from the market makers, that this stock was set to continue higher. Moreover, the last widespread down candle of late May was accompanied with only average volume, when compared with selling volumes during the trend lower of 2018, and once again confirming the stock is set to move higher and on through the $112 price where a low volume node now awaits on the volume point of control indicator. As such, we should see the stock pierce this level with ease with the trend monitor indicator remaining firmly blue and confirming the bullish sentiment for Proctor & Gamble.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.