Street Calls of the Week

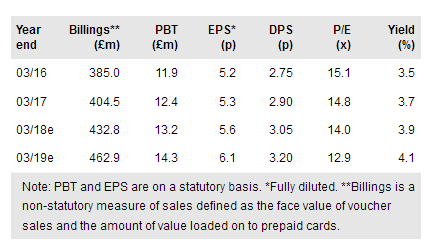

Park Group's (LON:PRKG) AGM statement confirms that trading in the year to date is in line with expectations and expresses confidence in the outlook. Our estimates are unchanged. Ongoing investment in digital technology to support product innovation and e-commerce has been at the centre of Park’s growth strategy over a number of years, and encouragingly for future prospects, the group reports progress with recent product and distribution initiatives. Park’s debt-free balance sheet and cash-generative business model support this growth investment, as well as an attractive growing dividend.

Continuing to trade in line with expectations

Despite some concerns about the strength of UK consumer demand in general, Park is continuing to deliver growth in both its corporate and consumer divisions, and is trading in line with expectations. Highlighting the growth in order books, particularly in Christmas prepayments, total cash balances (both shareholder balances and the segregated customer balances on which Park earns interest) have continued to increase and are again ahead of the same period last year. In the current year, the deposit rates applied to cash balances remain depressed. However, with investors again looking for a turn in the interest rate cycle, we note that Park, with a lag, would be a beneficiary, and that a 0.5% increase in rates have a c 5% impact on PBT.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI