Bitcoin price today: rises to new record high above $116,000

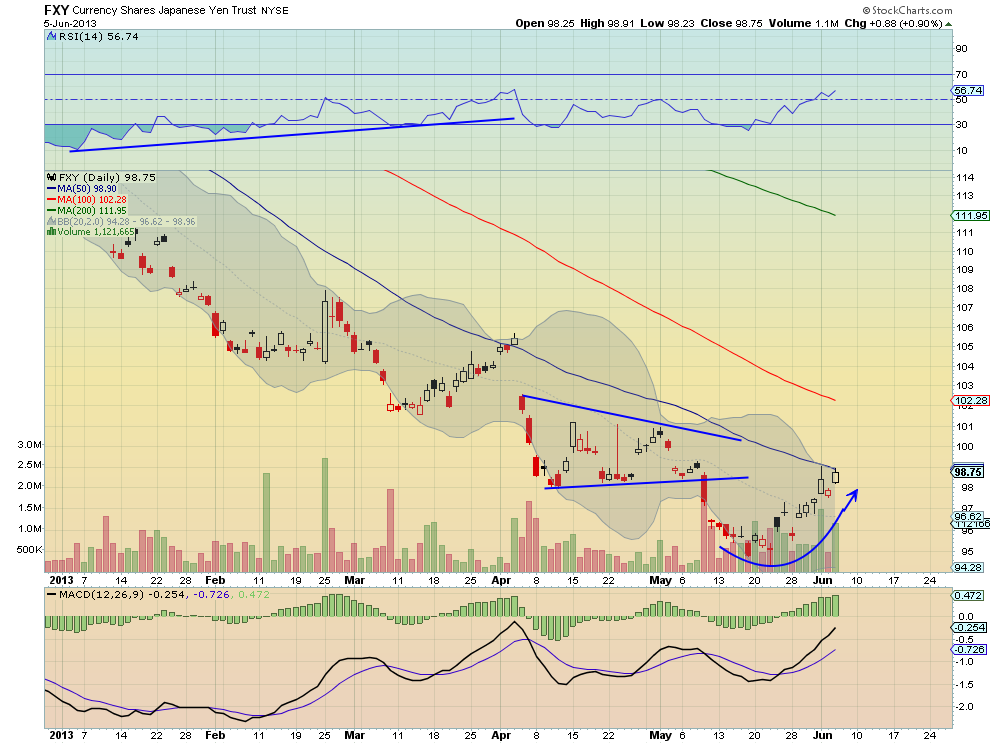

All eyes are focused on the Japanese market. The Smart Money is supposedly unwinding their position in Japanese Stocks and buying back their short Yen. Wednesday's chart for the Yen proxy, the FXY ETF, indicates this. The rounded bottom is moving higher, with a rising Relative Strength Index (RSI) and a rising Moving Average Convergence Divergence indicator (MACD) for support for further upside,

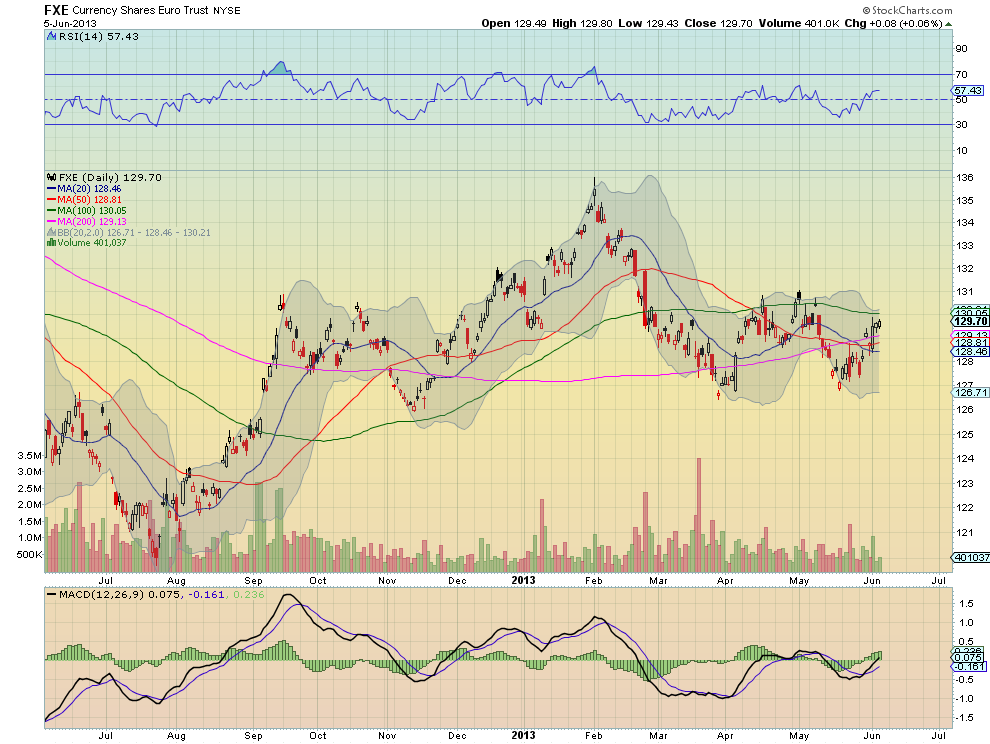

only have the top Bollinger Band® and the 50 day Simple Moving Average in the way of a breakout higher. It has been here before, so express yourself cautiously. Other major currencies were also moving higher. The Euro (FXE) has been rising since May 17th. It also had support for continued upward price movement from a rising RSI and MACD. And look at the British Pound ($FXB). Rising since May 22nd, it is now breaking over its 100 day SMA and has support to keep going from that same rising RSI and MACD.

So the Yen, Euro and British Pound all happen to be rising against the dollar and they all started at about the same time. Interesting. These 3 currencies happen to make up over 83% of the US Dollar Index. And the US Dollar Index is falling, hmmm. So what if this wasn’t driven by the Smart Money unwind on Abenomics? What if it was all orchestrated by the U.S Treasury? Instead of watching the Yen or the Euro or the Pound, try looing at the U.S. Dollar Index, where there are some clues as to where this may end. The Bearish Shark on the right of the chart is at the second downside target at 84.60 and the next target lower would be to 81.37.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post