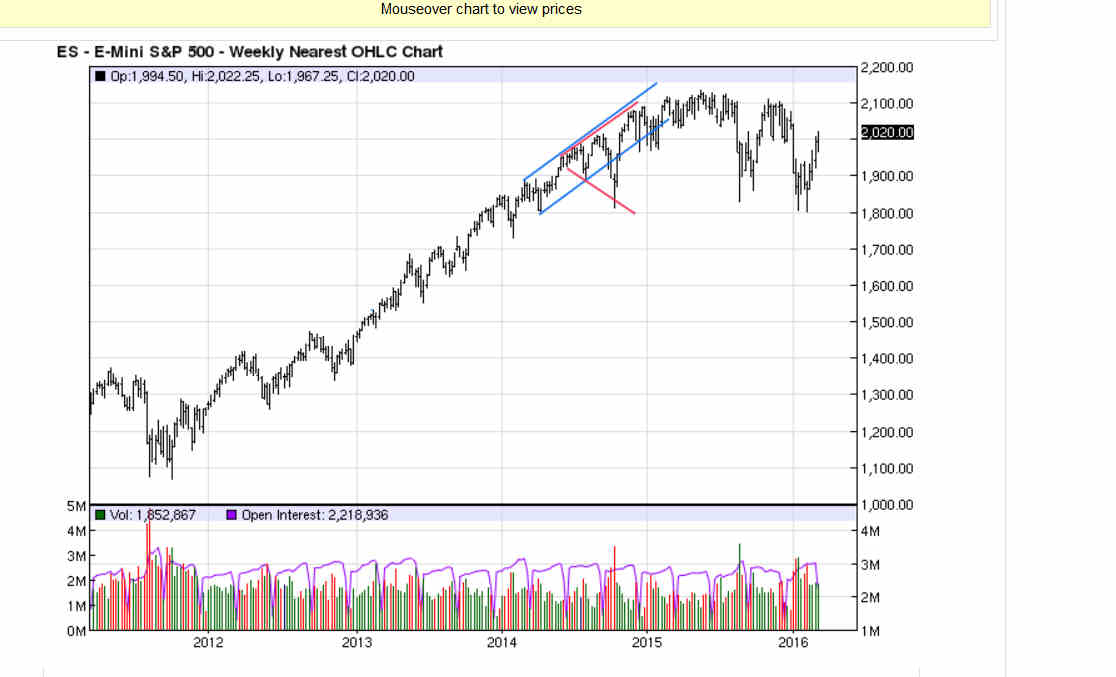

ES has Confirmed a Price Channel on its Daily Chart

ES has confirmed a price channel on its daily chart. The channel is in its critical decision wave, where a price channel either tops or sets up a break out into a melt-up.

You can find the same price channel on the S&P 500 and SPY (NYSE:SPY) daily charts.

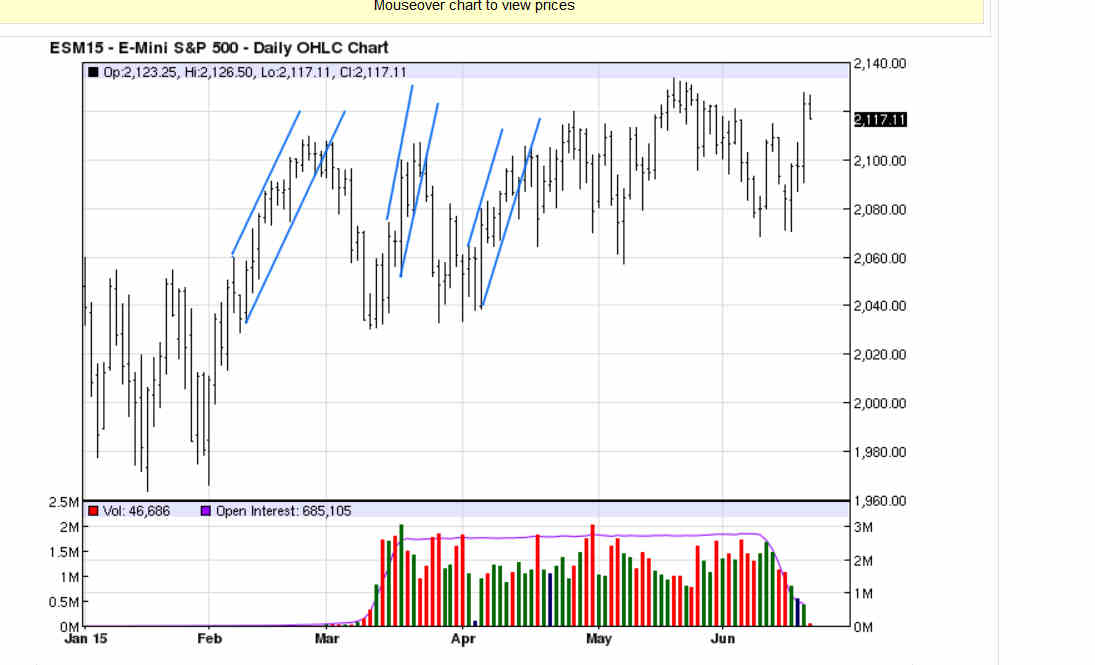

Same ES Price Channel (Red) on the 60-Minute Chart

Here is the same price channel on the ES 60-minute chart.

Normally at this point in a price channel I would be talking about how ES could break out upwards here into a melt-up (green scenario in top chart) vs how much farther it was likely to travel up if it elected instead to start a top (purple scenario in top chart).

However, the blue scenario in the top chart is a strong favorite. That is because this price channel has confirmed so late in an extremely bullish move.

Price channel confirmations tend to be bullish when the confirmation occurs early in an upwards move. The idea is that a price is ratcheting back and forth quickly, in a real battle between bulls and bears close to a bottom, and then the bulls run over the bears for a big melt-up.

The idea is the same in reverse with a bearish price channel confirming near a top.

But this late in a move, the buying at the bottom of the price channel is usually a sign that the only buyers left are little-guy technical traders. They usually have about enough buying power to push the price to a slightly higher high before it rolls over.

One tell to look for this late in a price channel is whether the 2nd touch on the channel bottom and move to a higher high have occurred within a megaphone. You can see clearly on the 60-minute chart that, in this case, these moves have occurred within a confirmed megaphone (navy blue).

Price channel confirmations that occur within a megaphone are almost always a sign that the price is about to roll over. Here are some recent examples.

Example of a Price Channel (Blue) Late in a Move Confirming within a Megaphone (Red)

Note that the price can resume climbing after the price channel rolls over to its likely retrace target.

More Examples of Price Channels that Confirmed Late in a Move

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.