As mentioned last week just as things took a dive, a look at the major market indices does not look promising. If we take an even longer-term look and examine the monthly charts we see that The S&P 500 and the Dow Jones have been approaching multi-decade, rising-channel resistance lines. Further, they also appear to be forming bearish rising-wedge patterns.

Historically Speaking

As many of my longer-term readers know, I always preach that technical analysis is one part art and one part science: you can never be completely certain on what the outcome of a pattern is going to be. However, we can use historical analysis to make better investments. The great American Novelist Mark Twain probably said it best, “history does not repeat itself, but it rhymes”. Regarding a rising-wedge pattern, we know that roughly two-thirds of the time they will break to the downside.

This also means that one-third of the time they break up. In accomplishing our goal of capital growth we must do a number of things. We must make returns on our investments, we must protect our investments and we must limit our losses. While all three aspects work in tandem, there are times when focus must be allocated to one specific approach.

Today's Indices

Regarding the current technical setup, I’m not so focused on the 67% chance that these wedges will break to the downside, but more on the impact of each outcome on the average Joe’s portfolio and mom and pop's business. The S&P 500 and the Dow are approaching long-term resistance lines that have been in place for decades. If we do break to the downside, which I suspect we will, there could be a very significant sell off with consequences that no one can predict, though I mention some things in the chart above. Alternatively, there is significant overhead resistance in the various indices and I don’t believe an upside break would be too monumental.

That said, I always like to keep an open outlook and wait for the right opportunity. I’m trying to think of scenarios that would prelude further upside action and I'm drawing a blank. As evidenced by the completion of the recent 5-wave uptrend on the S&P, which coincided nicely with the various quantitative easing policies, Ben Bernanke and the fed have had less-and-less impact. I truly can’t see many fiscal developments that would prompt significant bullish action.

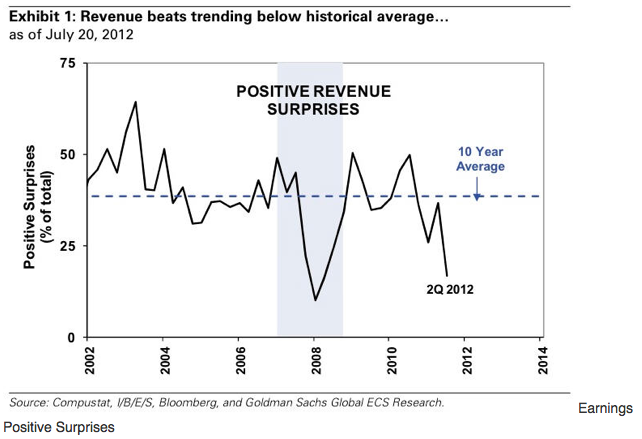

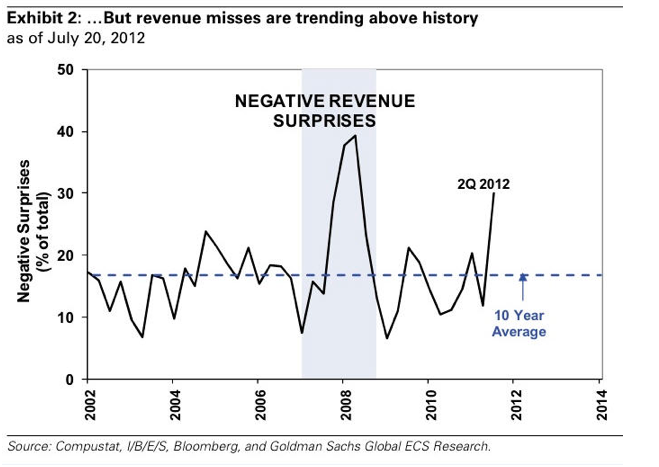

The only scenario I see that could pump up equities is a series of positive earnings announcements. A lot of expectations, earnings numbers, guidance, etc. have been revised downwards over the last couple of quarters, so there is the opportunity for some positive surprises that could lead to bullish price action. In absence of such a scenario, I can’t think of much else that would prompt a run up.

Look at these charts of positive and negative earnings surprises, along with the dates, and remember what happened following the negative data.

Positive Earnings Surprise

Negative Earnings Surprise

That said, I am recommending two courses of action. For those steadfast bulls, lock in some profit and/or buy protection. Missing out on some of the upside is a lot better than losing the gains you've fought so hard for over the past couple of years. For the more aggressive traders and investors, start following my updates a little more regularly as I foresee many shorting opportunities. As many of you know, sell-offs are often quick and abrupt and timing is extremely important when playing the downside.

Further, trading could soon get volatile. Historically -- and even more so looking forward -- August and September have been very costly for the average investor. Our focus will be in taking the highest probability trades that offer the best risk-to-reward scenarios. There will be times when we miss trades and times when they’re not timed perfectly. But, as those who have been with me for a while can attest, patience pays off in the long run.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.