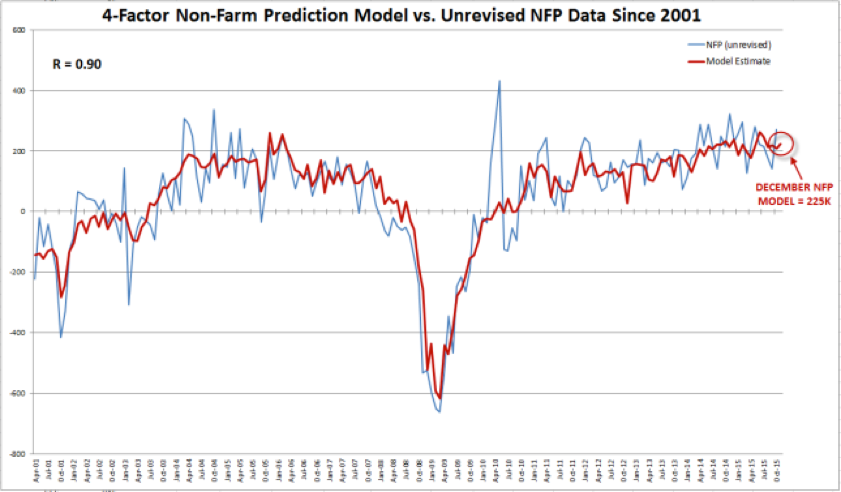

The December Nonfarm Payroll report will be released Friday morning at 8:30 EST (13:30 GMT) with expectations centered on a headline print of 203k after last month’s solid 211k reading. My model suggests that the report could exceed these expectations once again,with leading indicators suggesting a December headline NFP reading of 225K.

The model has been historically reliable, showing a correlation coefficient of 0.90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, FOREX.com

Compared to last month, the leading indicators for the nonfarm payrolls report were generally stronger. The ISM Services PMI Employment reading ticked up from 55.0 to 55.7 in December, Initial Jobless Claims in the survey week edged lower to 267k (showing fewer unemployed Americans) and the ADP Non-Farm Employment report jumped to 257k jobs earlier this week. That said, manufacturing remains the big laggard in the US economy, with the ISM Manufacturing PMI Employment reading falling by over 3 points to 48.1, suggesting that manufacturing employment actually contracted in December.

Trading Implications

Even though the Federal Reserve has started what looks likely to be a series of interest-rate hikes, there are still more questions for traders. Most importantly, the Fed and markets disagree over how many rate increases are likely this year, with the median Fed member anticipating four hikes, while the market has only priced in two. Friday’s NFP report will be the first piece of top-tier economic data for 2016 and will help shape expectations for the March FOMC meeting (the January meeting does not feature a press conference and the Fed is therefore unlikely to make any monetary policy changes).

Three possible scenarios for this month’s NFP report, along with the likely market reaction, are shown below:

As always, traders should monitor both the overall quantity of jobs created as well as the quality of those jobs. To that end, the change in average hourly earnings could be just as critical as the headline jobs figure, especially with many FOMC voters looking for signs of inflation on the horizon. Wages have risen for two consecutive months now, and dollar bulls would like to see a third to convince the Fed that the trend is sustainable.

Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, experienced traders know that the U.S. labor market is notoriously difficult to predict and that all forecasts should be taken with a grain of salt. As always, Friday’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop-loss orders may not necessarily limit losses in fast-moving markets.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI