T2108 Status: 70.3% (first overbought day)

VIX Status: 10.6 (dropped 12%)

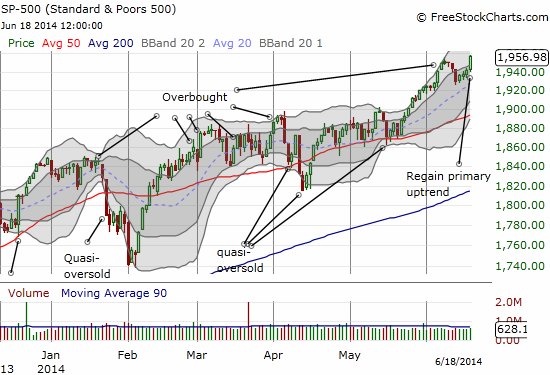

General (Short-term) Trading Call: Aggressive traders go or stay long. Stop below today’s low (1940 on the S&P 500)

Active T2108 periods: Day #239 over 20%, Day #91 over 40%, Day #18 over 60%, Day #1 under 70% (overperiod)

Commentary

The market’s seams are erupting to the upside.

Today’s post-Fed reaction featured a delicious irony. Central banks have been complaining and complaining about low implied volatility in global financial markets, under-pricing of risk, and low yields on risky bonds. Today’s trading took the alleged “implied complacency” to a deeper level as the Federal Reserve’s latest statement on monetary policy helped deliver a surge in the S&P 500 (SPDR S&P 500 (ARCA:SPY)) to a fresh (marginal) all-time high along with a fresh plunge in volatility to 7-year lows.

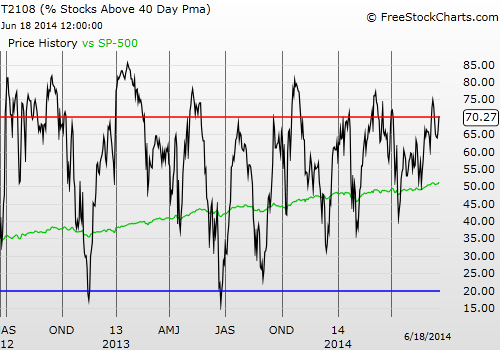

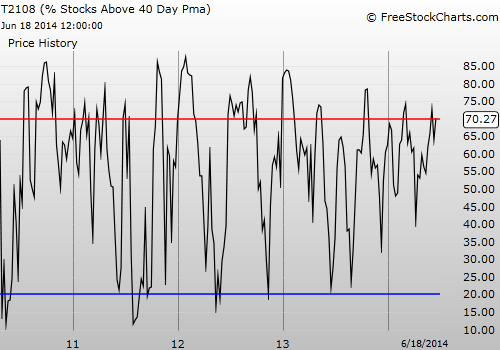

I think the two charts (along with Fed Chair Janet Yellen) are the pictures that say it all. Overbought conditions have started with a bang, and this is all the kindling needed for a summertime rally.

For traders, this is a time to ride the upward trend: get back on or stay on. As a reminder, SwingTradeBot.com can provide a lot of trading ideas depending on various chart technicals. Currently, Bollinger Bands® squeezes are erupting everywhere.

My revamp of T2108 observations during overbought conditions has made me much more disciplined and removed most of the desire to fight against the wind here. This patience is reinforced by the fleeting bearish signal delivered by the last breakdown from overbought conditions. Recall that after about 20 trading days, the overbought period gets MORE bullish in terms of its overall potential duration and price performance when it ends.

The next opportunities to return to the land of the bears are 1) a breakdown from overbought conditions along with a close below today’s low and selling follow-through and/or 2) some kind of climactic top (that read will depend on chart technicals). Without one of these, let the market run if that is what it wants to do…!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long SSO put options

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI