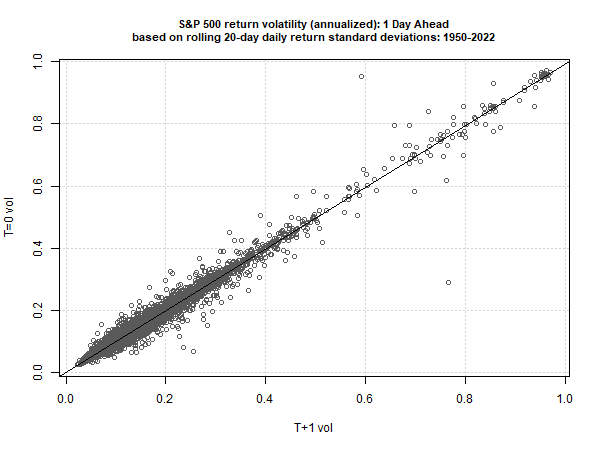

Predicting market risk is easier than predicting return, as demonstrated in the first instalment of this series. The caveat is that we shouldn’t conflate easier with easy. Nonetheless, a simple model of using yesterday’s return volatility proves to be a reliable forecast for today. The key question: how far into the future can we effectively forecast vol with this naïve model? The short answer: the reliability fades, quickly.

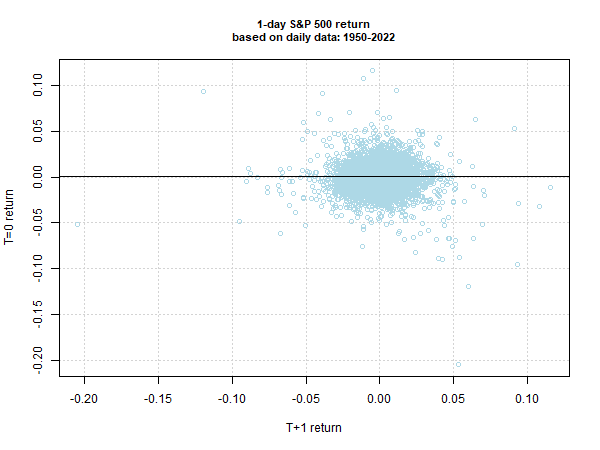

For perspective, keep in mind that a comparable degree of reliability with the same model with forecasting day-ahead returns would be a license to print money. Alas, Mr. Market doesn’t allow such things with performance data and so forecasting even a day-ahead based on the last data point is hopelessly random.

Volatility is another matter. The day-ahead forecast of return risk for the S&P 500 Index, for example, is highly reliable, as shown in the first chart below. It’s not perfect, but it’s close: the correlation between t+0 and t+1 vol is 0.991 since 1950 – a stone’s throw from a perfect score of 1.0.

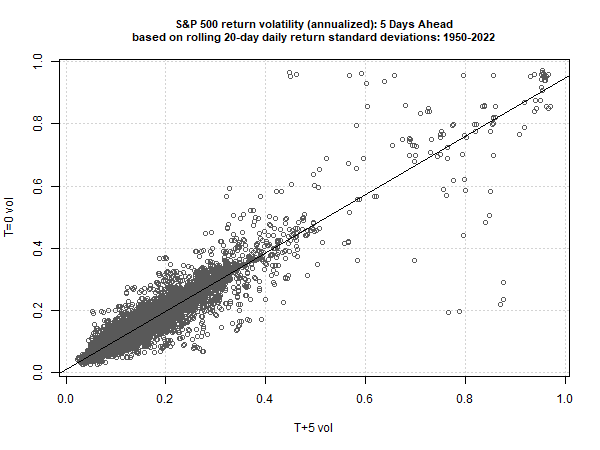

Reliability takes a modest hit when the forecast is pushed out to 5 days, although the correlation is still high at 0.940.

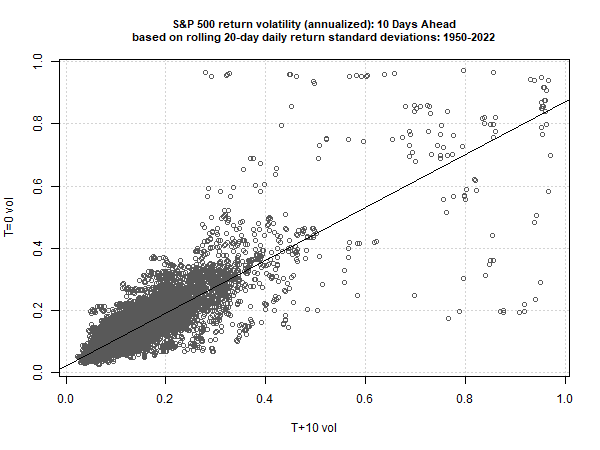

The model starts to show significant breakdown at 10 days ahead, with correlation falling to 0.845.

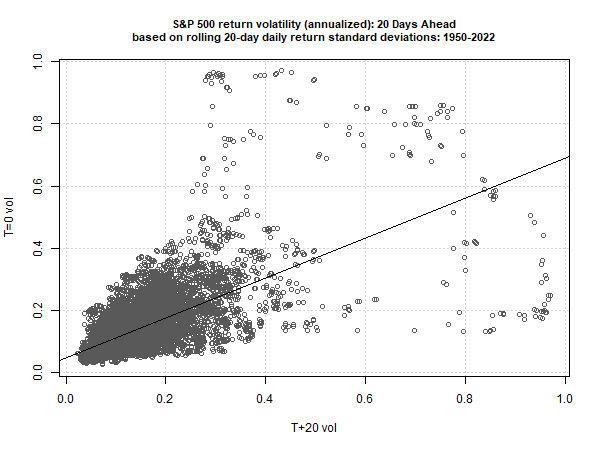

At 20 days, the jig is up and we’ve got borderline noise via a correlation of 0.642.

The lesson seems to be that you can develop reasonably reliable vol forecasts for the S&P 500 out to 10-days or so, but by 20 you’ll need another model. Are forecasting analytics up to the job? We’ll explore some possibilities in the next update for this series.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI