Apple's (NASDAQ:AAPL) new product launch event slated for September 9 is just around the corner. Rumors are running rampant and company stock is trading near all time highs. It’s generally accepted that two new iPhones will be announced in addition to a smartwatch. All of these products and their potential features are unconfirmed, but that’s not stopping investors from placing their bets. Here are all the gizmos that may be included in Apple's new hardware and more importantly how the different product scenarios may play out on the bottom line.

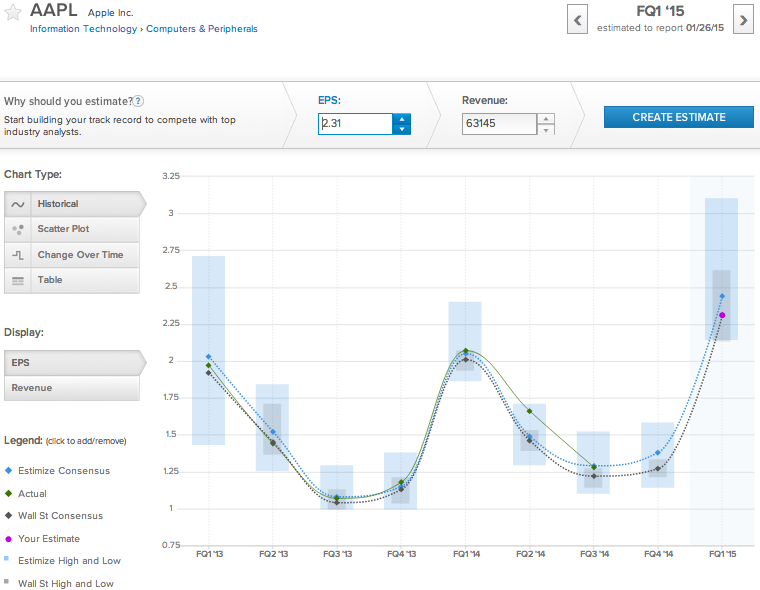

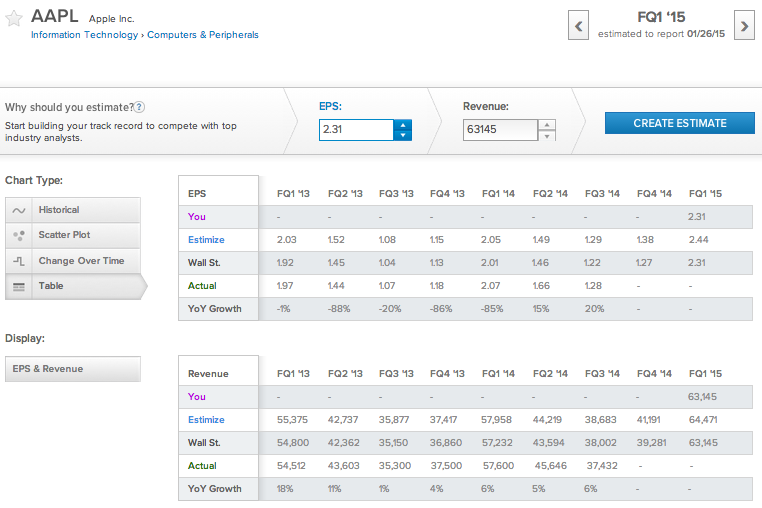

Apple is yet to unveil its product pipeline for the holiday season but 52 contributing buy side and independent analysts on Estimize have already submitted earnings predictions for Apple’s fourth fiscal quarter which covers through the end of September and will reported in late October. Although the new phones are only expected to be released a few short days before the end of the quarter, the Estimize community still expects Apple to beat the Wall Street earnings consensus by a hefty margin on the top and bottom line.

2 New iPhones?

Apple is widely believed to be releasing 2 new models of the iPhone later this month. Its speculated that Apple will include a larger screen on both models. The smaller of the two phones is expected to feature a 4.7 inch screen while a larger phablet style phone could contain a 5.5 inch display. One or both of these models may also feature sapphire glass, a more resilient and unlikely to crack material compared to the Gorilla Glass used in previous editions of the phone.

The Big Question: New Product Categories

The next iteration of the iPhone will undoubtedly play an important role in Apple’s near term future. But with a legion of dedicated customers the next version of the iPhone is all but guaranteed to be successful in established markets barring some major uncharacteristic failure.

Investors will be watching Apple’s September 9 conference looking for catalysts that will drive sales in new markets and product categories. The 5.5 inch phablet style phone is believed by many analysts to be a play at attracting more customers in Asia where large screen smartphones are in high demand.

Will we see the iWatch?

Techies across the globe are eager to get a peek at Apple’s first major new product since Steve Jobs showed off the iPad in 2010. Innovation at Apple has never been about being first into a new product category, it’s about being the best and raising the bar of the consumer experience. Apple did not launch the first mp3 player, but the strength of the tandem partnership between iTunes and the iPod was undeniable. Likewise BlackBerry (NASDAQ:BBRY) PDAs and other smartphones existed long before the iPhone, but the iPhone’s features and simplicity took handsets to the next level.

Several different wearable technologies have already hit the market but none has captured the imagination of consumers in the way that the iPod and iPad did. Most smartwatches have required a compatible smartphone in close proximity for full functionality. Given that Apple is expected to be launching 2 new iPhones it’s unlikely that an iWatch would be a stand-alone device, but it’s not something that can be counted out either.

Re/code has reported that the iWatch will be revealed on the 9th, but will not ship until early next year. It’s also been reported that Apple executives have considered a $400 price tag for the new wearable device, although multiple models at different price points are likely to be available. A $400 smartwatch has the potential to increase Apple’s margins and bring a significant increase to earnings when the device is finally released.

The X Factor: Mobile Payments

No company has quite gotten mobile payments right. Google Wallet is out there, there’s PayPal, and Square Cash but like wearables no individual platform has reached the mass adoption that the parent company desires. Rumor has it that Apple will be partnering with American Express Company (NYSE:AXP) to throw its hat into the ring on the 9th.

Apple is likely to use near-field communication technology to enable payments on the iPhone and perhaps the iWatch. This feature would hypothetically allow consumers to make purchases to nearby merchants and send money to peers with validation from a thumbprint scan.

It’s clear that Apple will be rolling out several new products soon, but mobile payments may be the factor with the single highest potential to move shares of Apple to the upside. Mobile payments could be a goldmine for Apple because there is so much money to be made at low cost.

Processing mobile payments does not require Apple to spend money on expensive supplies like sapphire glass, semiconductors, and tiny cameras. By cutting out credit card companies and processing payment transactions itself, Apple could grab a nice sized chunk of a massively profitable industry it previously had no foothold in.

So What Exactly is Priced In?

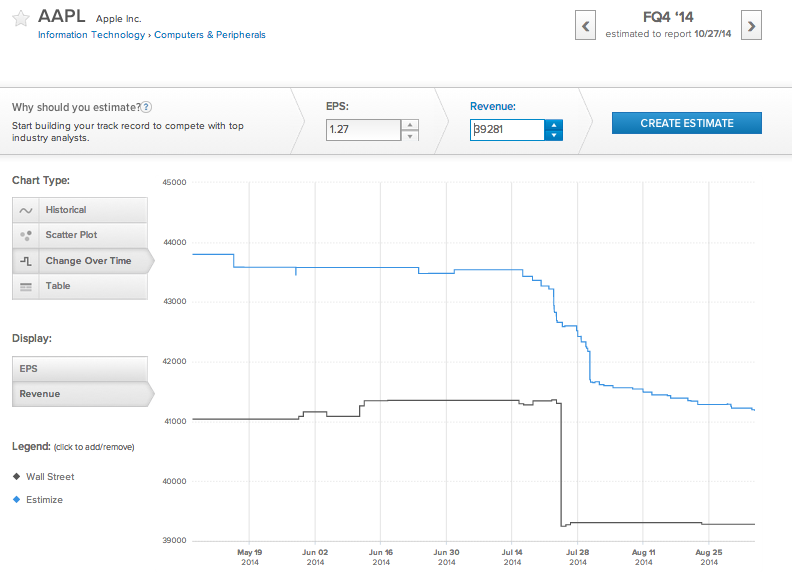

Earnings and revenue estimates for the current period came down in mid July when Apple reported earnings for its 3rd fiscal quarter of the year and set sales guidance between $37 billion and $40 billion. Since then Apple stock has continued to trickle lower in anticipation of a late FQ4 iPhone release and indication that the iWatch won’t ship this quarter.

The Wall Street revenue consensus now rests at $38.281 billion however the Estimize community believes that Apple is setting the bar low and will report sales of approximately $41.191 billion.

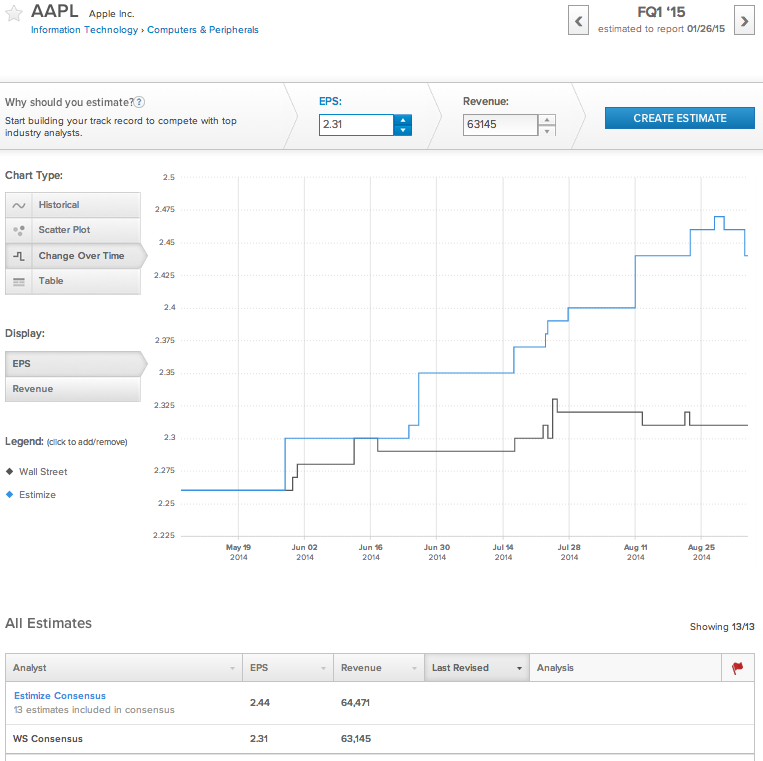

With Apple’s launch event set for September 9th, it’s likely that the new iPhones will hit shelves just before the end of the quarter. However the majority of new iPhone sales will be included in the holiday quarter which is likely to be reported in mid to late January. Expectations for Apple’s holiday quarter have been surging alongside Apple’s stock price heading into the product launch.

The advance of Apple’s stock price did hit a bump in the road on Wednesday when rival Samsung (LONDON:0593xq) unveiled a slew of new products including the Galaxy Note 4, the Note Edge, and the Gear VR which is a new mobile virtual reality accessory for the Note 4 made in partnership with Oculus VR.

Graph from ChartIQ Visual Earnings

The Note Edge and the Note 4 smartphones both feature screens larger than 5 inches and are expected to compete head to head with the soon to be seen Apple products.

On the same day of the Samsung announcement Apple shares tumbled 4.22% and earnings expectations pulled back slightly on Estimize. When we finally see what Apple has up its sleeve, earnings estimates are sure to change again. Investors appear to be demanding an awful lot from Tim Cook and crew, but if anyone can live up to towering expectations, it’s Apple.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.