Stock market today: S&P 500 in weekly win as Fed shakeup stokes rate-cut hopes

The National Federation of Independent Business released their monthly Small Business Optimism survey today which showed the overall index rising just one tenth of one percent in January to 93.9 from 93.8 in December. This dovetails with the data that we had garnered earlier in the month from NFIB prior to the BLS employment report which showed that small businesses had no hiring during the latest reported month. While the increase marks five consecutive months of improvement the issue, as shown in the chart, is that during the past year there has been no net improvement. Small businesses, while more optimistic than they have been, are still extremely cautious and simply peering out of their foxholes rather than jumping for joy. The real issue at hand, as always, is the overall trend of the data rather than a one month number. In this case the trend of the data shows simply that business owners are "LESS PESIMISTIC" rather than being "OPTIMISTIC" about the future of the economy.

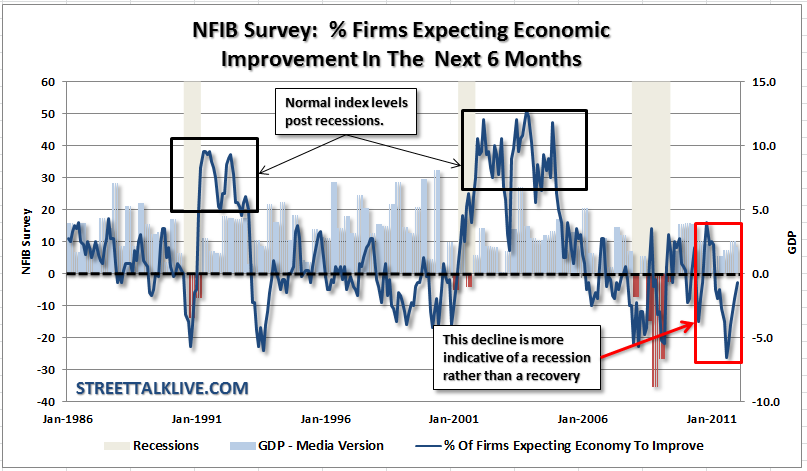

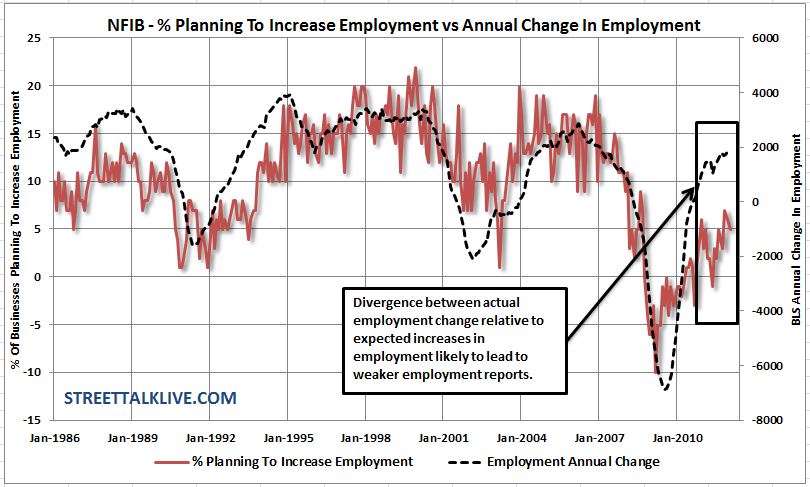

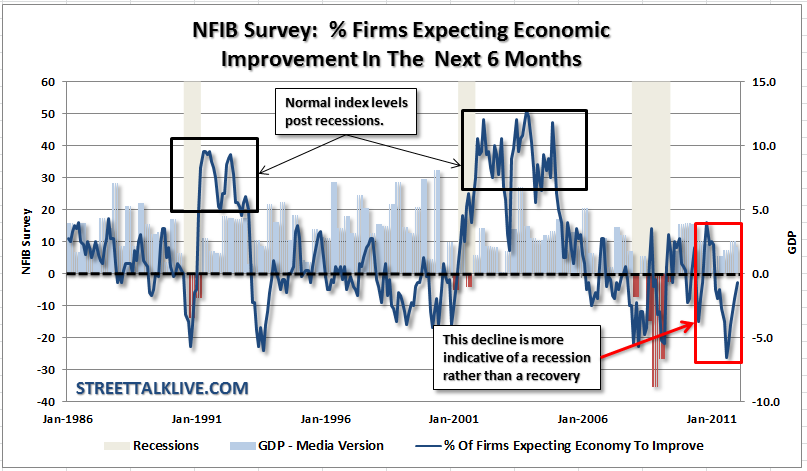

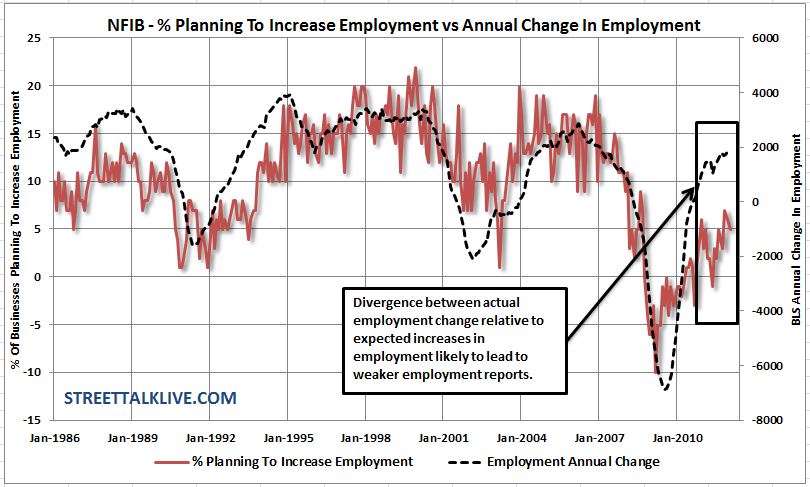

During normal business cycles the outlook for the economy post a recessionary spat is above 30 rather than below ZERO where it stands today nearly three years post the last recession. Therefore, it is not surprising that we are seeing less importance placed on hiring. In fact, in the most recent survey those planning to increase employment actually slipped and the divergence between employment data as released by the BLS and the small business survey results is the widest on record. This divergence makes one a bit suspect of the validity of the recent employment data considering the surge of temporary hires relative to full time employment as we discussed in our report on the employment data.

"The most positive statement that can be made about January's reading is that the Index did not go down; a change of 0.1 points is essentially no change and it is hardly indicative of a surge in economic activity," said NFIB Chief Economist Bill Dunkelberg. "Nothing happened last month that would significantly improve the small-business outlook; Washington is at a stalemate. The Index remains below its level a year ago of 94.1 which means that no progress was made in 2011. Congress has failed to pass a budget for over 1,000 days, and without discipline on spending or any budgetary priorities, there is no path to fiscal sanity in Washington. U.S. debt is now larger than our GDP, and headed in the wrong direction. This does not make for a comforting future, a fact reflected by low consumer and small-business owner optimism."

Some other highlights of January's Optimism Index include:

• NFIB reports of job growth improved (0.15) from December, but only to net zero (0) new workers per firm. The Bureau of Labor Statistics (BLS) report issued on February 3rd showed relatively strong job creation for January; NFIB's data suggest that there will be some downward revision in BLS numbers, especially in light of the adjustments in the Household Survey that suggested a huge number of adults left the labor force. Seasonally adjusted, 11 percent of owners added an average of three workers per firm over the past few months, while 11 percent reduced employment an average of 2.9 workers per firm.

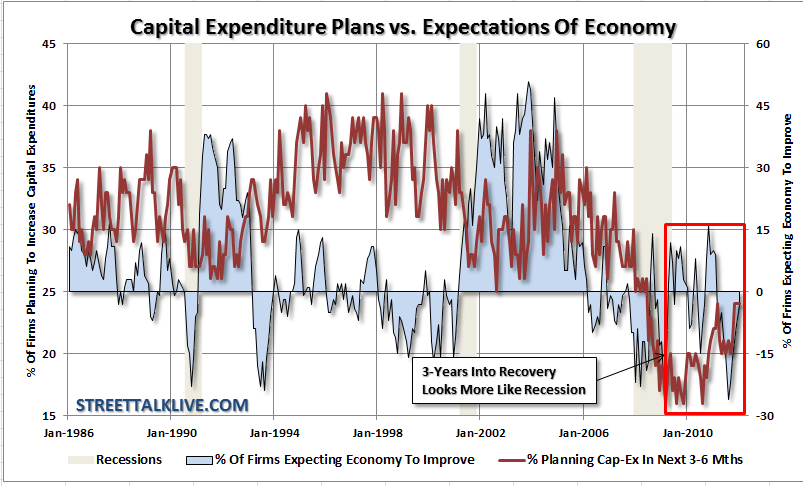

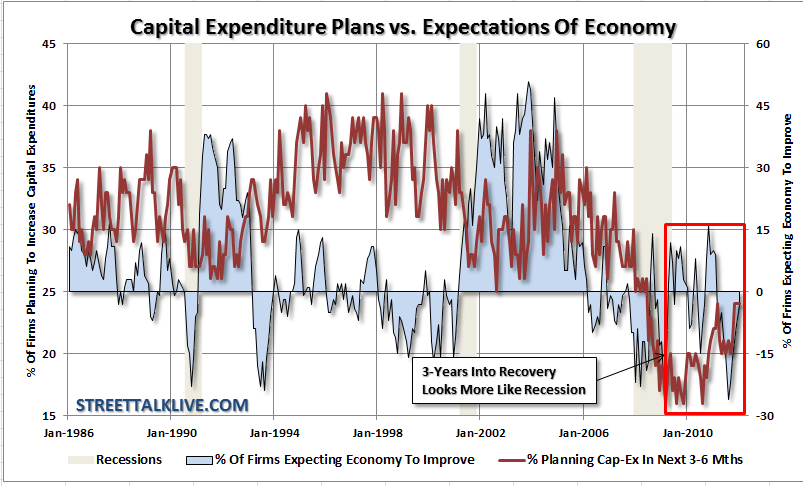

• The frequency of firms that reported making capital expenditures over the past six months lost one point, declining to 55 percent. The record low of 44 percent was reached most recently in August 2010. Of those making expenditures, 38 percent reported spending on new equipment (down 4 points), 20 percent acquired vehicles (unchanged), and 13 percent improved or expanded facilities (unchanged). Six percent acquired new buildings or land for expansion (up 1 point) and 11 percent spent money for new fixtures and furniture (down 2 points). While the spending picture has improved, it still falls short of "normal". The percent of owners planning capital outlays in the next three to six months held at 24 percent; this is the highest reading in years, but still 10 points lower than those typically seen in an expanding economy.

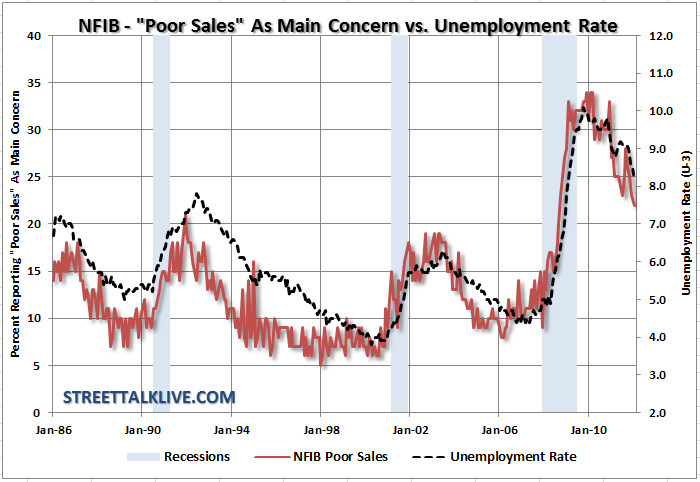

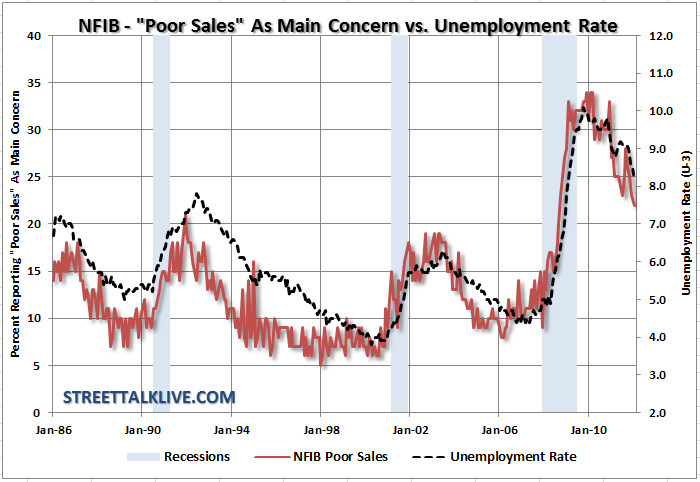

• The net percent of owners expecting better business conditions in six months was a negative 3 percent, 5 points better than December but still 13 percentage points below last year's reading. Not seasonally adjusted, 18 percent expect deterioration (down 4 points), and 22 percent expect improvement (up 7 points). Twenty-two percent report "poor sales" as their top business problem, down 1 point, but still the top business problem reported.

• Increasing 3 points over December, a net negative 7 percent of all owners (seasonally adjusted) reported growth in their inventories. January marks 56 consecutive months during which reported inventory reductions have outnumbered reported increases.

• Eighteen percent of the NFIB owners reported raising their average selling prices in the past three months (up 1 point), and 17 percent reported price reductions (down 1 point). Seasonally adjusted, the net percent raising selling prices was -1 percent, down a point from December. The frequency of price increases was highly concentrated in the Wholesale (a net 14 percent raised prices) and Retail (net 4 percent raised). Those cutting prices exceeded those raising prices by 14 percentage points in Construction and Agriculture, largely a result of seasonal impact. Twenty-three (23) percent of owners plan to raise average prices in the next few months, while 3 percent plan reductions. Seasonally adjusted, a net 17 percent plan price hikes up 3 points.

Of course, the issue with price hikes is that retail sales have not improved sufficiently to potentially absorb the impact of higher prices. Gasoline prices are already rising and are on track to hit $4 by summer which will result in an effective $70 Billion dollar tax hit to consumers that are already resorting to credit to make ends meet.

Overall, the analysis of the report details few positives in terms of a strong economic recovery. The reality of that statement is that we are now almost three years into a recovery that has been driven by trillions of dollars of direct infusions by the government. As David Rosenberg pointed out in his missive this morning: "Based on all this stimulus, if this were a normal post-recession recovery, GDP growth would be 8% right now, not sub-2%!"

The question we have to ask ourselves as investors is how much longer can the government continue to ply the printing presses to the economy and receive a positive effect from the efforts? More importantly - what are unintended consequences for running long term deficits, debt expansion and bailouts? Those are questions I don't have answers too. However, I suspect that we will not be a returning to the 1990's secular bull market extravaganza anytime soon.

During normal business cycles the outlook for the economy post a recessionary spat is above 30 rather than below ZERO where it stands today nearly three years post the last recession. Therefore, it is not surprising that we are seeing less importance placed on hiring. In fact, in the most recent survey those planning to increase employment actually slipped and the divergence between employment data as released by the BLS and the small business survey results is the widest on record. This divergence makes one a bit suspect of the validity of the recent employment data considering the surge of temporary hires relative to full time employment as we discussed in our report on the employment data.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

"The most positive statement that can be made about January's reading is that the Index did not go down; a change of 0.1 points is essentially no change and it is hardly indicative of a surge in economic activity," said NFIB Chief Economist Bill Dunkelberg. "Nothing happened last month that would significantly improve the small-business outlook; Washington is at a stalemate. The Index remains below its level a year ago of 94.1 which means that no progress was made in 2011. Congress has failed to pass a budget for over 1,000 days, and without discipline on spending or any budgetary priorities, there is no path to fiscal sanity in Washington. U.S. debt is now larger than our GDP, and headed in the wrong direction. This does not make for a comforting future, a fact reflected by low consumer and small-business owner optimism."

Some other highlights of January's Optimism Index include:

• NFIB reports of job growth improved (0.15) from December, but only to net zero (0) new workers per firm. The Bureau of Labor Statistics (BLS) report issued on February 3rd showed relatively strong job creation for January; NFIB's data suggest that there will be some downward revision in BLS numbers, especially in light of the adjustments in the Household Survey that suggested a huge number of adults left the labor force. Seasonally adjusted, 11 percent of owners added an average of three workers per firm over the past few months, while 11 percent reduced employment an average of 2.9 workers per firm.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The remaining 78 percent of owners made no net change in employment. • The frequency of firms that reported making capital expenditures over the past six months lost one point, declining to 55 percent. The record low of 44 percent was reached most recently in August 2010. Of those making expenditures, 38 percent reported spending on new equipment (down 4 points), 20 percent acquired vehicles (unchanged), and 13 percent improved or expanded facilities (unchanged). Six percent acquired new buildings or land for expansion (up 1 point) and 11 percent spent money for new fixtures and furniture (down 2 points). While the spending picture has improved, it still falls short of "normal". The percent of owners planning capital outlays in the next three to six months held at 24 percent; this is the highest reading in years, but still 10 points lower than those typically seen in an expanding economy.

• The net percent of owners expecting better business conditions in six months was a negative 3 percent, 5 points better than December but still 13 percentage points below last year's reading. Not seasonally adjusted, 18 percent expect deterioration (down 4 points), and 22 percent expect improvement (up 7 points). Twenty-two percent report "poor sales" as their top business problem, down 1 point, but still the top business problem reported.

• Increasing 3 points over December, a net negative 7 percent of all owners (seasonally adjusted) reported growth in their inventories. January marks 56 consecutive months during which reported inventory reductions have outnumbered reported increases.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Unadjusted, 11 percent reported growth in inventory stocks (unchanged) and 22 percent reported inventory reductions (up 1 point). More owners reported weaker sales quarter on quarter than improvements, so demand can be met by reducing inventories on hand. Overall, it appears that small-business owners have reduced inventories to acceptable levels given the outlook for sales growth. Without improved sales, there is little motivation to order new inventory stocks. Plans to add to inventories dropped 5 points, arriving at a disappointing net negative 3 percent of all firms (seasonally adjusted). This drop is notable because December's reading was the best in 18 months. • Eighteen percent of the NFIB owners reported raising their average selling prices in the past three months (up 1 point), and 17 percent reported price reductions (down 1 point). Seasonally adjusted, the net percent raising selling prices was -1 percent, down a point from December. The frequency of price increases was highly concentrated in the Wholesale (a net 14 percent raised prices) and Retail (net 4 percent raised). Those cutting prices exceeded those raising prices by 14 percentage points in Construction and Agriculture, largely a result of seasonal impact. Twenty-three (23) percent of owners plan to raise average prices in the next few months, while 3 percent plan reductions. Seasonally adjusted, a net 17 percent plan price hikes up 3 points.

Of course, the issue with price hikes is that retail sales have not improved sufficiently to potentially absorb the impact of higher prices. Gasoline prices are already rising and are on track to hit $4 by summer which will result in an effective $70 Billion dollar tax hit to consumers that are already resorting to credit to make ends meet.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Overall, the analysis of the report details few positives in terms of a strong economic recovery. The reality of that statement is that we are now almost three years into a recovery that has been driven by trillions of dollars of direct infusions by the government. As David Rosenberg pointed out in his missive this morning: "Based on all this stimulus, if this were a normal post-recession recovery, GDP growth would be 8% right now, not sub-2%!"

The question we have to ask ourselves as investors is how much longer can the government continue to ply the printing presses to the economy and receive a positive effect from the efforts? More importantly - what are unintended consequences for running long term deficits, debt expansion and bailouts? Those are questions I don't have answers too. However, I suspect that we will not be a returning to the 1990's secular bull market extravaganza anytime soon.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.