With only a few days left to 2016, ‘tis the season of the year-ahead outlook. It’s a tradition freighted with baggage, but there’s something about a calendrical denouement that inspires crystal-ball gazing. In short, everyone has a view about what’s in store for 2017. Some of the predictions could be right, although the historical record suggests that most will be wrong. The bigger challenge is figuring out, in advance, where accuracy lies… or doesn’t. With that caveat out of the way, let’s throw one more forecast into the mix by way of Mr. Market’s implied estimate for near-term price trends via momentum.

As predictions go, momentum-based analytics suffer all the usual caveats, but you could do a lot worse. As a first cut of how the major asset classes are faring in the waning days of the year, let’s review the state of price trends via a set of proxy ETFs. Today’s installment focuses on equities, followed by bonds (Wed), commodities (Thurs), and concluding with real estate (Fri).

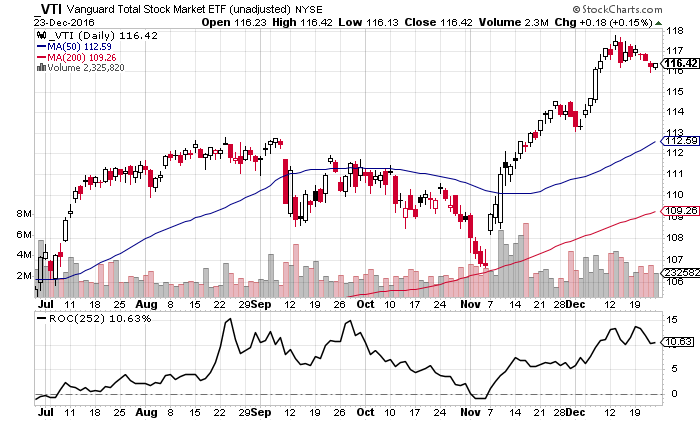

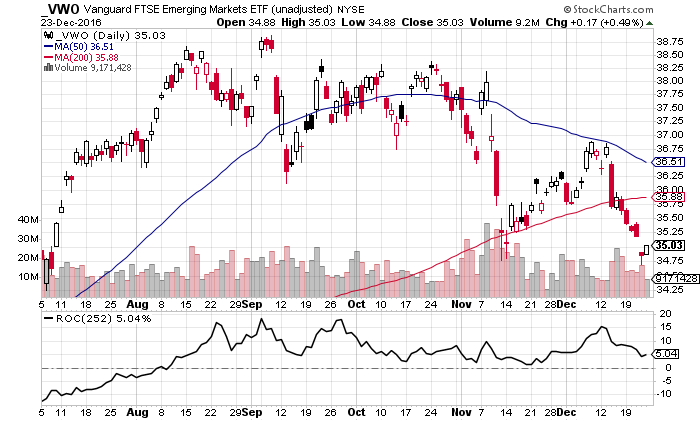

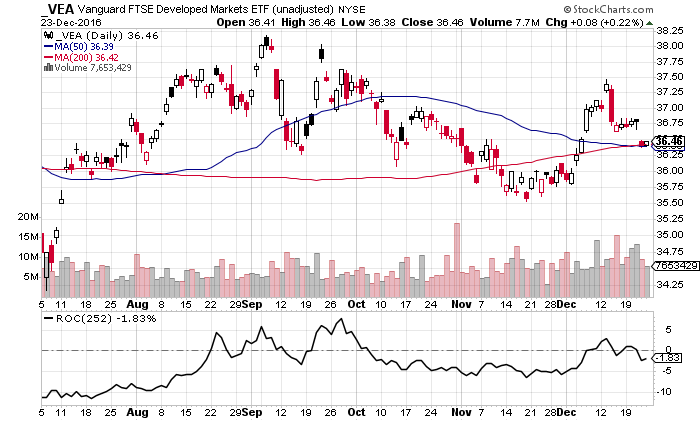

The toolkit of choice for this recap: 50- and 200-day moving averages plus one-year returns (252 trading days). Positive one-year performance and a 50-day average above its 200-day counterpart is considered a bullish signal, with the reverse signaling a bearish outlook. For direct comparison, all the results are based on price-only data, which is to say that distributions are ignored in the charts below. What follows is far from a definitive accounting of the current state of momentum, but it’s a reasonable start. Without further ado, let’s check in on Mr. Market’s implied forecasts, based on data through December 26 courtesy of StockCharts.com.

The lead story at the moment: Bullish momentum remains strongest in the US stock market. Vanguard Total Stock Market ETF (NYSE:VTI) is posting a solid 10%-plus price return over the trailing one-year period and the ETF’s 50-day average is well above its 200-day average. In short, momentum paints a rosy near-term outlook for this slice of the world’s equity markets.

The encouraging momentum profile doesn’t suffer when we break out US stocks into large- and small-cap pieces (NYSE:IWB and NYSE:IWM, respectively). In both cases, the bullish trend is intact. In other words, the recent rally is broad based.

By contrast, stocks in developed markets ex-US (NYSE:VEA) and emerging markets (NYSE:VWO) look wobbly as the year winds down. The emerging-markets ETF has recently slipped below its 200-day average. If VWO’s 50-day average follows suit, and the trailing one-year performance dips into the red, the near-term outlook for these stocks will deteriorate further.

Within the developed space, most of the weakness is coming from European markets. The momentum profile for Vanguard FTSE Europe (NYSE:VGK) is moderately bearish these days. Equities in Asia’s developed markets, on the other hand, are somewhat stronger by comparison, based on Vanguard FTSE Pacific (NYSE:VPL).