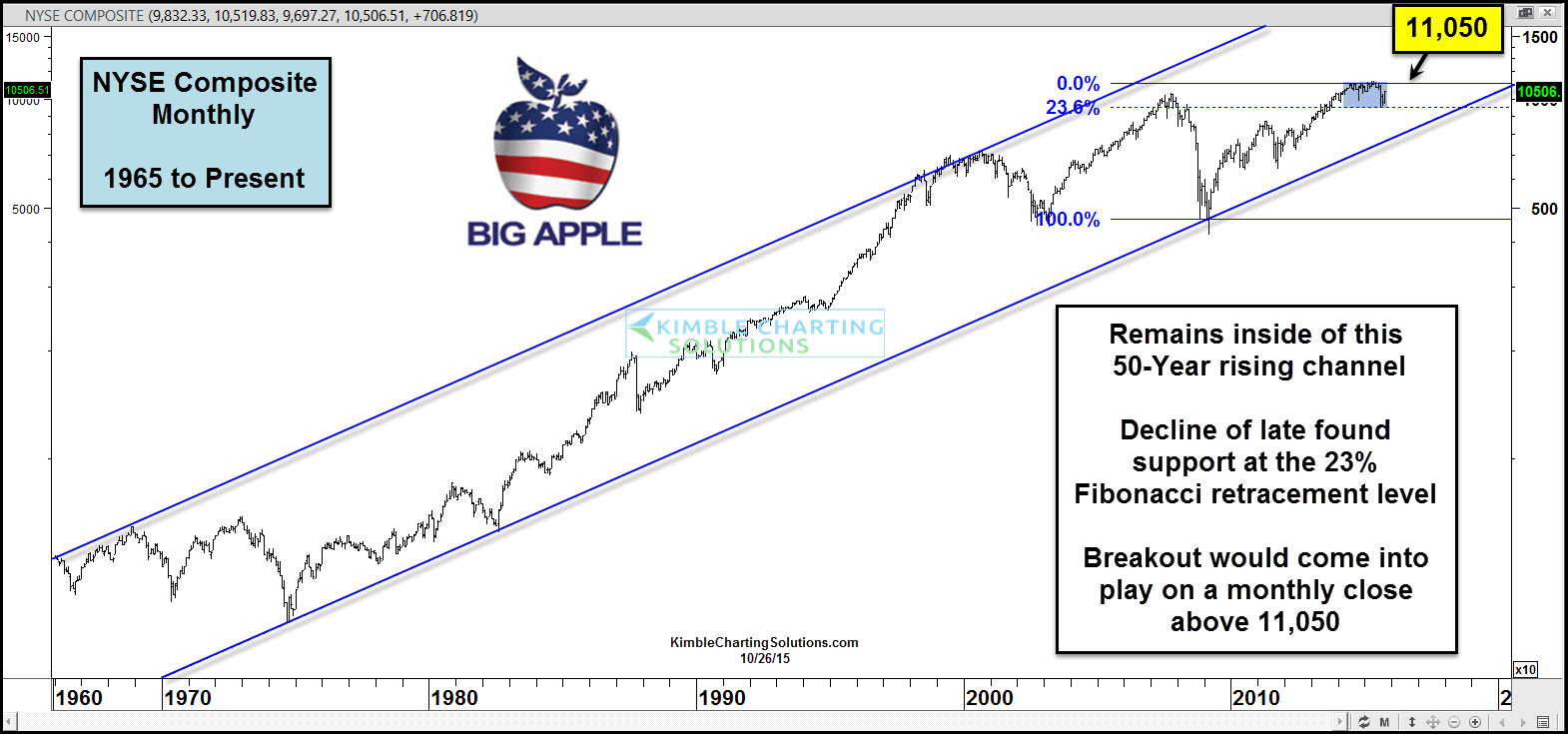

The NYSE Composite remains inside of the rising channel that has been in play for the past 50 years.

If one applies Fibonacci retracement levels to the 2009 monthly closing lows and the highest monthly close this year, the NYSE index hit the 23% Fibonacci retracement level in August and stopped on a dime.

At this time, the index is above 23% support and below resistance created earlier this year.

If the NYSE index can close above the 11,050 level, around 5% above current prices, it would find itself looking at a breakout.

With seasonal patterns positive as we get closer to year end, a breakout here could pull in buyers that were shook out of late.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.