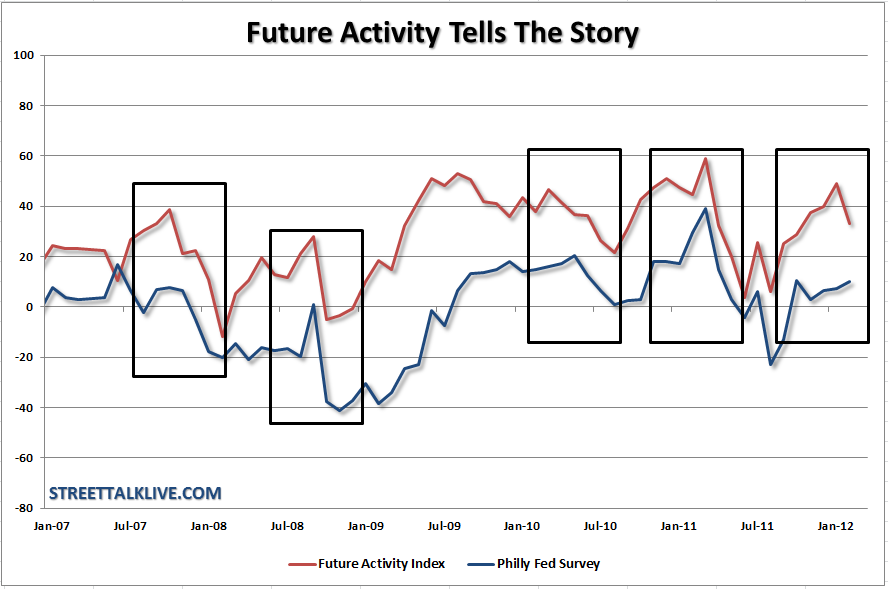

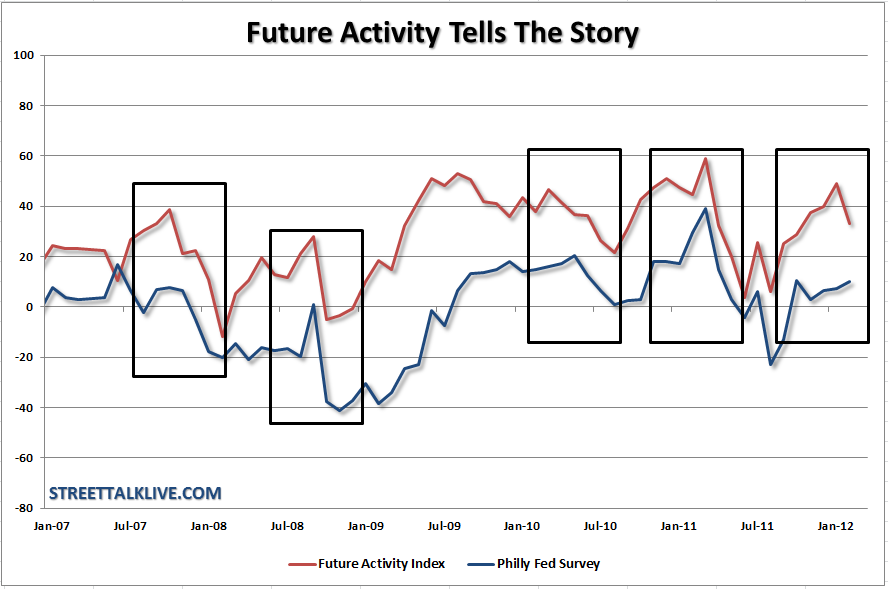

The Philadelphia Federal Reserve Board posted their monthly business activity survey this morning. While the media was quick to jump on the headline number which did show a rise from an anemic 7.5 to 10.2 what was missed was the dive in the expectations of future activity by 16 points. As you can see in the chart above when future expectations dive - the current index tends to follow. While the media dismissed the recent economic numbers out of Europe the manufactures in the Philly Fed region haven't. With big chunk of exports and profits coming from the Eurozone the recession that plagues the region is no trivial matter. If the future activity index continues to weaken we should see weaker numbers out of the current activity index in the months ahead.

