Nvidia, AMD to pay 15% of China chip sales revenue to US govt- FT

The Start of a weekly, or so, series of ideas based on the longer term, weekly charts, for a position trade.

I do not mean trade back and forth at break even or for small spread to garner interest in your stock. Put literally looking at paint stocks. There are 3 that are looking ready for you to add another coat of paint to your portfolio. Take a look.

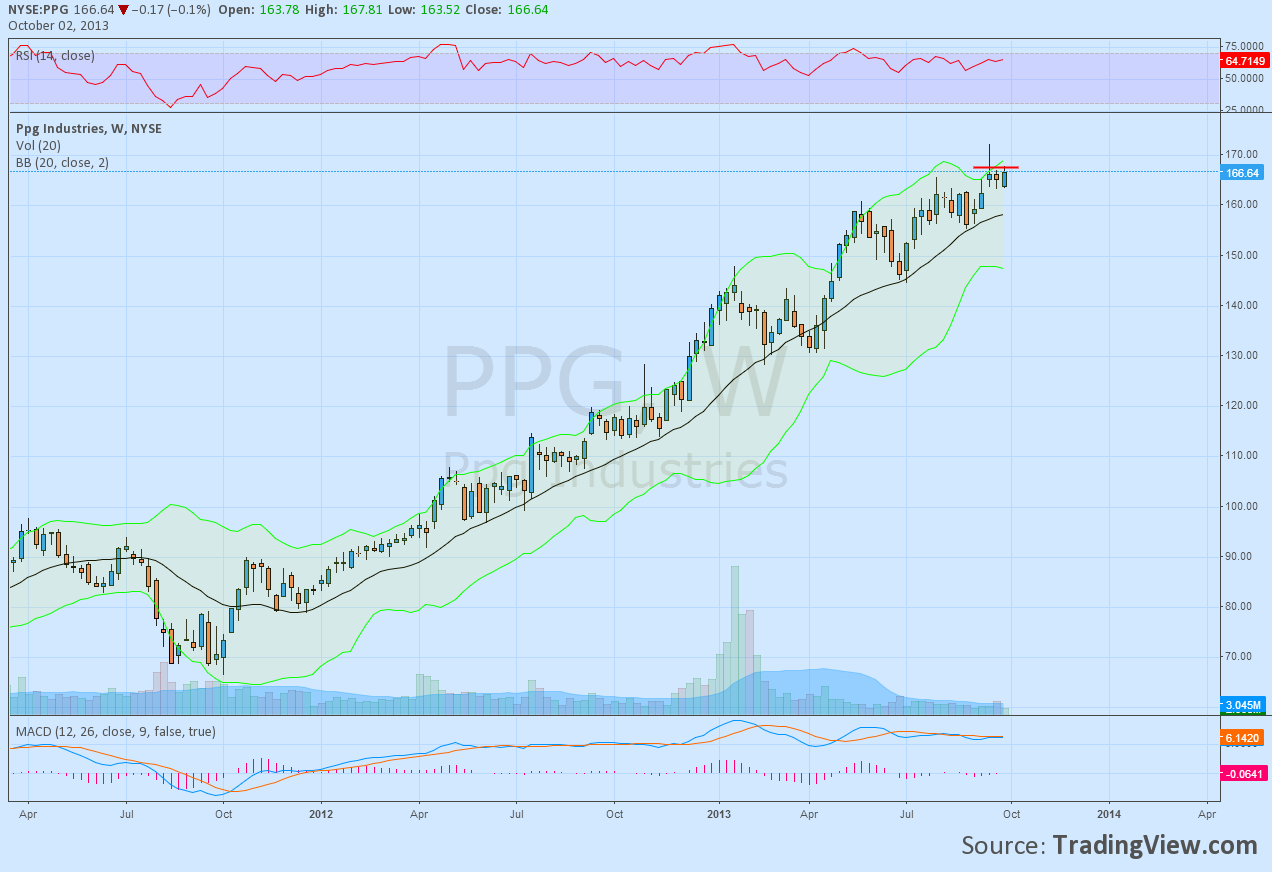

PPG Industries, (PPG), Weekly

PPG Industries, (PPG), has just been on a tear higher. A wonderful trend since late 2011, that is rising along side the 20 week Simple Moving Average (SMA), essentially the same as the 100 day SMA. The problem with stocks like this is how to enter, where is the trigger. The weekly chart above shows that it is consolidating under 167 now and is printing a bullish candle for the week thus far, with two days to go. A move over 167 could trigger an entry to this trend with a stop just under the 20 week SMA.

Sherwin-Williams, (SHW), Weekly

Sherwin-Williams, (SHW), had that same trend going until it fell below the 20 week SMA in July. But after touching the bottom Bollinger band it has risen back through the 20 week SMA and is moving higher. The action since June is building out a bearish Shark Harmonic but the Potential Reversal Zone (PRZ) is higher at 191.77 or 197.80. The direct price action itself sees the Relative Strength Index (RSI) rising and the MACD crossing to positive, both supporting more upward price action.

Valspar, (VAL), Weekly

Valspar, (VAL), may be the least attractive of the bunch, but should it break higher has the best potential for upside. The price has held support at 62.25 since June and the RSI is turning back higher, slightly, after holding over the critical 40 level on the pullback. The MACD has not crossed but the histogram is approaching the zero level. The bullish engulfing candle that is building, would give it a boost higher and over the 20 week SMA and then falling trend resistance it can be bought. Longer term trading sometimes requires longer term stalking. With that said however, a break under 62.25 looks to be a good short opportunity with a target on the triangle break to 50 below.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI