As we slide into the last weekend of 2013, I read several articles this week that got me thinking about where the markets and economy are likely headed in 2014. However, before we get into today's list of "Things To Ponder This Weekend" I just wanted to wish you a happy, safe and prosperous New Year.

1) The Year The Fear Bubble Popped by Eddy Elfenbein

I have written several articles in the past discussing that there was currently Too Much Bubble Talk for a bubble to exist currently. Just as with Alan Greenspan's infamous "irrational exuberance" call in 1996 - the bubble actually popped four years later. Eddy's discussion of the "bubble in fear" follows a bit of the same logic suggesting that there is "no bubble" in assets, it has been in people's "fear" of another market crash.

"Lately, many investors have been tripping over themselves in an attempt to call the current stock market "a bubble." Me, I'm in the doubter camp. But what's interesting is that this question misses a much larger point — we've been watching a bubble pop all year. The bubble was in fear."

He posts several charts to support his thesis of how the "fear trade" has gone horribly wrong with gold plummeting, bonds getting smashed and even "safe haven" stocks underperforming.

However, here is an interesting question to ponder this weekend:

"The lack of 'fear" has been a hallmark of every market bubble in history. Therefore, is Eddy's thesis of a "pop in the fear bubble" a tell-tale sign of an asset bubble in the making?"

2) The Limits Of Expansionby Edward Lambert

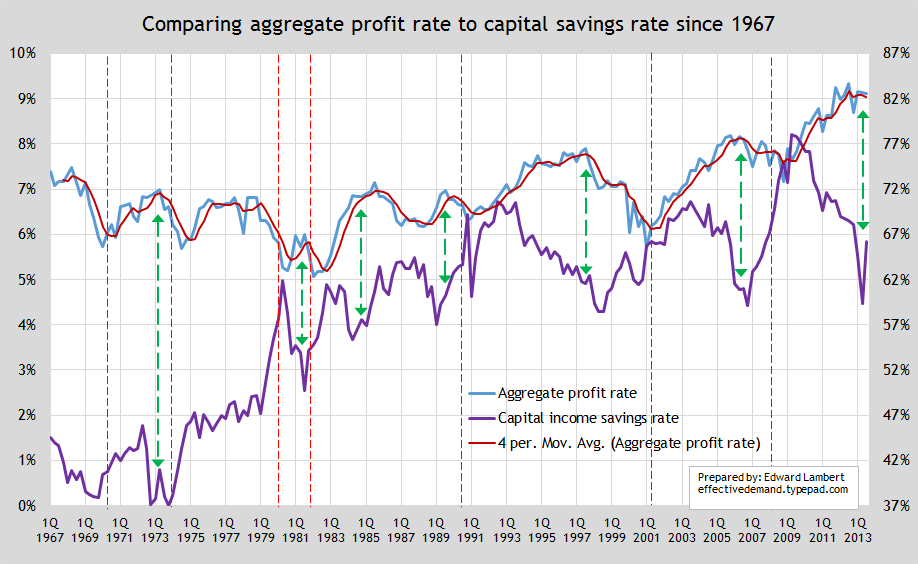

The discussion of the "lack of fear" got me to thinking about the real long term driver of the financial markets which is economic growth and corporate profits. Edward Lambert posted a very interesting discussion of aggregate profit and capital income stating:

"The most recent data implies that the economy is reaching the limit of its expansion. Capital income's savings rate tends to decline to a level around 59% since the 80′s. Then it rises before a recession. It jumped briskly up in the 3rd quarter 2013. You really only see increases like that before and during recessions.

I realize many economists celebrate the strong real GDP growth of over 4% in the 3rd quarter 2013, and they forecast more strong growth for years to come... Many people get enthusiastic too. It is easy to celebrate the height of an expansion. However, everything needs to be put into the context of a larger picture. The dynamics of profit and savings for capital income are signaling the limit of the economic expansion."

3) A Great Ride, But Reality Is Returning by Jeff Sommer, NYT

Jeff did a nice analysis of the 2013 stock market run and the drivers behind it. It is well worth reading.

"It's been the kind of year that makes an average investor feel like a genius: You could just put your money in a stock index fund and watch the market speed ahead. Why not take a few moments to savor it?

Let's reflect on how remarkable the American stock market has been lately, and on how well it has been weathering the first few days of a late-December shift in Federal Reserve policy. And then let's get used to worrying again, because stormier times are coming, probably fairly soon. What we've been experiencing is outside the typical range of market behavior over the last 100 years.

It's just that a basic law of finance — that you need to take risks in order to get higher returns — may become more obvious. Risk has been suppressed. It may be coming back"

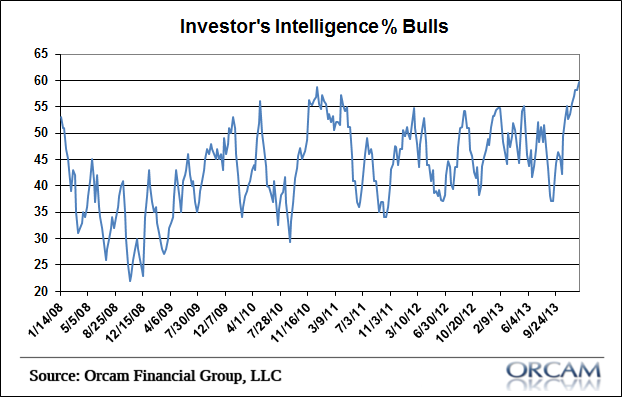

4) Bullish Sentiment Surges by Pragmatic Capitalist

"The most hated bull market in history is slowly but surely turning into one built on perennial optimism. If there was one major insight from 2013 it was that the stock market, increasingly, is rallying on true optimism rather than merely overcoming what long looked like negative expectations. The S&P 500′s meager earnings growth this year combined with strong multiple expansion makes this clear.

This week's Investor's Intelligence survey was another sign of strong optimism as the bulls surged to 59.6%. This is fast approaching the "danger zone" according to the survey. Levels above 60% are extremely rare and were last seen in October 2007 when the market peaked."

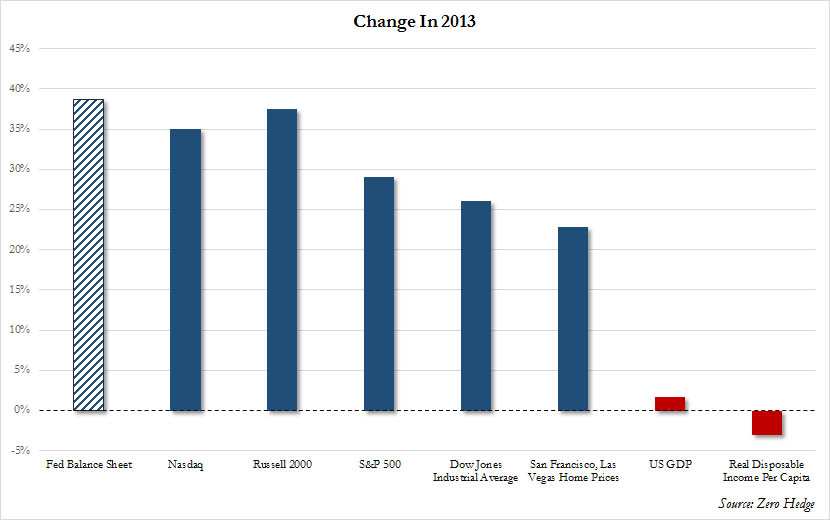

5) Chart Of The Day via Zero Hedge

Tyler Durden at Zerohedge posted a terrific chart that really sums up 2013 and sets the stage as we ponder the outcome of 2014.

There are many high hopes going into 2014. Mid-term election years have a 67% chance of sporting positive returns, interest rates remain subdued along with inflationary pressures and the Federal Reserve is still pumping in $75 billion a month.

Markets rising are not what we as investors should be thinking about. Rising stock markets are easy. What we should be pondering are the rising risks that could potentially take it all away when we least expect it. Complacency has never been a hallmark of investor success.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI