Trump says U.K. would fight for U.S., doubts EU commitment

NZD/USD is in a strong downtrend for the last few weeks, which is expected to continue soon if we consider a five wave fall from 0.7402 followed by a recent bounce towards the 0.7171 level, which could be the first leg of a minimum three wave rise in corrective wave 2), labeled as wave A.

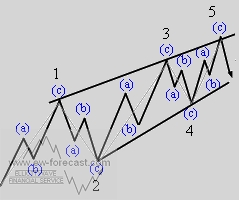

If that is the case, then drop from the mentioned level was sub-wave B that seems completed and current bullish development could be wave C the final leg of this three wave rise. As we see on the chart, we labeled a possible ending diagonal pattern in wave C, that may unfold because of overlapping price movement. The ideal reversal zone for this whole correction may be around 0.7220 area.

NZD/USD, 4h

The ending diagonal is a special type of motive wave that occurs primarily in the wave 5 position when price has moved too far and too fast. Some ending diagonal triangles appear in the C wave of an ABC correction. In all cases, the ending diagonal terminates the move of larger patterns. They consist out of five waves, with each having three more sub-waves.

Ending Diagonal Pattern:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI