Trade agreements, Intel, Trump/Powell - what’s moving markets

Mosaic has a whole new look and feel (it’s been a long time coming) so I thought I’d take a little breather and explore some possibilities for predicting volatility thresholds as part of the evolving PDQ module.

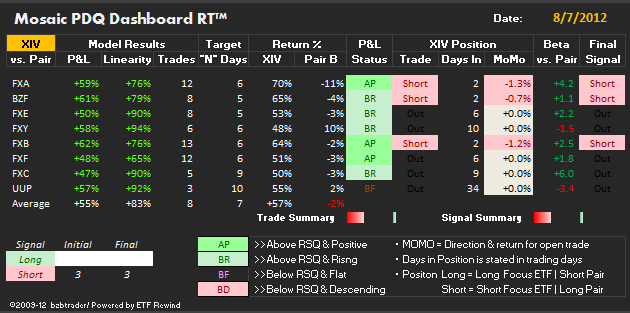

In this case we use the PDQ to look at XIV (the Inverse VIX ETF) vs a variety of currencies. What?, you say. How does that compute? Well, like I said… this is a jumping off point, not a final destination. The general consensus among many technical traders is that it’s easier to predict volatility than momentum in the equities markets…so let’s see how we might test that idea.

As always with the PDQ, we’re using the z-score algorithm to examine the correlation and differential long/short returns from a basket of pairs, all of which have XIV as one side of each pair. We want the returns from the VIX side of the pair to consistently exceed the “pair B” side since that is the instrument being traded. Today’s snapshot suggests that XIV is a modest SHORT candidate…we could use some more confirmation to get us enthusiastic about this trade…but today’s live action at least has the trade moving in the right direction.

Bernanke Put

Breadth was strong and the market finished in the green again on more QE rumors. Buyers put aside worries as Central Banks around the world are standing by ready to act. Bears and fund managers are probably caught off guard and are exaggerating the recent up moves as call writers are forced to buy equities and asset reallocation out of bonds are adding fuel to fire.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

That said, we are getting very overbought and a 9-14pt pullback is likely in the near term and it may have already started right before the close. However trends are still pointing up and looks like the bulls are setup to finish strong into option expiration next week.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI