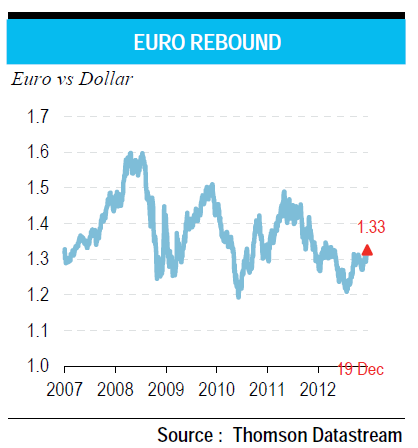

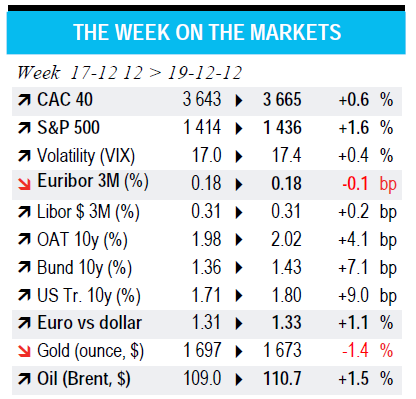

- The euro and the stock markets at a year-high

- A rally which is not only technical …

What’s behind this rally? Mainly Frankfurt (the ECB) and Brussels (the European Union). By pledging the irreversibility of the euro on 26 July, followed by the announcement of a mechanism for unlimited (but conditional) purchases of the debt instruments of EMU member countries, ECB president Mario Draghi is largely responsible for turning things around.

The European heads of state and governments also made their contribution by showing proof of solidarity: banking union project (29 June); a more relaxed timetable for reducing public deficits in Portugal and Spain; a EUR100bn credit line to recapitalise Spanish banks; and the rescheduling of Greek debt (27 November), which was heralded by a 6-notch upgrade of its sovereign rating on 18 December.

While its existence was threatened a year ago, the EMU has found the means to strengthen its bonds again. However, the advances, though major, are not sufficient (the banking union is still far away, and so are Eurobonds…). The biggest error for 2013 would be to content oneself with the latest.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

By Jean-Luc PROUTAT

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI