For a security doomed to decrease in value over time, iPath's S&P 500 VIX ST Futures ETN (VXX) does amazingly well. Its volume averages over 40 million shares per day and its assets under management have stayed above $1.1 billion for the last couple of years. Not bad for a product that has averaged a 64% annual loss since its inception in January 2009.

Barring a major stock market correction, I predict Barclays will reverse split VXX 4:1 in early February 2014.

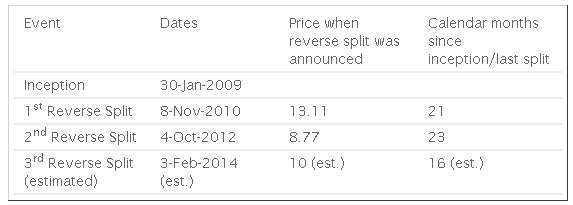

According to its prospectus Barclays can reverse split VXX any time after it closes below $25. In its two previous splits they have waited until the Exchange Traded Note (ETN) price is around $10. The prospectus states that reverse splits will be at a four to one ratio.

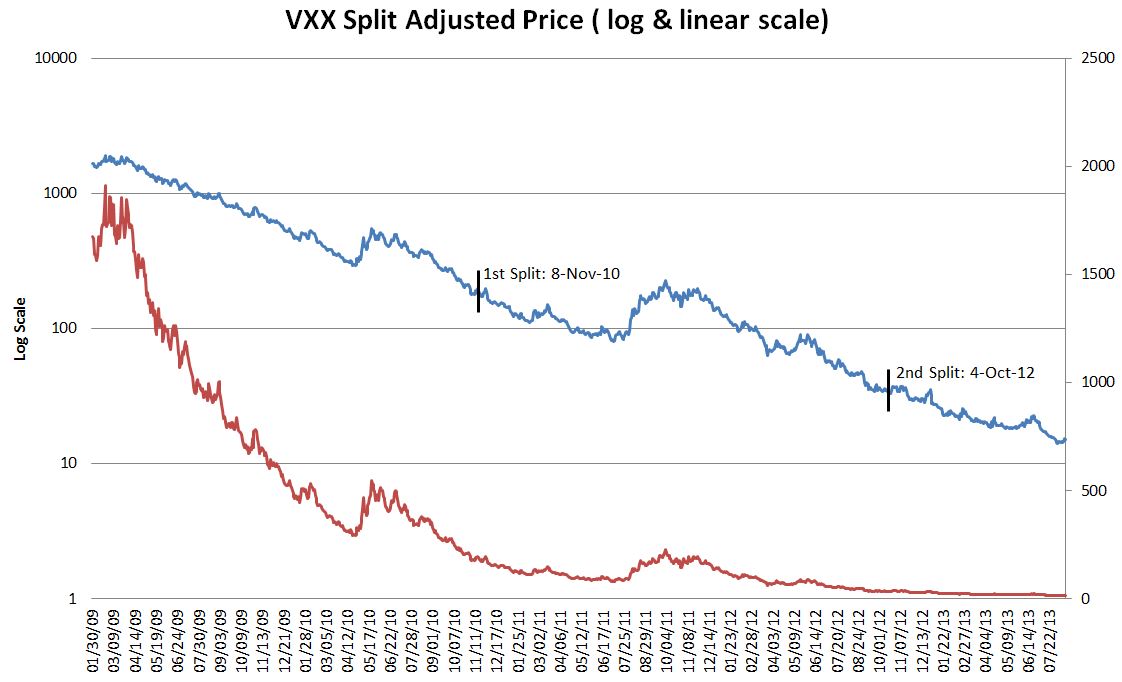

The previous splits of VXX occurred after about 22 months, but 2012 did not provide a volatility bump like 2010 and 2011, so the next reverse split might be as soon as 16 months after the last one. The chart below, both log and linear scaled, shows VXX’s sordid split adjusted price history.

Given its horrid track record, it’s fair to ask why people keep investing in VXX. I had assumed it was mostly retail investors, but the quarterly Nasdaq report indicates otherwise:

Fifty one percent of VXX’s ownership (as of 30-June-13) was institutional. I was very surprised to see Barclays as number one on the list, with 19 out of the 91 million shares outstanding at that point. They of all people should know this ETN is a dog.

A closer look at the institutions and activity on this list (e.g., Goldman Sachs, Susquehanna, UBS, Deutsche Bank), suggests that most of these holdings are transient, related to the activities of Exchange Traded Product (ETP) issuers, market makers, and Authorized Participants (AP). These are the people that facilitate / use arbitrage to keep ETP prices close to their index values—and make money in the process. For more on this see this very good IndexUniverse article.

I suspect retail investors on the other hand are trying to hedge their equity holdings with VXX because it is one of the few securities that reliably goes up when the market is panicking. Unfortunately this strategy rarely works well. Unless your timing is very good owning enough VXX to effectively hedge your portfolio is prohibitively expensive.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.