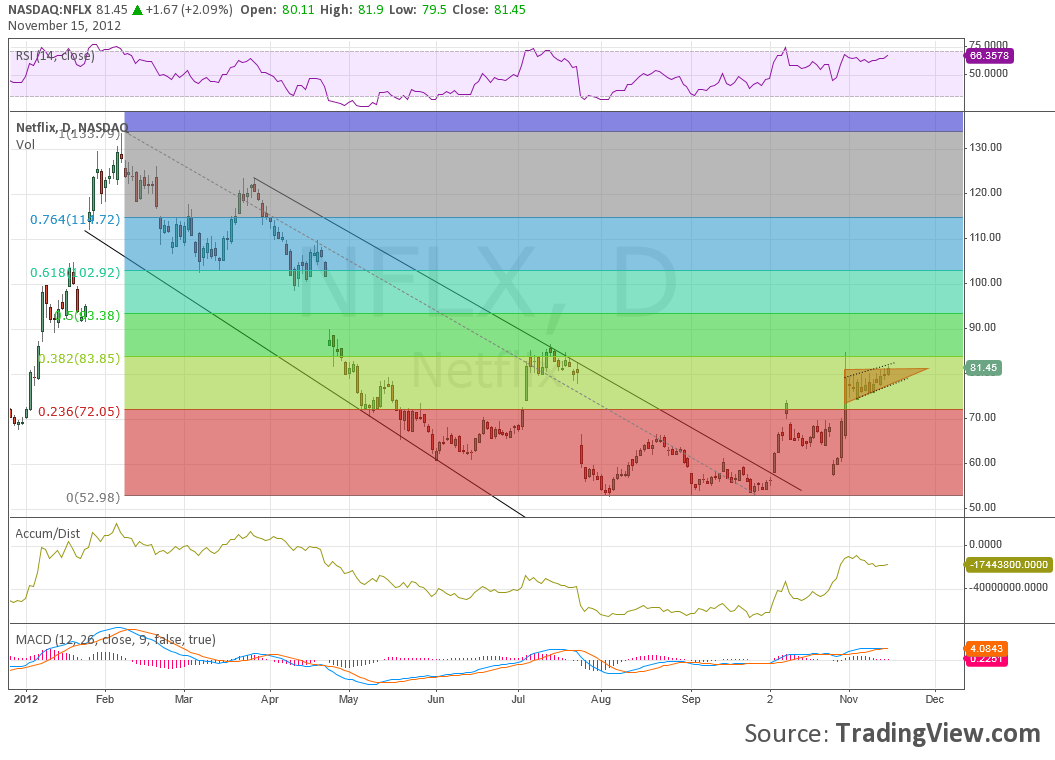

Netflix (NFLX) has exhibited crazy price action over the last year. Loved, hated and now loved again. On the most recent joy ride higher it is now breaking an ascending triangle into resistance at 80. But if you want to be precise, this could be a rising wedge, signalling a more cautious tone.

Either way, the stock seems to be setting up for a crazy move. Over 81 it has a Measured Move higher to 100 with resistance at 85 and 90 along the way. Below 78 it looks to easily retest 70 or 65. The Relative Strength Index (RSI) is bullish and supports the break higher, while the Moving Average Convergence Divergence indicator (MACD) is positive but very near a diverging bearish cross to negative.

From a long-term perspective the 3-box reversal Point and Figure chart sides with the upside break, but will also continue to do so until it falls under 75. The accumulation/distribution indicator has been rising but is also confusing the picture as it is now moving lower. What to do? Set alerts for the break either way to be prepared to play this volatile name.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.