Goldman Sachs speculative trading indicator hits record high

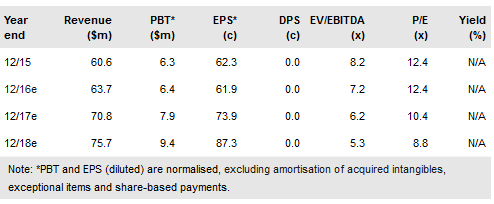

Pointer Telocation Ltd (NASDAQ:PNTR) is a telematics company with a focus on Israel and Latin America. In addition to sales of its own telematics devices, the group generates high recurring revenues from mobile resource management services. The results for the first nine months support our top-line and normalised full year profit expectations, representing 74-76% of our forecast FY revenue and EBIT. We have nevertheless cut our current year PBT forecast by 6% to account for higher finance and one-off costs. PNTR’s forward P/E discount to the sector has widened from 34% to 37% in recent weeks and we see potential for a re-rating on stronger earnings growth, which should be driven by the recent acquisition of Cielo Telecom in Brazil, a strong pipeline of new products and rising service margins.

Strong top line but sales and marketing costs higher

Pointer Telocation reported a pick-up in third-quarter US dollar revenue growth from the 3% y-o-y in H116 to 9%, reflecting a continuation of mid-teens local currency revenue growth and a stronger trend in Latin American currencies. Good market conditions in Israel, Brazil, Argentina and Mexico helped generate a 14% y-o-y increase in MRM subscribers to 198k while PNTR’s high operating leverage helped drive a 10% higher gross profit. Higher sales and marketing outlays and finance costs resulted in normalised operating profit of $1.8m, up 1% y-o-y, versus the 3% decline in H1. One-off costs of $0.2m related to the CT acquisition and higher financial costs, boosted by forex translation losses, resulted in a 34% y-o-y reduction in US GAAP net profits to $0.7m (H1: $2.3m). Although we have increased our revenue and EBITDA forecasts over 2016-18, adding in the above-mentioned items has reduced our reported PBT forecasts by 7% in 2016 and 2-3% in 2017 and 2018.

To read the entire report Please click on the pdf File Below