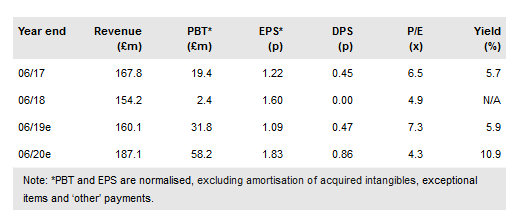

While Pan African Resources’ (LON:PAFR) pre-tax profit for the year to end-June 2018 was within 5% of our prior forecast (on an underlying basis, excluding impairments), bottom-line results were significantly ahead of our expectations as a result of a material tax credit applied to Evander. While FY18 was a challenging year, in which the board elected not to recommend a final dividend (as expected), an idea of its future financial potential may be gleaned from the fact that underlying earnings from continuing operations nevertheless amounted to £19.6m, or 1.08p per share (1.60p excluding ‘other’ items).

Elikhulu continues accelerated track to production

Management reiterated its production guidance of 170,000oz in FY19, reflecting the fact that commissioning at Elikhulu is progressing “very well”, with 56kg (1,800oz) of gold produced from 1–19 of September and with a forecast of 90–100kg (2,894–3,215oz) for the month as a whole. By November, the plant is expected to be operating close to capacity of 1Mt and 145kg (4,600oz) gold per month.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI