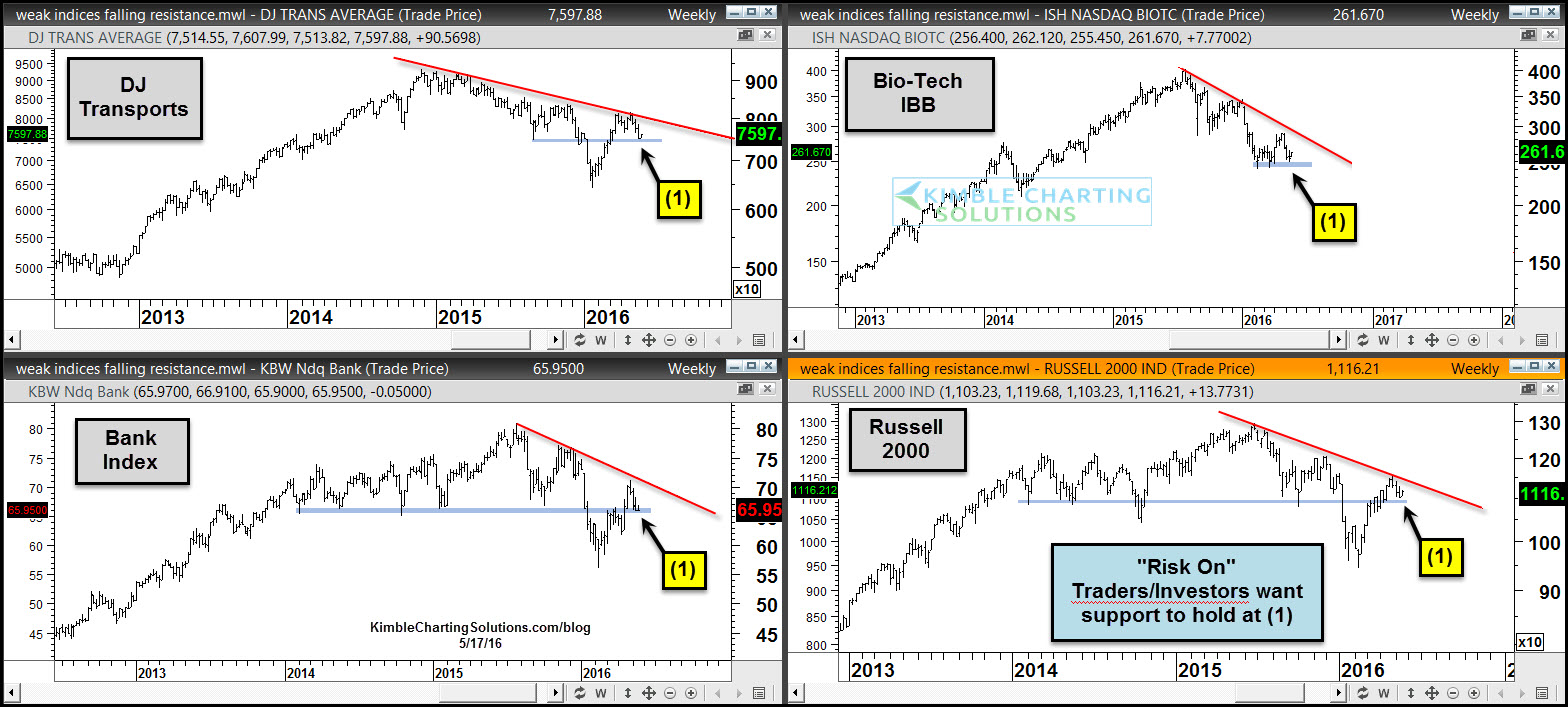

Over the past year, a few sectors [Transports, Biotech (via iShares Nasdaq Biotechnology (NASDAQ:IBB)), Banks and the Russell 2000] have been weaker than the broad markets. For the broad market to move higher, “Risk-On” traders/investors want these weak sectors to start reflecting some strength.

The block of charts below look at the patterns of these downside leaders. As you can see, each as created a series of lower highs since 2014/2015.

Will the third time be the charm and will each of these sectors break falling resistance?

To help push the broad markets higher, these sectors need to start reflecting some strength by breaking falling overhead resistance. Each sector is testing a support zone at (1) above, not far below falling resistance.

To be optimistic about the broad markets breaking out to new all-time highs, traders/investors want breakouts to take place in these downside leaders from the past year.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.