Morgan Stanley identifies next wave of AI-linked "alpha"

Pointer Telocation Ltd (NASDAQ:PNTR) is a telematics company with a focus on Israel and Latin America. In addition to sales of its own telematics devices, the group generates high recurring revenues from mobile resource management services. After forex-hit H1 results, the stock is trading on a 34% forward P/E discount to its peers. We see potential for a re-rating on improved earnings growth, which should be driven by a recent acquisition in Brazil, a strong pipeline of new products and rising service margins.

Solid business plus innovative product pipeline

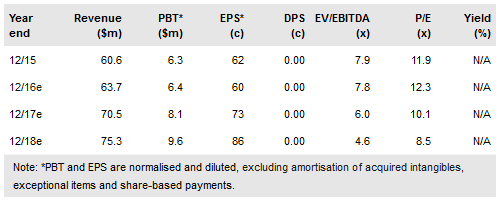

PNTR has an attractive business mix with a safe core mobile resource management (MRM) business. Two-thirds of revenues are recurring, further enhanced by operational leverage from a cloud-based SaaS model and innovative product development, including a new wireless multi-sensing internet of things (IoT) product for refrigerated transport. Double-digit local revenue growth did not show through to the US dollar P&L in H116 due to FX weakness in Latin America, but with demand picking up in Brazil, the recent acquisition of Cielo Telecom, and rising new product sales, we see prospects for strong earnings growth in 2017.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.