On November 30th, the Organisation for Petroleum Exporting Countries (OPEC) and its major non-OPEC partners, including Russia, announced an extension of the production freeze agreed last year. The extension aims to keep 1.8 million barrels per day (mb/d) off the market until December 2018. The group’s compliance in 2017 with the agreement has been exceptional, averaging over 80%, which has helped oil prices average USD54/b through eleven months of the year. We have long held the view that the group was likely to extend the cuts in 2018 and with global demand and US production evolving in line with our expectations, we forecast an average oil price around 60/b in 2018.

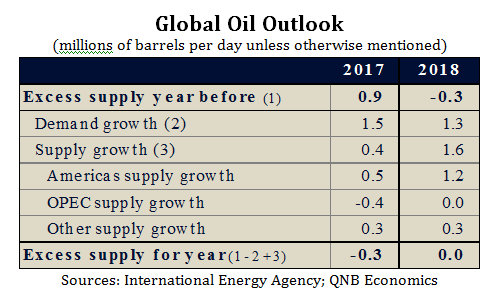

Broadly speaking, the global oil market underwent a major rebalancing this year having gone from being oversupplied by 0.9mb/d in 2016 to under supplied by 0.3mb/d. This was due to OPEC’s initial production cut and higher-than-expected global demand on the back of strong global economic growth and in response to lower prices. Together, the production cuts and demand growth more than compensated for increases in US supply. The improvement in global supply-demand conditions, along with heightened geopolitical tensions, pushed prices to a nearly 20% average rise from 2016 levels and to above USD60/b currently, their highest levels in two years.

In 2018, we expect the market to move from being under supplied to balanced as supply growth exceeds demand growth.The International Energy Agency (IEA) projects demand growth to moderate to 1.3mb/d from 1.5mb/d in 2017 in line with marginally slower global GDP growth and as higher prices temper demand.

Although OPEC production should remain flat, global supply is expected to increase by 1.6mb/d as US output is expected to ramp up by around 1mb/d. The projected acceleration in US oil output reflects producers taking advantage of the current high price environment. Numerous reports suggest that US oil producers are aggressively hedging their future production at current prices which are above their breakeven prices. The same dynamic is playing out in other countries as well, such as Brazil and Canada, which account for the majority of the remainder of the supply increase.

Global Oil Outlook

(millions of barrels per day unless otherwise mentioned)

Sources: International Energy Agency; QNB Economics

Hence, it appears the market will depend on OPEC and its major partners ability to sustain a high compliance rate once again in 2018 in order to tighten supply. Assuming a repeat of same level of compliance as 2017,the global oil market should be balanced in 2018 and oil inventories should decline to their five year average by the third quarter of 2018. Based upon our modelled historical relationship between the supply and demand balance and prices, this results in an average price forecast around USD60/b in 2018. Although oil prices are currently higher than this, we expect regional geopolitical tensions to fade, reducing some of the political risk premia embedded in current prices.