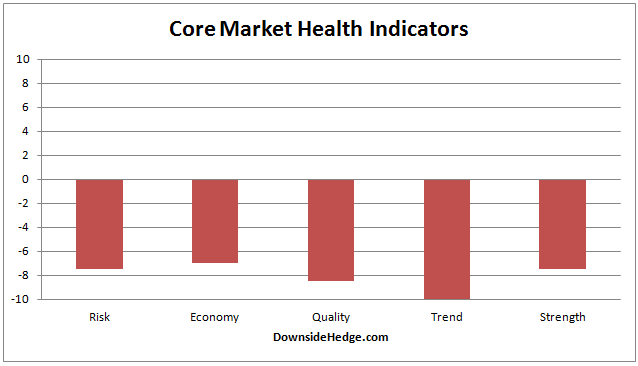

This week didn’t help any of my core market health indicator categories. They’re still looking ugly. To make matters worse, Dow Theory signaled yesterday that we’re in the midst of a long term bear market that could last from one to three years.

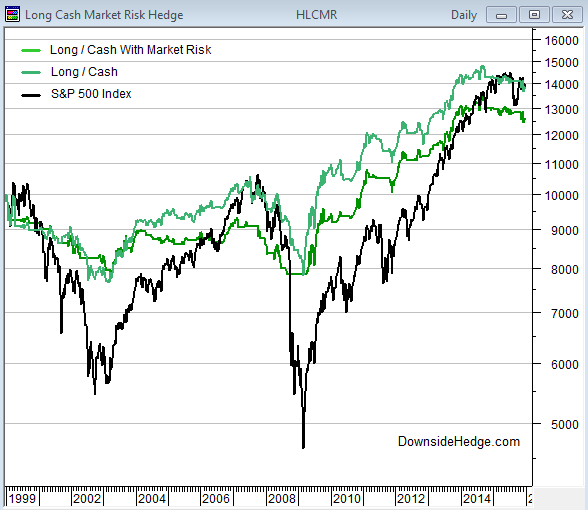

Bear markets are a time where it’s hard to make money. You’ll see that all of the hedging strategies except for the Volatility Hedged portfolio lost money during bear markets. The Volatility Hedged portfolio benefited from the extremely steep declines in 2008 and 2009 (and subsequent historically high levels of volatility). I don’t think it’s reasonable to expect the current bear market to unfold in the same fashion so if you’re following the Volatility Hedged portfolio expect it to lose some (more) money during this bear.

My point is that you need to have reasonable expectations during bear markets. You’ll most likely lose money, but the important thing is that we don’t take catastrophic or unrecoverable losses. I consider anything above a 35% loss during a bear market the extreme pain point because it requires a 54% gain to recover the losses. If you take a 50% loss it requires a 100% gain to get back to even.

The chart above was updated on 12/31/15. As you can see, this bear is unfolding similar to the start of the previous two long term down trends. The hedged portfolios lost money as the top was being built, and they’ll likely lose money until the bear declines into it’s final death throes. So please keep that in mind. If you have reasonable expectations it’s easier to stick with the plan, which should ultimately result in keeping a large portion of our portfolio left to ride the next bull.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.