Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

Now I admit that the title is a bit of a mental stretch but hang with me for a minute. First, the Philly Fed survey weakened substantially with todays report from 8.7 in October to 3.6 in November. This decline in the past month followed a sharp, and very suspicious, rise in the index in September when it jumped from a -17.5 read to 8.7. The next couple of months will give us a much clear picture about the actual state of the Philadelphia Fed Reserve manufacturing region.

The internal components of the index were primarily all soured with New Orders declining from 7.8 to 1.3, Unfilled Orders falling from 3.4 to -1.5 and Shipments slowing by almost 45% from 13.6 to 7.3. While employment showed a temporary increase from 1.4 to 12 which was a good sign for the jobs market unfortunately rises in Delivery Times from -0.5 to 2.5, Inventories from -7.7 to 6.6 and Prices Paid lifting from 20 to 22.8 don't bode well for future strength.

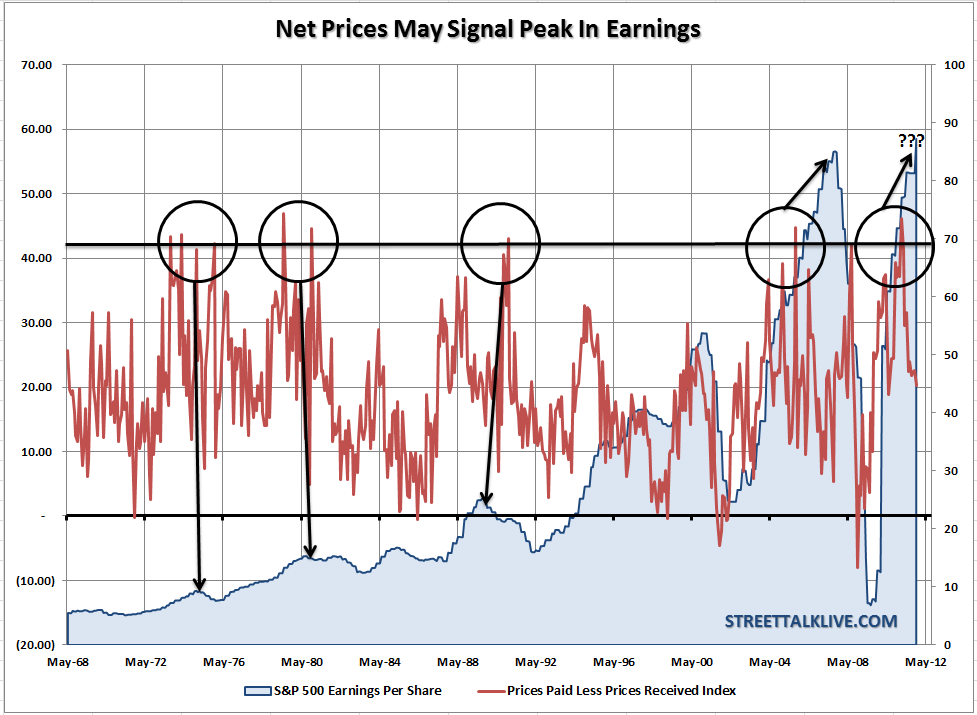

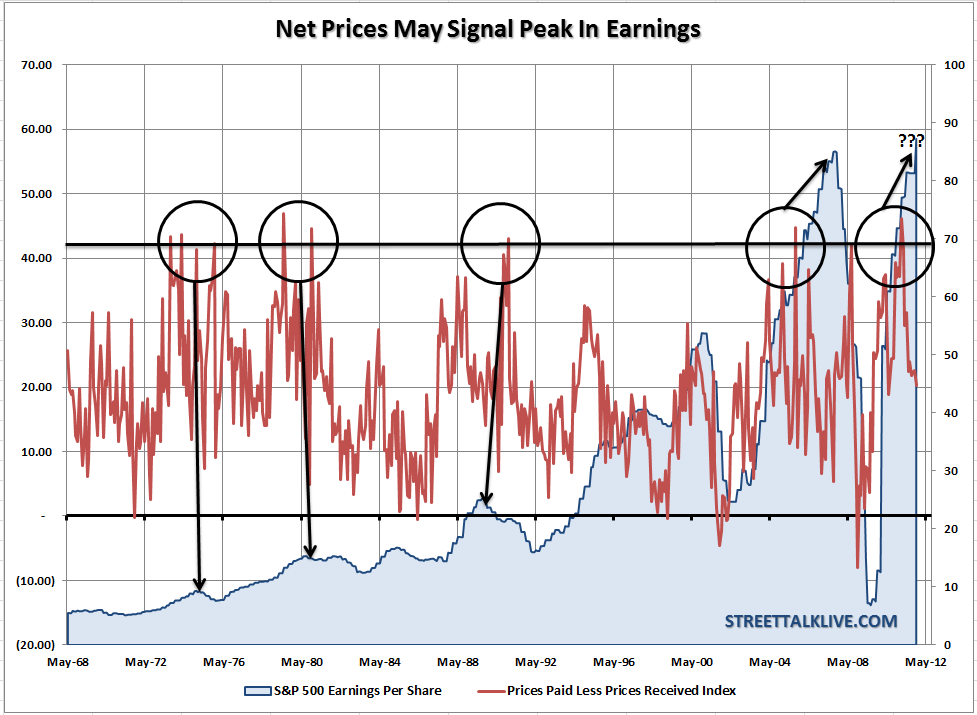

What is concerning is that the prices paid versus prices received by manufacturers in the region (net prices) recently peaked above 42 which has only occurred 4 other times in the history of the index. Those peaks in net prices have generally coincided with earnings cycle peaks. With forward earnings estimates already on the decline from 15% growth in the next quarter to 11%, only 2/3 of the companies that have reported actually beating their estimates and fewer showing improvements in operating profit margins it is likely that we have seen the current peak for this cycle.

This will make it tougher for the index to climb higher as earnings slow and makes it a much riskier bet to be invested on the long side of the market. Income generation, total returns and hedged investments reign in this type of cycle.

The internal components of the index were primarily all soured with New Orders declining from 7.8 to 1.3, Unfilled Orders falling from 3.4 to -1.5 and Shipments slowing by almost 45% from 13.6 to 7.3. While employment showed a temporary increase from 1.4 to 12 which was a good sign for the jobs market unfortunately rises in Delivery Times from -0.5 to 2.5, Inventories from -7.7 to 6.6 and Prices Paid lifting from 20 to 22.8 don't bode well for future strength.

What is concerning is that the prices paid versus prices received by manufacturers in the region (net prices) recently peaked above 42 which has only occurred 4 other times in the history of the index. Those peaks in net prices have generally coincided with earnings cycle peaks. With forward earnings estimates already on the decline from 15% growth in the next quarter to 11%, only 2/3 of the companies that have reported actually beating their estimates and fewer showing improvements in operating profit margins it is likely that we have seen the current peak for this cycle.

This will make it tougher for the index to climb higher as earnings slow and makes it a much riskier bet to be invested on the long side of the market. Income generation, total returns and hedged investments reign in this type of cycle.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI