If you run a regression of the magenta line on variables that have similar trends, you will get a spuriously high R2. I think you should try to explain the weekly changes in the magenta series instead. (I may have misunderstood you regression, in which case please show the actual data series in the regression so I’ll understand it better.)

Um, that’s not always true. I did not get a Ph. D., but I passed my Ph. D. field in econometrics, including passing the oral exam. I try to be really careful with regressions, unlike most. I avoid multiple passes over the data, and I avoid “specification searches,” which are glorified hunts for correlations.

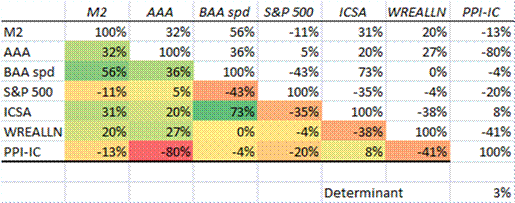

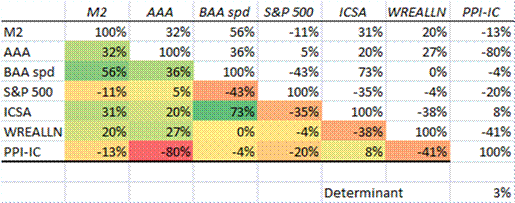

As it is, the regressors that I used are not highly correlated with each other. They don’t have similar trends. Here is the correlation matrix:

The regressors were very different variables, and were independently useful for deciphering the relationship. Had it been otherwise, the t-coefficients would have weak, with the F-coefficient strong. As it was, the t-coefficients were all strong.

This is not spurious.

Um, that’s not always true. I did not get a Ph. D., but I passed my Ph. D. field in econometrics, including passing the oral exam. I try to be really careful with regressions, unlike most. I avoid multiple passes over the data, and I avoid “specification searches,” which are glorified hunts for correlations.

As it is, the regressors that I used are not highly correlated with each other. They don’t have similar trends. Here is the correlation matrix:

The regressors were very different variables, and were independently useful for deciphering the relationship. Had it been otherwise, the t-coefficients would have weak, with the F-coefficient strong. As it was, the t-coefficients were all strong.

This is not spurious.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI