The overwhelming consensus has many continuing to see a last minute deal that avoids a default by the US government. Even the rating agencies are managing to get onside with the same thought – Moody’s says there is a “very low” chance of default occurring. Mind you, if the US happens to miss a payment, the rating agencies will likely respond by putting the US in “selective default” until the payment is made. However, a “default is a default” and any default could end up impacting the US’s own ratings. Previously, Moody’s and Fitch still gave the US the highest rating, while S&P’s showstopper was to cut the world’s largest economy one notch.EUR/USD" title="EUR/USD" src="https://d1-invdn-com.akamaized.net/content/picb7f3b078958c6d288f9a12eb3f097fa8.png" height="300" width="400">

Investors are being led to believe that the Republican leadership (and Democrats) will not allow for a debt ceiling default to occur on or about October 17 – but what can be agreed to between now and then (if anything)? If it comes right down to it, House speaker Boehner will almost certainly agree to suspend the debt ceiling to avoid default – the only question is will it be a short-term suspension (4-6 weeks) or a longer-term outage (6-12 months)? Either way, he will take such action to avoid a US worst-case scenario and seek to continue his party’s debate offline. Today’s policy makers seem adapt at kicking out at any ‘can’ – as long as it continues on down the desired road.  USD/JPY" border="0" height="300" width="400">

USD/JPY" border="0" height="300" width="400">

As for funding and the ongoing government shutdown, beyond raising the debt ceiling, it is certainly possible that Speaker Boehner will seek to continue to pressure Obama and company to come to the table to negotiate a further reduction in spending (and Obamacare). However, now that the Department of Defense has managed to recall +400k furloughed defense department employees back to work over the past weekend – an act reducing the hit to the military, the staunchest Republican support may even care less that the US government remains shutdown now that the military have been somewhat taken care of. Currently, its onward and upward with the House Republican to continue to press their case while Obama continues to push back and seek a “clean solution.”

Even as we enter Day 8 of the US government shutdown there is no hint of a thaw in the political standoff between the Republicans and the White House. Obama remains eager to sit down with opposition to discuss healthcare and other issues once the debt ceiling has been raised and has even challenged the House speaker Boehner to hold a vote to prove there are not enough votes for a clean CR. Now that China is back online after a weeklong public holiday, leaders there are becoming more vocal, voicing their own concerns over a US default risk and the impact this would have on the global economy.

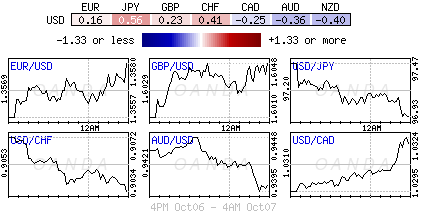

It seems that despite the public holiday Asian bourses did not miss a beat, notwithstanding Wall Streets negative closeout intentions in yesterday sessions. Most Asian and early Euro markets have managed to move into positive territory on the back of supportive economic data from China – HSBC’s private sector PMI revealed a continued expansion in the service activity (52.4 in September). Investors will combine this with upcoming trade and inflation data over this weekend and early next week to see whether China will produce further signs of an economic recovery that has helped to support equities of late. USD/CNY" title="USD/CNY" src="https://d1-invdn-com.akamaized.net/content/pica752b815dfa24475e9fd19291de59574.png" height="300" width="400">

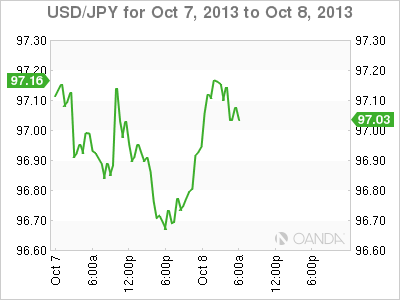

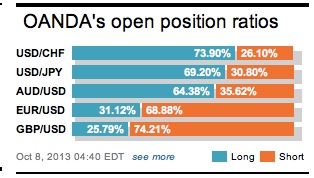

Market forex volume and investor enthusiasm has been rocked ever since US partial government commenced last week. The lethargic investor attitude has confined all major currency pairs to a tight trading range. At best, the dollars direction has ebbed and flowed without much conviction. Against the yen, the dollar has managed to trade away from its six-week low outright, revisiting and trading currently above ¥97.00. Dealers and investors remain wary about taking on too big a position. The absence of economic releases is making it that more difficult for traders and investors alike to get a better handle on what is actually occurring in the world’s largest economy.

The lack of data releases leads one to believe that the near-term prospect for the USD remains highly uncertain. In the event of a resolution to the government shutdown, dealers and investors will be expecting the greenback to strengthen marginally against low yielding currencies such as JPY, EUR and GBP. At the same time, the likely risk-on reaction would bias the USD lower against EM currencies. However, an extended shutdown will surely bring risk aversion position trading back in style, and this in spite of the dovish impact of the delay in US data releases on the Fed’s tapering plans.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.