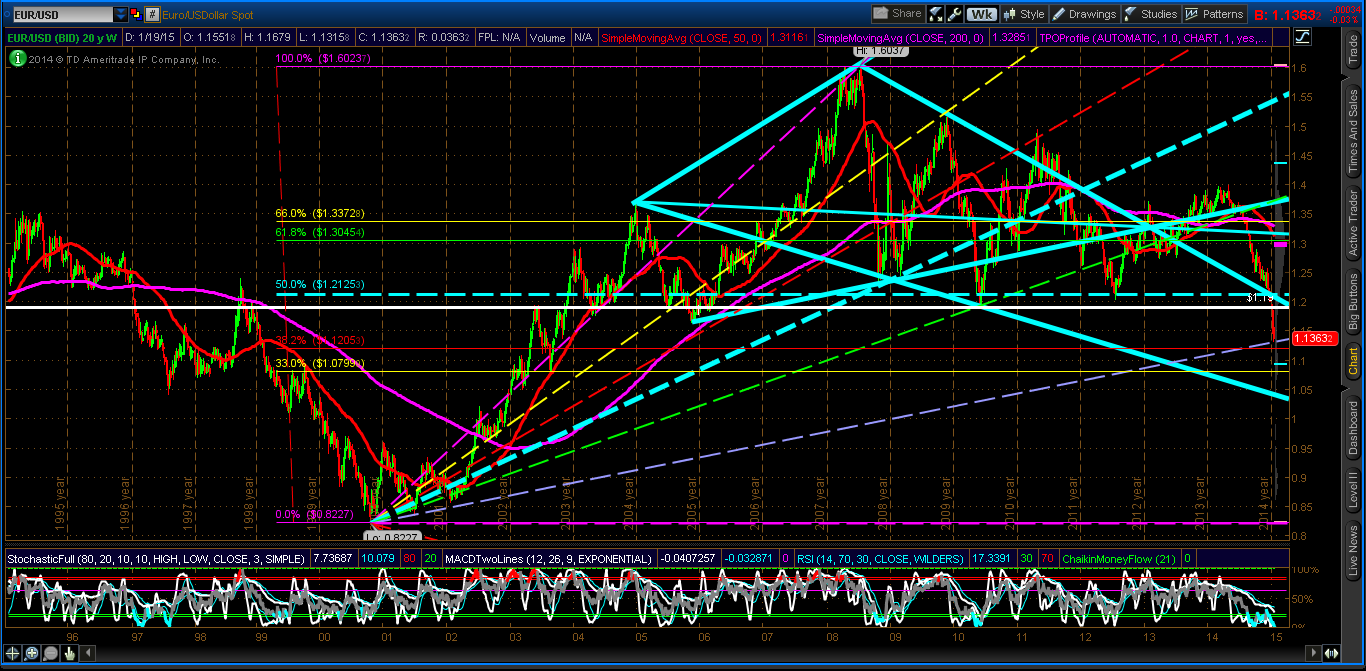

Further to my recent posts here and here, the EUR/USD Forex pair has reached a potential (double Fibonacci) support level between 1.1205 and 1.13, as shown on the following Weekly chart. A possible bounce is in store for the euro.

Failure to begin stabilizing at this level and reclaim the major resistance level between 1.19 and 1.2125 (seen pre- and post-2007/08 financial crisis) could send the euro plunging down to the 2000 lows of 0.8227. I can't imagine that's what Mr. Draghi has in mind with his ECB QE policy announcment earlier today...although stranger things have happened.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.