STOXX Europe 600: UBS weighs in as index hits its 2025 price target

Thomas Gresham observed in the 1500’s that “bad money drives out good.” The concept applied to gold and silver coins and the value of precious metals used in the coins relative to their face value. Back then, silver coins would be debased by replacing some of the silver content with base metals. Of course, that practice of monetary debasement goes back to ancient Rome.

But the idea applies today in the sense that, as fiat currency continues to be devalued with money printing and artificially low interest rates, those paying attention will begin to convert cash savings into physical gold and silver and use the devalued fiat currency for transactions settlement. This is likely part of the reason the price of gold and silver are at all-time highs in almost every fiat currency globally.

But I got to thinking about the further imposition of negative rates after absorbing Alasdair Macleod’s must-read essay, “Deeply negative nominal rates are on their way.” In this brilliantly written explanation of the problems with negative rates, Macleod references two working papers from the IMF, which address the problem of hoarding cash if commercial banks impose a negative rate on cash balances by “taxing” cash withdrawals. This would be the implementation of negative rate on money held at banks. Money spent electronically would not be taxed like this.

As preposterous as that may seem, if the IMF is publishing working papers that discuss taxing those who attempt to remove cash from the banking system, it likely means implementation of this policy is being considered not only by the IMF but also the BIS.

The imposition of a negative rate policy in the form of a “tax” on cash withdrawals will likely lead eventually to a run on the banks by large depositors, who will “smell” this policy in advance. This cash – or “untaxed good money” – will be removed from the financial system. Currency needed for daily use would remain in the banks and used electronically – this would be the “bad money.”

In a sense, we’re already seeing Gresham’s Law in the sovereign bond market. Large pools of capital are flooding into sovereign bonds as the price of these bonds grinds inexorably higher. It would be absurd to pay a huge premium above face for a bond knowing that if you hold it to maturity you’ll be repaid substantially less than the price you paid for the bond (i.e. a negative return on these bonds held to maturity). So it’s rational to assume that savvy players will eventually sell before the price of the bond is below the price paid.

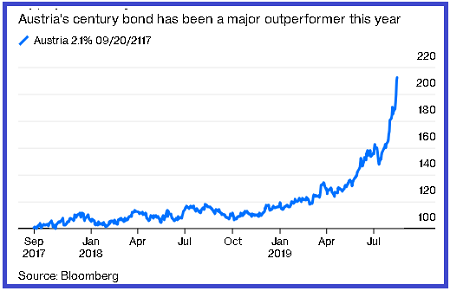

It’s performance-chasing that gives the investor a better return than simply holding cash if he sells at the right time. The alternative is holding the cash in short-term money market type investments, which guarantees a negative return. To visualize this dynamic, here’s the price chart of a 100-year Austrian sovereign bond:

As Bloomberg describes it: “this type of debt carries heavy risks. After all, it will only redeem at 100% of its face value (or par) so investors who have bought in at much higher prices would suffer if yields returned to levels seen as recently as the start of this year – and the price of the bond fell. Furthermore, while interest might not be the priority for many investors in ultra-long maturities, the Austrian paper is only yielding 60 basis points currently. That won’t butter many parsnips.”

Again, as I argued above, rationale investors will begin to sell paper like this and look for alternatives. At some point, as the monetary policies of the Central Banks become more totalitarian, rational investors will turn to gold and silver rather than chasing bond prices into even more negative territory. Unfortunately for them, institutional investors will be confined to gold and surrogates like GLD and SLV, both of which have seen massive inflows of capital already. But wealthy investors will soon be converting cash into physical gold and silver and safekeeping it outside of the banking system, thereby effectively removing good money – i.e. untaxed large bank deposits – from the system and using gold and silver as wealth preservation assets.

This will turn into a real gold rush and the price of gold and silver will go parabolic. To visualize what this will look like, refer to the chart of the 100-year Austrian bond above.

I agree with Alasdair Macleod’s conclusion that deeply negative interest rates will eventually lead to a collapse of fiat currencies – probably not as soon as this year but, then again, a bell won’t ring when it’s time to get out of fiat currencies and bank accounts.

Given the rapidity with which the global economy is now declining, we will be lucky if a credit crisis leading to deeply negative nominal rates doesn’t happen later this year. The pace at which depositors in the banks then become aware of what is happening to their fiat currency will determine the speed and extent of the currency collapse.