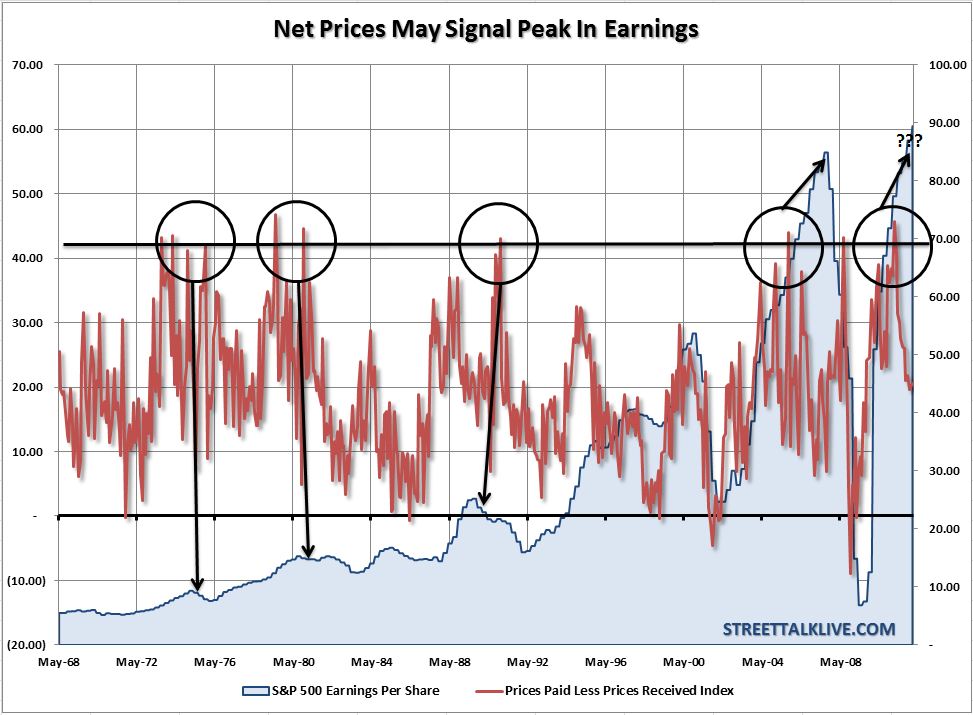

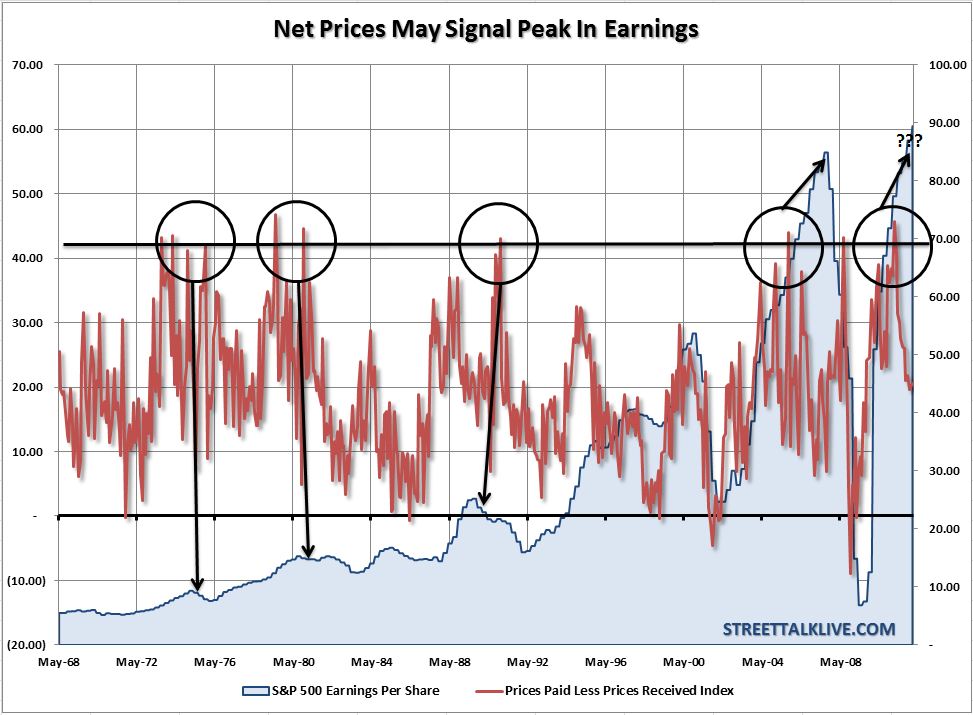

The Empire Manufacturing Index that we saw earlier this week, while up over all, displayed weakness in six out of the nine underlying components. Of particular note was the weakness in new orders and backlogs which doesn't bode well for future economic strength. In today's Philly Fed report we witnessed employment drop by over 10 points from 11.6 to 1.1 which is definitely a sign of concern and prices paid rise which points to profit margin compression ahead.

With profit margins already pushing peaks for this cycle, and the financial markets pricing in extended economic growth, the weakening of margins due to pricing pressures puts investors at risk. Expectations for Q4 earnings were reduced by roughly 50% going into the earnings season and the beat rate of those reduced expectations has still been extremely weak. The markets are currently advancing on hopes of a resolution in Greece but even if that is done it is likely that the repricing of risk in the face of weakening margins will be just as damaging.

The Empire Manufacturing Index that we saw earlier this week, while up over all, displayed weakness in six out of the nine underlying components. Of particular note was the weakness in new orders and backlogs which doesn't bode well for future economic strength. In today's Philly Fed report we witnessed employment drop by over 10 points from 11.6 to 1.1 which is definitely a sign of concern and prices paid rise which points to profit margin compression ahead.

With profit margins already pushing peaks for this cycle, and the financial markets pricing in extended economic growth, the weakening of margins due to pricing pressures puts investors at risk. Expectations for Q4 earnings were reduced by roughly 50% going into the earnings season and the beat rate of those reduced expectations has still been extremely weak. The markets are currently advancing on hopes of a resolution in Greece but even if that is done it is likely that the repricing of risk in the face of weakening margins will be just as damaging.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI