Next weeks non-farm payroll (NFP) release only gets bigger after yesterday’s FOMC communiqué. The Fed’s perfectly hedged statement was a tad more hawkish than many had been expecting and now leaves the possibility of a December rate hike on the table by specifically noting that the Fed will be watching the data and then deciding whether or not to raise rates at that meeting.

In determining whether it will be appropriate to hike, the Fed will be assessing the progress toward its objectives of “maximum employment and +2% inflation.” So, in acknowledging the cooling in September’s jobs report would suggest that NFP could be the tiebreaker for a 2015 hike.

It seems that U.S policy makers want to see the labor market data bounce back strongly. The statement referenced “the pace of U.S job gains slowed and that the unemployment rate held steady” versus the previous statement, which indicated that “the labor market continued to improve, with solid job gains and declining unemployment.” Its no doubt that every U.S jobs report is a significant event, but the remaining few probably has got that wee bit more important.

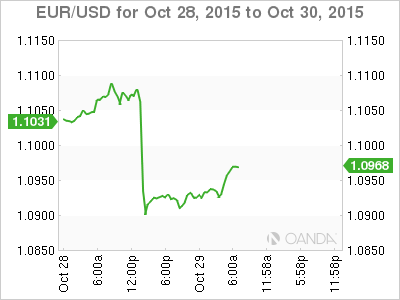

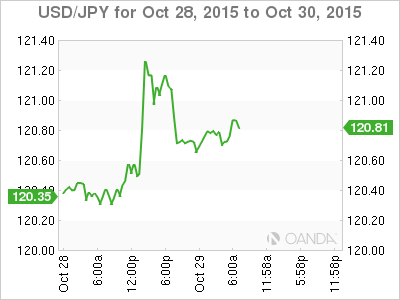

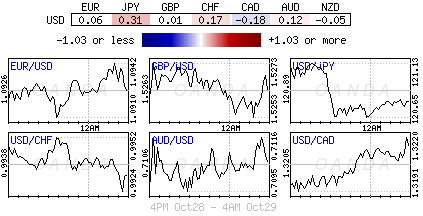

The Fed’s somewhat hawkish tone has had a definitive market impact – the U.S yield curve have steepened, the mighty dollar is in demand, gold is under pressure and rate divergence trading is again in vogue (€1.0933, ¥120.85). Nonetheless, as per the Fed’s directive of data dependency, investors will always be waiting for the next surprise benchmark report to break out of the consolidating range trading that many have become accustomed to. Could that come as early as today’s U.S Q3 GDP print? Thus far, the Fed’s (+0.8%) and private estimates (+1-+1.6%) are not on the same page, but they do agree that the U.S economy likely slowed over the summer months. Perhaps a weaker Q3 and Q4, no matter what NFP delivers, will end delaying a Fed rate hike?

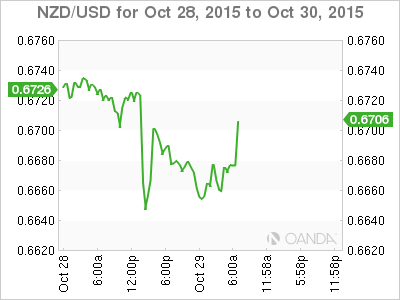

The kiwi surprised the markets: The NZD (N$0.6677) did come under pressure when the Fed signaled a possible rate increase, but managed to claw all that back and then some, when the RBNZ surprised the market and kept rates on hold yesterday. Governor Wheeler held rates (+2.75%) for the first time after three consecutive cuts. It certainly was not a surprise to see kiwi policy makers being downcast in their assessment for global economic growth, citing as “below average,” but it was surprising to hear the RBNZ being a tad more vocal on the short-term fluctuations in their exchange rate. They noted that the NZD rally since last month, if continued, would “dampen tradable sector activity and medium-term inflation” and that “would require a lower interest rate path than would otherwise be the case.” In actual fact it seems that the RBNZ is now back on the fence, unless the kiwi rallies. Money market dealers have now slashed their odds for a December rate cut.

Japan September Preliminary IP beats expectations: The case for further Bank of Japan (BoJ) policy easing later today has been dented by surprisingly strong Japan industrial production in September. Industrial output rose +1%, m/m, compared with a -0.5% fall forecasted. This has convinced some investors to lock in some well-earned profits (¥120.83) ahead of the BoJ meet. Complicating matters for the ‘doves’ is the Cabinet Office actually upgrading its view of industrial production to “moving sideways,” anticipating more strength this month before a modest decline in November. However, the BoJ does have a history of surprising. There are a number of independent reports out of Japan that are speculating that the BoJ will likely have to push back the date of achieving its +2% CPI target beyond the H1 of 2016 currently expected.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI