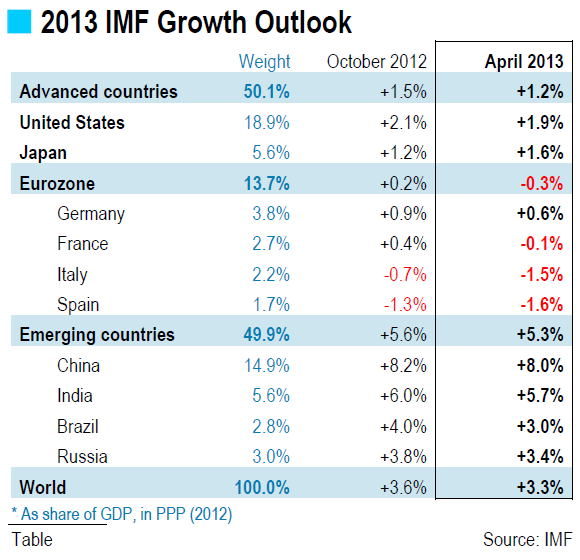

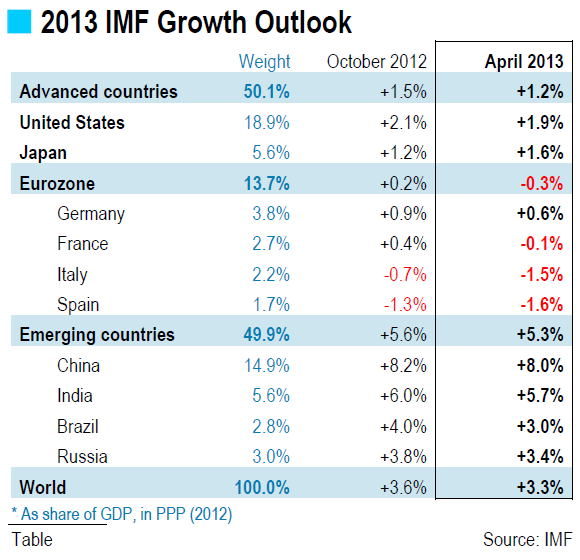

In early spring, as usual, the International Monetary Fund (IMF) released its “World Economic Outlook”. Prospects are not bright. World growth is now estimated at 3.3% in 2013, down 3/10ths of a point from last fall’s publication (see table). With the exception of Japan, where a massive stimulus plan is being rolled out, all the major countries - both advanced and emerging - saw their growth rates revised downwards.

Eurozone: no miracle

Eurozone growth forecasts were adjusted the most. Hopes for a slight upturn were dashed, and growth will remain in decline. According to the IMF, GDP in the EU-17 will contract 0.3% in 2013 following a 0.6% decline in 2012. This feeble showing obviously plays a role in the downward revision of the world growth outlook. The eurozone can be blamed for a quarter of the decline, even though it accounts for only 14% of world GDP. Some countries, such as Italy and Spain, are clearly mired in recession. Others, like France, keep flirting with it. According to the IMF, the French economy will contract very slightly this year, by 0.1%. In our scenario, we have already been warning of zero growth for quite some time now.

Yet in 2013, the eurozone should have benefited from less fiscal austerity: the pace of public deficit reduction was cut in half from the 2012 level. Spreads on government bonds have also narrowed. The IMF notes, that the constraints on activity are also due to balance sheet adjustments in the private sphere, and not solely in the public sector. Household and corporate debt ratios have not fallen as much in the eurozone as in the United States. Debt reduction efforts are still underway, notably in southern Europe, where both credit supply and demand are very depressed. The situation is particularly alarming in Spain, where the drop-off in corporate lending is accelerating, undermining prospects of a recovery. Nonetheless, the country has made big efforts to boost competitiveness. It is exporting more and has balanced its current account, an achievement that should convince its European partners, especially Germany, to uphold their commitments: banking union, direct capital injections or guarantees by the European Stability Mechanism (ESM), and ECB financial assistance to States via OMT, its Outright Monetary Transactions programme.

United States: a small miracle

As a result, the United States is widening the gap with Europe. U.S. growth will still hold at around 2% in 2013 (1.9% according to the IMF, 2.3% based on our scenario), a small miracle in the light of Congressional mismanagement. Failing to reach a budget agreement, Congress ended up letting the sequester take effect. A series of automatic, across-the-board budget cuts, which combined with tax increases at the beginning of the year, will cost the economy 1.75 GDP points. Yet the sequester is coinciding with a much stronger environment: house stocks are extremely low, encouraging housing starts; lending is picking up; corporate margin ratios are high and returns on investment are at record levels.

China: threatening the miracle?

With over 5% growth in 2013, the emerging regions explain most of the expansion in the world economy (together they account for 80% of growth). In the short term, the IMF does not see any signs of deterioration: buoyant exports, strong capital inflows and low spreads are all helping maintain strong growth. Yet a certain number of risks are looming on the horizon, such as the rapid expansion of informal credit in Chinai. Little by little, the world’s second largest economy is becoming one of the most heavily indebted countries in the emerging world. At the end of 2012, the private sector debt ratio hit a record high of 170% of GDP. Shadow banking - non-traditional forms of financing - reached 40% of GDP. Any excess credit is likely to be concentrated in loans to companies, which were highly encouraged to invest during the 2008-2009 crisis. Households, in contrast, still have relatively little debt.

BY Jean-Luc PROUTAT

Eurozone: no miracle

Eurozone growth forecasts were adjusted the most. Hopes for a slight upturn were dashed, and growth will remain in decline. According to the IMF, GDP in the EU-17 will contract 0.3% in 2013 following a 0.6% decline in 2012. This feeble showing obviously plays a role in the downward revision of the world growth outlook. The eurozone can be blamed for a quarter of the decline, even though it accounts for only 14% of world GDP. Some countries, such as Italy and Spain, are clearly mired in recession. Others, like France, keep flirting with it. According to the IMF, the French economy will contract very slightly this year, by 0.1%. In our scenario, we have already been warning of zero growth for quite some time now.

Yet in 2013, the eurozone should have benefited from less fiscal austerity: the pace of public deficit reduction was cut in half from the 2012 level. Spreads on government bonds have also narrowed. The IMF notes, that the constraints on activity are also due to balance sheet adjustments in the private sphere, and not solely in the public sector. Household and corporate debt ratios have not fallen as much in the eurozone as in the United States. Debt reduction efforts are still underway, notably in southern Europe, where both credit supply and demand are very depressed. The situation is particularly alarming in Spain, where the drop-off in corporate lending is accelerating, undermining prospects of a recovery. Nonetheless, the country has made big efforts to boost competitiveness. It is exporting more and has balanced its current account, an achievement that should convince its European partners, especially Germany, to uphold their commitments: banking union, direct capital injections or guarantees by the European Stability Mechanism (ESM), and ECB financial assistance to States via OMT, its Outright Monetary Transactions programme.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

United States: a small miracle

As a result, the United States is widening the gap with Europe. U.S. growth will still hold at around 2% in 2013 (1.9% according to the IMF, 2.3% based on our scenario), a small miracle in the light of Congressional mismanagement. Failing to reach a budget agreement, Congress ended up letting the sequester take effect. A series of automatic, across-the-board budget cuts, which combined with tax increases at the beginning of the year, will cost the economy 1.75 GDP points. Yet the sequester is coinciding with a much stronger environment: house stocks are extremely low, encouraging housing starts; lending is picking up; corporate margin ratios are high and returns on investment are at record levels.

China: threatening the miracle?

With over 5% growth in 2013, the emerging regions explain most of the expansion in the world economy (together they account for 80% of growth). In the short term, the IMF does not see any signs of deterioration: buoyant exports, strong capital inflows and low spreads are all helping maintain strong growth. Yet a certain number of risks are looming on the horizon, such as the rapid expansion of informal credit in Chinai. Little by little, the world’s second largest economy is becoming one of the most heavily indebted countries in the emerging world. At the end of 2012, the private sector debt ratio hit a record high of 170% of GDP. Shadow banking - non-traditional forms of financing - reached 40% of GDP. Any excess credit is likely to be concentrated in loans to companies, which were highly encouraged to invest during the 2008-2009 crisis. Households, in contrast, still have relatively little debt.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

BY Jean-Luc PROUTAT

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI