Risk assets are surprisingly stable at the open on Sunday night, in spite of the news out of Europe (see post). Key development providing support to markets is the positive economic news coming out of China. Here are some of the recently released indicators:

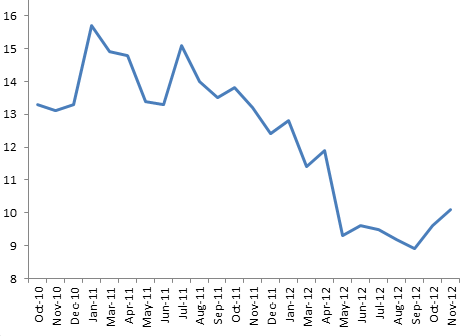

1. Inflation rate seems to be at the lowest level since early 2010.

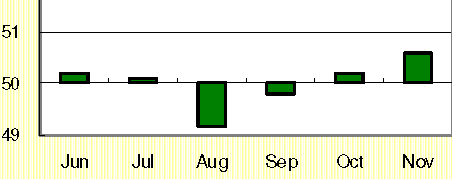

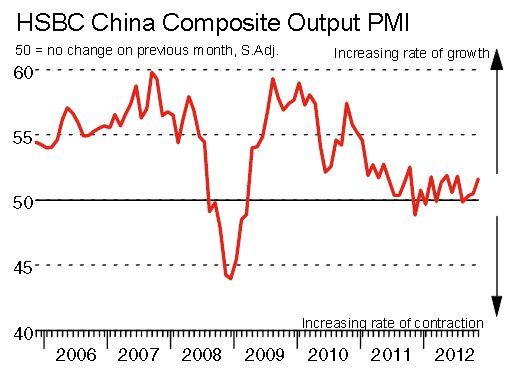

2. The official manufacturing PMI shows expansion - quite modest, but expansion nevertheless (>50 = expansion, <50=contraction).

3. Services PMI is also shows some signs of life.

4. Industrial production is up some 10% YoY. Not great relative to recent history, but still an improvement.

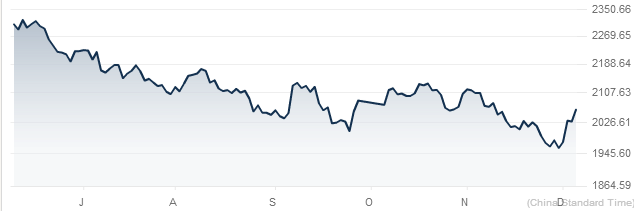

5. The equity market, which has become too scary for retail investors (see discussion), had its biggest rise in 13 months.

Clearly there are still some major problems. For example a "wealth management product" sold at a branch of Huaxia's Shanghai Branch defaulted last week. There is certainly more to come (see this story). People have been talking for some time now about China's shadow banking and Huaxia's product should be a wake up call.

There are also problems with the property bubble, as housing now grinds higher for a sixth straight month. So much for making housing cheaper.

In spite of these issues, at least for now it looks like China has been able to avoid "hard landing" and is beginning to show some recovery.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.